Asian economies and currencies to watch in 2017

The Asian continent is an economic hub, being the fastest growing economic region in the world. This growth can be attributed to the wide variety of economic activities in the region including services, manufacturing, energy, finance and services. The large population, too, thanks to India and China, have made the continent home to 60% of the world’s population, and that also contributes to economic growth. Despite the overall economic performance, a few Asian economies stand out from the rest by performing astonishingly well, and these will be the focus of this post.

A report by World Bank has stated that the economy in East Asia is expected to remain resilient up to 2018. There has been significant growth in the economies of the countries in the region due to external investment. The only problem remains to be financial inclusion whereby there is a wide and growing poverty gap. Among the countries that top Asia’s growing economy include:

China

You cannot talk about Asia without mentioning China, and this is because it is the second largest economy in the world. Ever since 1978, China’s economy has been growing at an astronomical level, maintaining an average growth rate of 9%. Starting from 2015, however, China started to record smaller and smaller growth rates below 7% and the world panicked over fears of an economic slowdown.

On the 20th of January this year, the GDP growth rate for the 4th quarter of 2015 was 6.8%, which was slightly higher than that of the previous 3 quarters. This was good news and helped to ease the fears in the markets, but now we’re into a different environment. The election of US president Donald Trump might not be good news for the recovering economy. All through his presidential campaign, Trump expressed his negative opinions about China, and promised to revise many trade deals between China and the US.

Already, he has issued several executive orders, and now there’s a proposal to impose a 20% tax on all imported goods. China is the largest exporter of manufactured goods in the world, which is one of the reasons the economy is so huge. Therefore, the proposal by Donald Trump will most definitely affect China’s economy if it is passed into law.

On the other hand, this may not be the worst news for China, and it might actually not affect their economy all that much. Although the US is a major importer of Chinese products, China has been looking at other countries to trade with. The most prominent ones are in Europe and Latin America. Trump’s withdrawal from the Trans-Pacific Partnership and criticism of NATO have caused several European countries to look elsewhere for partnerships. The World Economic Forum in Switzerland earlier this year showed the potential for new trade deals between China and European nations.

Furthermore, American companies operating in China have called attention to Trump’s words about making better trade deals with China and not just eliminating them. These companies point out that they have suffered from protectionism where Chinese companies prefer to deal with other Chinese companies over American ones. If this is what trump was referring to, then renegotiating with China could actually increase the presence of American companies in China.

All these have caused many to believe that China’s economy won’t suffer as much as it is feared to. In fact, the IMF has revised up their predictions for this year’s economic growth in China to 6.5%, which is above the 6.2% predicted last year. With all the speculation around the economy of China, the Yuan is certainly one of the currencies to watch this year. All through 2016, the Yuan has been losing due to the strengthening dollar, and analysts are concerned about the dwindling foreign currency reserves in China. There’s speculation of currency devaluation, and although this is not certain, it will certainly lead to an even weaker Yuan.

One thing’s for certain, we’re in uncharted territory with no idea what will happen next, so the Chinese economy should be closely watched by everyone. The World Bank, seems to think that the gradual lowering of China’s GDP growth rate may actually be beneficial. It will stabilize at a moderate rate rather than the runaway economic growth prior to 2005.

India

The 6th largest economy, India has also managed to maintain an impressive GDP growth rate over the years. This has been through the expansion of the industrial sector away from the predominantly agricultural economy. It is now the fastest growing economy in the world, even above China. Other important sectors include the service sector, which accounts for more than 50% of the country’s GDP.

In the first quarter of 2016, the country’s GDP soared to 7.9% due to increased private spending, but this dropped to 7.1% in the second quarter and 7.3% in the third quarter. As for the fourth quarter, expectations are grim following the demonetization of the 500 and 1,000 INR (Indian Rupee) banknotes. Keep in mind that these banknotes represent 86% of the currency in circulation, and they were no longer legal tender overnight.

This move sent shockwaves throughout the country and it is definitely going to affect India’s economy negatively. The former Indian Prime Minister Manmohan Singh has been quoted as saying that the country’s economy is not in good shape, and we agree. The economy of India ground to a halt starting from the day of the announcement on the 8th of November to the 30th December redemption deadline for the demonetized notes. Despite having recovered somewhat by now, the effects of this announcement will affect India’s economy this year, if only for the first quarter.

Prior to this setback, the World Bank had placed India’s economy at the top of the growth outlook in 2017, expecting the GDP to increase by more than 8%. Now, the general consensus expects the growth to slow down to 6.5% in the first quarter of 2017, but it may recover as the year goes on.

The value of the rupee dropped from 66.2 to 68.8 INR for every US dollar, before stabilizing around 68 INR for every US dollar. The move to demonetize was supposed to get rid of fake banknotes, and if the move is successful, it might strengthen the rupee in 2017 as inflation decreases. Reports so far have shown the move not to have worked and that those holding fake notes still managed to redeem their money through corruption. Whatever the case may be, the Indian rupee and economy will be closely watched by everyone this year.

