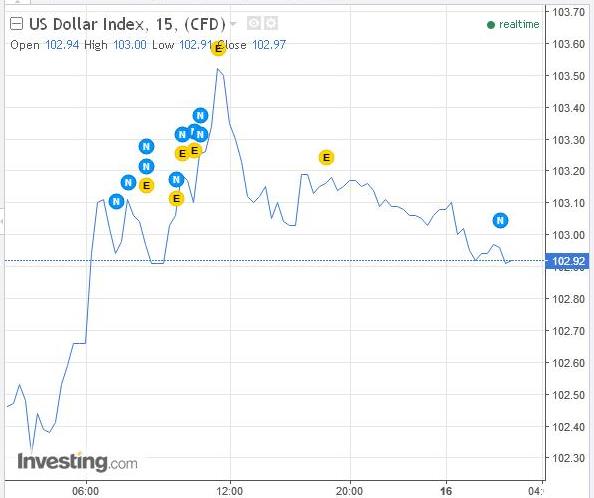

Fed Rate Move Sparks Strong Dollar Rally

The dollar is on a tear. The greenback rose to a 14-year high Thursday, only a day after the US Federal Reserve raised interest rates for the first time since December 2015.

The US Dollar Index, which gauges the strength of the greenback against six major trading partners, rose 0.94% to 102.97. That jump put the dollar to the levels it last touched in 2003.

The dollar is surging amid growing appetite for US yield assets following Fed’s interest rates hike.

Source: Investing.

While raising lending rates, the Fed also set the tone for swifter rate increases next year. The central bank is tentatively targeting three more rate hikes in 2017.

Higher US interest rates make dollar-denominated assets for attractive for yield seekers. Investors stepped up dollar buying after the US election ended with Donald Trump clinching the presidency and the latest Fed rate move has only boosted the appetite for the dollar.

Investors are betting on the prospects of economic prosperity in the U.S. under Trump presidency. The President-elect is coming to Washington with the promise to create more jobs, keep more jobs in the country and increase government spending. Trump’s proposals include expanded government investment in infrastructure and enabling US companies with stockpiles of cash stashed in offshore accounts to repatriate the cash at a lower tax rate of just about 10% instead of the standard 40%.

Increasing government infrastructure spending and repatriating the more than $2 trillion in corporate profits stores abroad would lead to more jobs being created in the country. Some of the repatriated cash is expected be used in boosting wages for American workers. The combined effect of these will be increased consumer purchase power, which should in turn boost corporate earnings.

SoftBank, the owner of mobile carrier Sprint Corp (NYSE:S), has already committed to inject $50 billion in the U.S. through an investment that would create more than 50,000 new jobs. If the investment is successful, it would further stimulate the U.S., offering more support for a stronger dollar.

Trouble for global economies

But a stronger dollar is a mixed bag of fortunes for many economies around the world. For instance, dollar-denominated credits will be more expensive to repay. Several developing countries borrowed heavily during the low interest rates period. Many oil exporters also borrowed locally and abroad to make up for the shortfall in their national budgets when crude prices were falling. These borrowers will now contend with expensive credit as rates rise in the US and the dollar surges.

China beginning to take heat

The Fed’s adjustment has already hit the yuan hard. The Chinese currency sank to a 14-year low Thursday amid capital outflow from China as investors hunt for US assets.

The euro also dipped, sinking to a low last seen in 2003. With EURUSD at 1.0415, the common currency has moved closer to parity with the greenback. Several analysts have predicted that the dollar could match euro beginning in the first quarter of 2017.

Besides the Fed rate hike lifting the dollar against euro, the common currency has been rattled in the recent months amid a surge in anti-European Union sentiments in the Eurozone. In Britain, they voted in June to pull the country out of the EU and other EU member countries like Germany and Italy are struggling with rising eurosceptic wave. These developments have put pressure on the euro.

On the other hand, a stronger dollar should spur export trade in Asia, Europe and other countries that sell to the U.S. A strong dollar means that good priced in other currencies become cheaper for dollar holders.

Comments (0 comment(s))