Could we witness hyperinflation in Zimbabwe again?

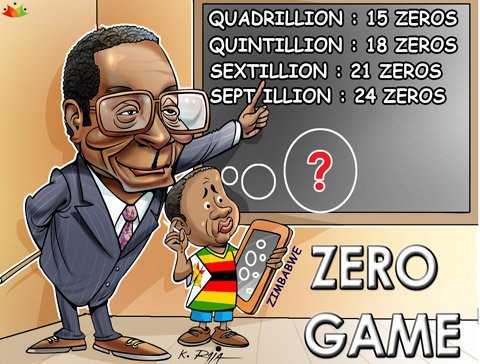

Hyperinflation in Zimbabwe was an extreme case that peaked in 2009. By definition, hyperinflation is considered as a state where the monthly inflation rate is above 50% or when it remains above 100% for 3 continuous years. By the end of 2008, the inflation rate in Zimbabwe was at 79.6 billion percent! Then, the Zimbabwe government stopped declaring the inflation statistics, although some people believe it went as high as 500 billion percent.

Following this, Zimbabweans switched to using foreign currency unofficially, with the US dollar being the main currency in use. In 2015, the government considered using the US dollar as the official currency, then the Chinese yuan, but all these planes were scrapped in 2016.

Now, the government is considering creating ‘bond notes’ to act as the official currency, and this has got people worried.

What caused the deterioration of the economy again?

Initially, reduction of exports and printing of money caused the Zimbabwe dollar to lose value, leading to the hyperinflation of 2008. When the government stopped printing these dollars, people adopted foreign currencies and the economic situation seemed under control.

A similar situation was once again caused in 2016 whereby exports were still minimal but government spending remained high. The balance of trade was destabilized by the number and value of imports which far outweighed the exports, causing the outflow of foreign currency reserves. The situation got so bad that banks had to limit the amount of money a person could withdraw in a day, $50.

Could the bond notes cause hyperinflation in Zimbabwe again?

The plan to peg the new bond notes to the US dollar is supposedly going to curb inflation, but as we all know, this doesn’t always work. If you look at Nigeria’s previous situation, they had fixed the naira at a rate of N196 to every US dollar, but a parallel market emerged. In the parallel/black market, the US dollar was trading at around 470 naira despite the peg being placed at 305 naira per dollar.

This is what happens when countries try to fix exchange rates – the laws of economics always win. There is a huge possibility the same will happen with the new bond notes being introduced, thereby causing hyperinflation in Zimbabwe once again. Already, another parallel has emerged, this time exchanging dollars for the bond notes at very high premiums.

Plus, there’s the glaring problem of a country without proper leadership – if the same mistakes could be repeated in less than a decade. The Zimbabwe government owes various international money lenders debt amounting to $9 billion and they have missed last year’s payment. Furthermore, the country’s economic sector is still not any better than it was a decade ago.

What this government is doing it trying to mask the problem, but not addressing it, which could be disastrous. If it insists on following this path, then hyperinflation in Zimbabwe occurring again is certainly a possibility.

Comments (0 comment(s))