Buying of gold either physically or online

Gold has always been a precious metal, and it has been used for millennia as a form of currency. Archaeologists have discovered gold coins dating back to 600BC which were supposedly used as a form of currency. Gold maintained this purpose for centuries until the 20th century when fiat money was created to replace it. Nevertheless, buying of gold still continues to this day, although for different purposes.

Furthermore, new methods for the buying of gold have been created through online platforms, even though the physical trade still exists. In this post, we’re going to examine the buying of gold through physical and online platforms – why it still happens and which is the best way to do it.

Why people buy gold in the first place

There are 2 kinds of people interested in trading gold – speculators, and investors. The former, speculators, are those people who buy gold just so that they can make a profit from the changes in the value of gold. Speculators have no actual need for physical gold, and they will primarily purchase their gold online. For investors, they see gold as a solid form of investment for the long-term. The reasoning behind this is actually very simple, gold will appreciate over time because there is more demand for it that there is supply. When something is in high demand, its value goes up. For gold, the value rises exponentially because the gold reserves are finite, so it will always have value.

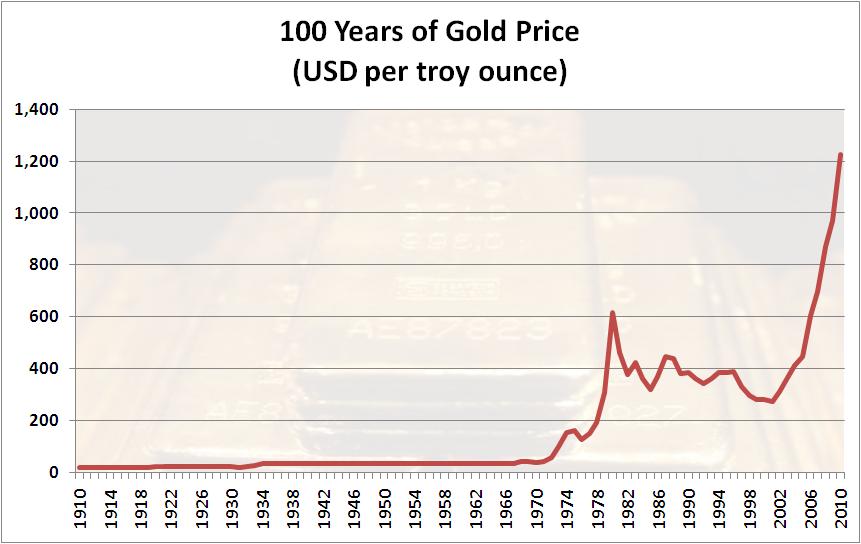

Take for example the growth in gold value over the past century. In the 1900s, the value of gold peaked at $612.56 in 1980 after trading at barely above $300 in the years before. In the 19th century, it was valued at around $20. Today, the same ounce of gold is trading at $1,237. Keep in mind that is a dip from its all-time high of $1,668.98 in 2012. Therefore, for investors, buying gold is akin to purchasing the stock because it rises in value with time.

The only downside to buying gold instead of stocks is that it doesn’t provide the annual dividends that stocks provide. When you buy a company’s stock, you are entitled to annual dividends from the year’ profits. Gold won’t give you this, but it is way more secure than stocks. Think about all the factors that can cause the downfall of a stock that has made huge companies like Lehman Brothers file for bankruptcy. When companies fail and file for bankruptcy, all the stocks become worthless and all the investment is lost. Not gold, it has endured the great recession of the 1930s, numerous stock market crashes and the most recent global recession in 2007 to 2008. The value of gold is intrinsic and, while it may be swayed by external factors, it cannot be wiped out. This is why people buy gold, for the security of an asset that will perhaps never fail.

In favour of physical gold

Physical gold comes in 2 main forms, bullion, and coins. Gold bullions are the gold bars you often see in movies being stolen from a bank vault by hooded thieves. The often seen trapezoid gold bullion are the standard form found in central banks, gold reserves like Fort Knox and major gold dealers. Its weight is about 12.4kg (438.9 ounces) and with a minimum purity of 99.5%. Bullion can also be found in smaller ingots of 1kg, which is the form in which it is most commonly traded. Still, the value has to be 99.5% pure.

