Overload on bitcoin exchanges causes a strain on transactions

While investors are counting their coins, an overload on bitcoin exchanges has taken them aback from a sudden increase in demand. Major exchanges around the world have been issuing statements regarding delays in execution, due to the sudden increase in demand for cryptocurrencies.

At the beginning of the year, bitcoin value reached an all-time high when it cracked the $1,000 ceiling. Now, that figure seems low considering that now prices are hovering around $2,250 after retreating from a high of almost $2,800 on the 24th of May. This astronomic rise in bitcoin value has been pushed by increasing demand from all over the world.

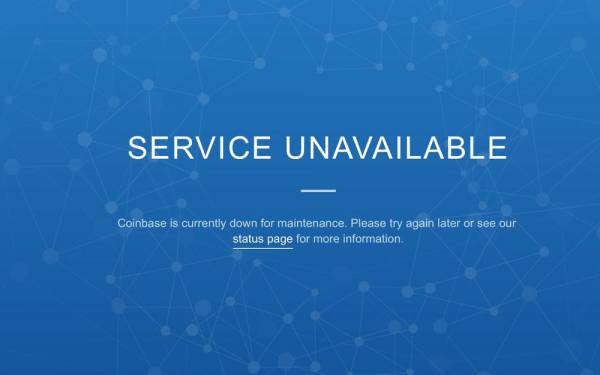

For the investors, it is great seeing how their investment is racking in profits, but for the exchanges, it presents a situation they were unprepared for. It now seems some of the most reputable bitcoin exchanges have been experiencing outages and problems verifying transactions. Apparently, their systems were not equipped to handle the amount of volume they have been getting.

This has caused outrage by new investors who were hoping to get in on the action, while also causing panic to existing investors. This was one of the reasons for the plunge that occurred on the 26th and 27th of May in bitcoin value. Today, the value of bitcoin is hovering around $2,250 having fell almost 20% from the high set on the 24th of May.

Besides the overload on bitcoin exchanges, another cause of the plunge is a market correction predicted through use of the Fibonacci retracement by analysts. In addition, some experts believe many buyers have cashed in on their profits for fear of a possible bubble like the dot-com bubble in early 2000.

Affected bitcoin exchanges

Among the first examples of the overload on bitcoin exchanges was on the 16th of May with Poloniex exchange. It is an exchange based in the US that deals with bitcoin as well as other altcoins. Even before the 16th, users had been complaining of slow transactions, but the company was forced to shut down severally on the day.

According to the company, they had acquired 600% more clients, with most of them being active intra-day traders. It was also around the time when the ripple (XRP) cryptocurrency had just started to go up, leading to a heavy increase in traffic. Poloniex also claimed they had been hit by DDoS attacks, which are used by hackers to overwhelm systems.

Following the slowdowns, Poloniex promised to scale up their systems and to work harder to prevent the attacks, keeping its clients’ coins safe. About a week later, other major exchanges also complained of the same, and this includes exchanges like Coinbase, Kraken and even Bitstamp.

Most of the new transactions are coming from Asia, particularly in Japan, which is the largest bitcoin market in the world. Elsewhere, bitcoin is also becoming popular, such as in India. When the Reserve Bank of India (RBI) showed interest in blockchain technology, they also requested feedback from the public. As a result, the demand for bitcoin in India rose very fast that the overload on bitcoin exchanges in the country could not handle the volume.

One of India’s bitcoin exchanges, Zebpay, has been experiencing an overload, and has now chosen to implement a limit of about $780 in bitcoin transactions per day. Before the limitation, bitcoin value in India was among the highest in the world at around $3,500 due to scarcity. Indians then turned to western exchanges, thus causing the overload on bitcoin exchanges.

Also prior to the limitation by India’s exchanges, the high bitcoin value in India made it favorable for arbitrage. Arbitrage is a profitable strategy where you buy an asset at one exchange at a lower price and sell the same asset on another exchange that has the asset listed with a higher price. It is a popular strategy by investment banks, and it had become popular with bitcoin too. Now, with the daily limits, it is no longer possible. However, the process of arbitrage had led to increased volume and probably contributed to the overload on bitcoin exchanges.

How the overload on bitcoin exchanges affects the industry

So far, bitcoin value is indeed low, but analysts expect the correction to only last a while before the previous uptrend resumes. However, due to problems facing bitcoin, other altcoins have had their day in the sun, especially ripple. The cryptocurrency now has over $8 billion in market capitalization from only $1 billion in April.

Nevertheless, bitcoin remains to be the most popular cryptocurrency, and with the increasing volume of transactions, the exchanges are expected to earn more and scale up. Therefore, this is only just a temporary setback, but the rise in bitcoin value is still going.

Comments (0 comment(s))