Philippines

Philippines recorded the strongest growth in Asia with a GDP growth rate of 6.8% over the entire 2016 which is more than 2015’s 5.9% growth rate. The consensus is that the country’s economy will keep on growing in 2017 due to the plans by the president. President Duterte has launched a plan to improve infrastructure in the country, a plan that will take up $160 billion and provide employment to thousands. Furthermore, there has been a 20% increase in foreign investment which has also improved the country’s growth.

However, there are fears about the country’s outlook for 2017. President Duterte has been quoted severally making some unfavorable statements about the US, and President Trump might not put up with it as Obama did. Nevertheless, the Philippine Peso will be a currency to watch this year due to the expected changes in the country and the anticipated growth. Remember, the Philippines still remains to be an outperformer in the Asian continent, and there’s no doubt it will stay that way with Duterte at the helm.

Vietnam

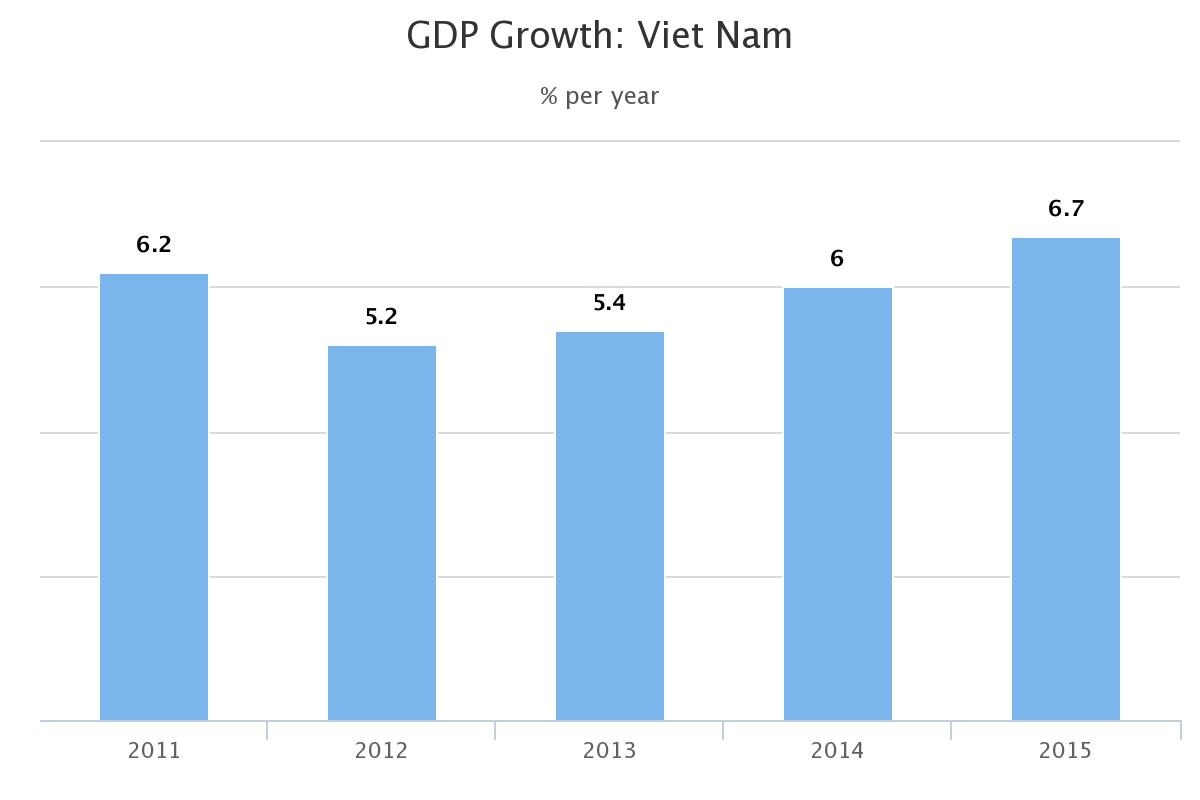

Despite several setbacks to Vietnam’s economy in the beginning of 2016, the country is starting to recover fast. Among the setbacks were the declining global prices of crude oil, of which contributes almost a third of the revenue. Plus, there was a severe drought that put a dent on the agricultural sector of the country.

These setbacks made the GDP fall below 6% to 5.5 % in the second quarter of 2016, but the economy quickly bounced back to end the year with an annual GDP growth rate of 6.68%. These figures were later revised down to 6%, which was still impressive for a country facing so much tribulation.

To boost the economy, Vietnam turned to its services, construction, and manufacturing sectors to provide the much-needed boost. This plus increased foreign investment all helped to keep the economy healthy thus the impressive end-year GDP growth rate. Forecasts for the year 2017 stand at 6.3%, which is a minor improvement, but one that is sustainable given the political and economic uncertainties this year.

Vietnam’s currency, the dong, also suffered from a strong dollar last year, but still managed to remain pretty stable. For now, there’s not much to predict, but we have to wait and see how the political climate changes as the year goes by.

Comments (0 comment(s))