Gold coins are in the shape of regular coins, but they don’t have to be that small. Gold coins can have different sizes depending on the manufacturer, the only thing that matters is the purity. Gold coins will usually have less purity than bars because they require an alloy added to them. Pure gold is very soft, and to be shaped like a coin needs to be made into an alloy. In the UK, the standard is 22 karats, which is 91.7% pure, and any reading above this are considered okay.

Regardless of the form of gold you buy physically, its purity and the name of the manufacturer will be stamped at the top to identify it.

So, why is the buying of gold physically attractive:

Gold is recognized worldwide

When you travel from your country to another, you have to exchange the currency you came with to the currency of the destination country. The exchange rates will vary from one second to the other, so it is really difficult to determine what amount of currency you will get. This isn’t the same for gold, because the value of gold is universal, and is calculated by weight. One ounce of gold will be worth the same in the US, UK, China or wherever else in the world. The universality of gold makes it a preferred commodity because its value won’t be changed by the same factors that influence the strength of a currency.

The value of gold is relatively stable

Sure, the value of gold changes just like other commodities and currencies, but fluctuations in gold prices are not as dramatic. Besides, the value of gold, being intrinsic, is not affected by inflation and other economic forces. Take Venezuela, for example, where the currency has been so severely devalued. Gold will still retain its value even in such situations and can be converted into Venezuelan bolivar at the global rate. This is why people convert money into gold during times of economic uncertainty and political turmoil.

Security

Owning and storing a few gold bars, ingots or coins in a bank vault provides you will all the security you need for your wealth. Physical gold, therefore, provides the security everyone worries about in times of turmoil. In addition, the stored gold appreciates in value just by sitting in a vault, becoming both a safety measure and investment opportunity. There are also those who prefer to convert money into gold to avoid taxes and other government intervention measures. While these may not be the best reasons, they show just how physical gold is secure.

In favour of buying online gold

In this section, we won’t be talking about the purchase of physical gold through an online platform. Instead, we shall be looking at how someone can be in possession of gold in an online form without having actual possession of the yellow metal. From your Forex trading platform, you may already be able to purchase gold under the symbol XAU. This is already one way of buying gold online.

You could also purchase gold futures, forwards and options, all of which give you the right to sell the gold at the time of your choosing. Of course, these forms of gold purchase are mainly used by speculators, but you could buy gold certificates which are just a piece of paper entitling you to a certain amount of gold. These gold certificates are not common, but there are several programs by banks in Germany, Switzerland and even Australia that accommodate this trade.

Ease of trade

We have already seen that gold can be quite heavy, and if you’re buying in bulk, the transaction and transport will be complicated. This will be followed by storage and other measures of security you will have to take. Online buying of gold eliminates most of this hassle, allowing you to buy and sell gold with ease and without the many complications physical gold presents.

Less costly

Buying of gold physically can be very expensive. When buying gold from a dealer, they will often sell it to you at a higher price than the market price at that moment. Then, when you do decide to sell the gold, they will buy it at a less value than the market price at that moment. Trading gold physically can, therefore, be very costly and may even make you lose. Buying gold online doesn’t have such high costs, even though there are costs, and this reduces the cost of the transaction. In fact, if you buy gold in the form of futures or forwards contracts, you can even end up paying very little fees.

Security

If you have a bar of gold or two, you have to be really careful to keep it safe. Physical gold does not have the owner’s name ingrained on it, so anyone can take possession of it and change it into cash. This is why many people choose to stash their gold in bank vaults for security. Online gold, on the other hand, cannot be physically stolen because it is… well, online. If you buy gold online, you have the right to trade that gold at any time even though you don’t have the gold physically.

Then there’s the problem of buying fake or poor quality gold during the buying of gold physically. There may be many honest gold dealers, but there are just as many crooks who will not hesitate to dupe you into buying ‘bad’ gold. Buying of gold online removes most of this risk because it is easier to find a reliable gold dealer.

Where do you buy gold?

Buying gold online is actually very easy nowadays, whether you want to purchase physical gold or otherwise. For online purchases, you can purchase gold futures, options and forwards contracts through a broker. For physical purchases, gold dealers are found in most major cities around the world. Be careful, though, because some of them won’t hesitate to dupe you into buying gold which is less pure or just fake. In both cases, physical or online, do your research to find the most reputable broker or dealer, and always be careful.

Comments (0 comment(s))