The bitcoin flippening may be coming soon

We have argued before about how ether is competing for the top cryptocurrency spot against bitcoin, and now it seems possible. So, just what is the flippening? Well, it’s a term coined (pun intended) by the crypto community to refer to the point when a competing cryptocurrency exceeds bitcoin’s market capitalization.

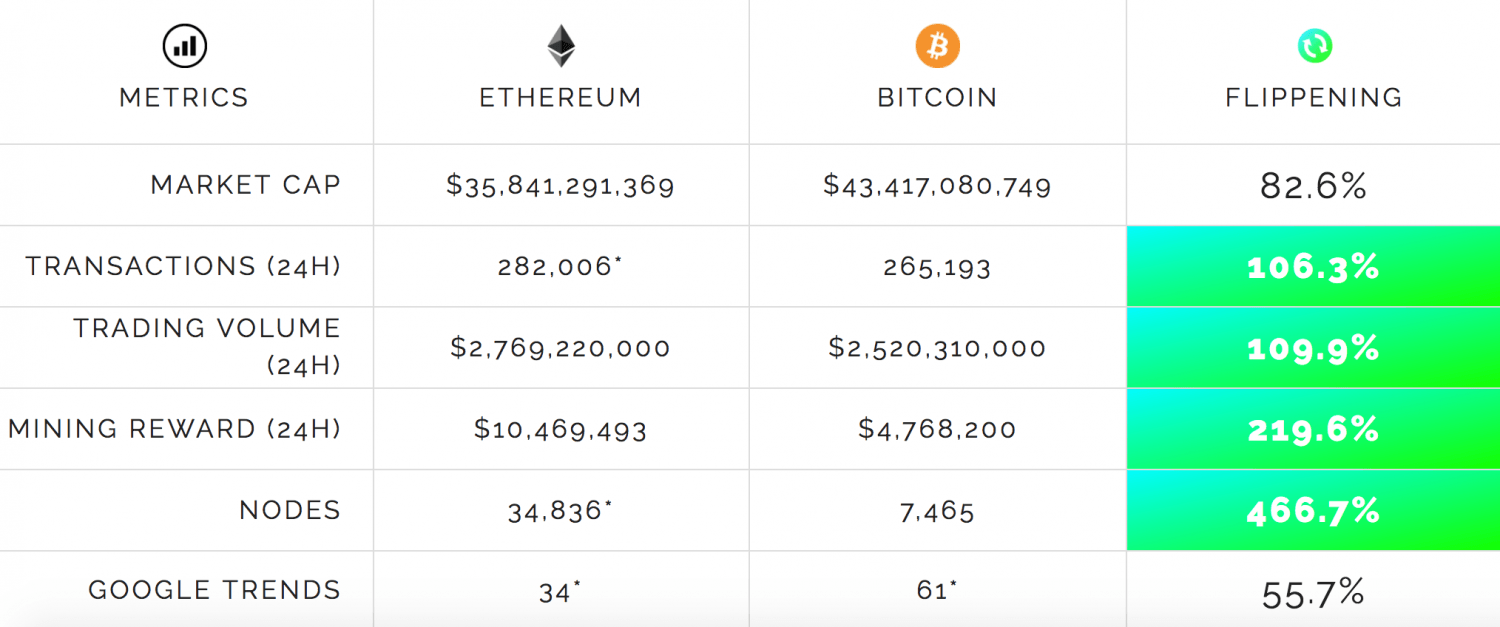

Today, the market capitalization of bitcoin is slightly above $45 billion while that of Ethereum is above $36 billion. That is less than a $10 billion difference. Moreover, considering how ‘young’ Ethereum is, then anyone can see that Ethereum is growing much faster than bitcoin is. For investors in virtual currency, it is certainly worth considering if a flippening may happen, and if so, what to do.

Approaching the flippening

Like any good statistician, the key to making accurate predictions is to look at historic performance. We have covered most of this in previous posts, so let’s just keep it brief this time. By the time Ethereum became mainstream in July 2015, bitcoin’s market capitalization was above $4 billion. Compared to today’s market cap, which translates to more than a 1,000% growth.

On the other hand, coming from under $1 billion to its current market capitalization, Ethereum has had more than a 3,500% growth rate. This year alone, Ethereum experienced just as much growth while bitcoin’s growth was about 150%.

In addition, the market share for bitcoin is also decreasing. Earlier in the year, bitcoin transactions accounted for more than 80% of all the cryptocurrency transactions worldwide. Today, that figure is lower than 50% showing that other cryptocurrencies are continuing to gain popularity. Ethereum has taken most of bitcoin’s market share, and this is why its market cap is growing so rapidly.

The figure above shows the narrowing dominance of bitcoin, with the flippening approaching fast.

Why has bitcoin’s growth slowed compared to other cryptocurrencies?

There are several reasons explaining bitcoin’s slowing growth, but the main one today is in processing difficulties. There are so many bitcoin transactions every day that processing transactions is becoming slower every day. What was once an attractive feature of bitcoin transactions is now a weakness. People loved that bitcoin transactions were much faster than bank transfers were, but now the opposite is true. Since every bitcoin transaction has to be verified by a number of nodes on the blockchain network, the high number of transactions is making the process slow. It is not uncommon, therefore, for someone to have to wait a few days before a single transaction is confirmed.

The problem has now spread to the bitcoin exchanges handling the transactions too. These exchanges have become overwhelmed by the transaction requests that their systems are experiencing slow transactions or just total shutdowns. This week on Monday, Coinbase and BTC-E websites both went down for several hours due to high traffic. BTC-E even blamed BBoS attacks for their website’s shutdown. Even if that’s true, the failure of bitcoin exchanges to fill customer orders coupled with the slow transactions have left many investors with a bad taste in their mouths. These investors are much more likely to turn to other virtual currencies, and Ethereum seems like a great choice because it has been quite stable compared to bitcoin.

Ethereum is also widely scalable compared to bitcoin, which has ensured swift transactions even amid high trading volumes. The bitcoin community has tried to solve the scaling issue through a hard fork, but this move did not receive the needed support and bitcoin’s blockchain remains limited to 1MB per block.

What would it take to accelerate the flippening?

As it stands today, the flippening may occur soon if bitcoin continues to experience the problems it is right now. Ether has already proven to be on a fast track to reaching bitcoin’s market cap, and it can cause the flippening if the momentum remains. There are differing opinions on this, however, with some experts claiming that ether is in bubble territory.

These experts claim that ether has had such a great run by being supported mainly by ICOs. ICOs, initial coin offerings, are like cryptocurrency IPOs where new cryptocurrencies raise their value by offering their coins for pre-existing cryptocurrencies. The most popular are, of course, bitcoin and ether, with the latter being preferred for its lower value. There are new cryptocurrencies being launched every day, and these may have been a reason for ether’s rising value. On the other hand, ether has some strong support from major institutions like Microsoft and even major banks.

Therefore, to accelerate the flippening, ethereum should receive more funding from investors and interest from speculators. Legalization of ether just like bitcoin in Japan would certainly be a boost, while continued problems with bitcoin could keep pressure on the competition. However, if ether really is in a bubble, the truth may come to the surface and ether may lose its momentum.

Comments (0 comment(s))