XAUUSD Technical Outlook

For the first time in 4 trading sessions, we witnessed a slump in the price of Gold, as it shed a significant amount of its previous gains on the week, this was in response to the recovery mounted by the US dollar after the European Central Bank (ECB) dumped all speculation of slowing down its stimulus. As was expected, the ECB decided not to change its monetary policy. The key interest rate remained at 0% while the deposit rate was kept at -0.4%. Commenting the decision, Draghi noted that the quantitative easing program could be extended after its completion in March next year. The Dollar, in its turn, is supported by commentaries of the Fed officials who, as before, remain supportive of an interest rate hike in the nearest future.

The XAUUSD edged higher in today’s early trading session. The pair went as high as $1274.37 an ounce but was unable to maintain its position above the 1270 level as prices later fell to orbit the $1265 region.

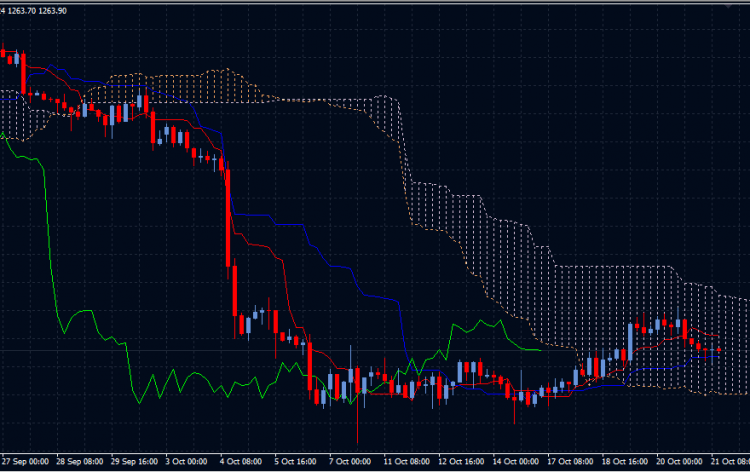

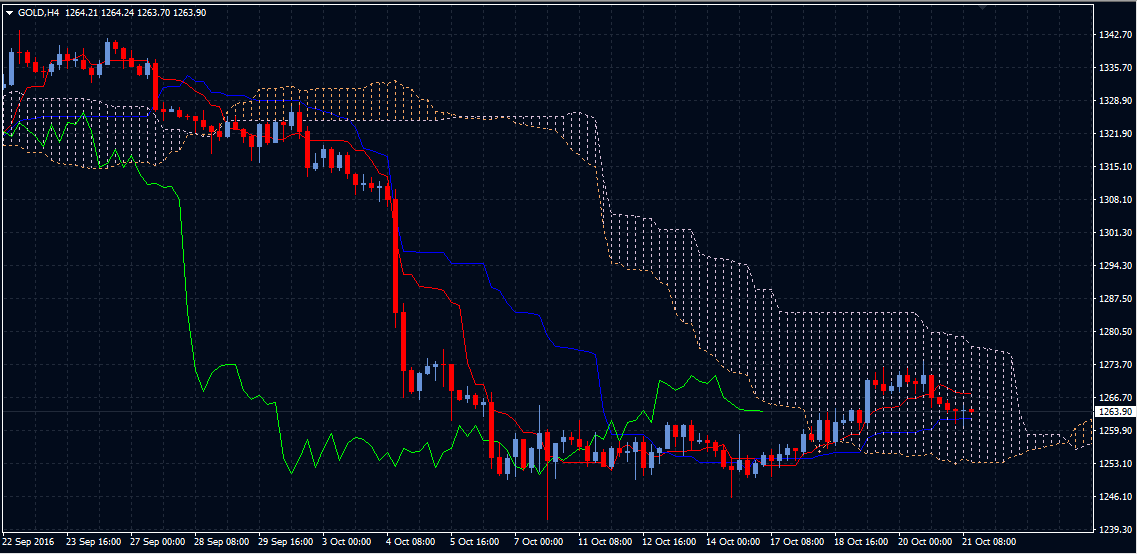

The pair currently sits just above the 1265 level but trades inside the 4-Hour Ichimoku cloud; this indicates that there is a major struggle between to bulls and the bears as to the fate of the pair’s price. The XAUUSD is likely to trade in a tight range in the near term.

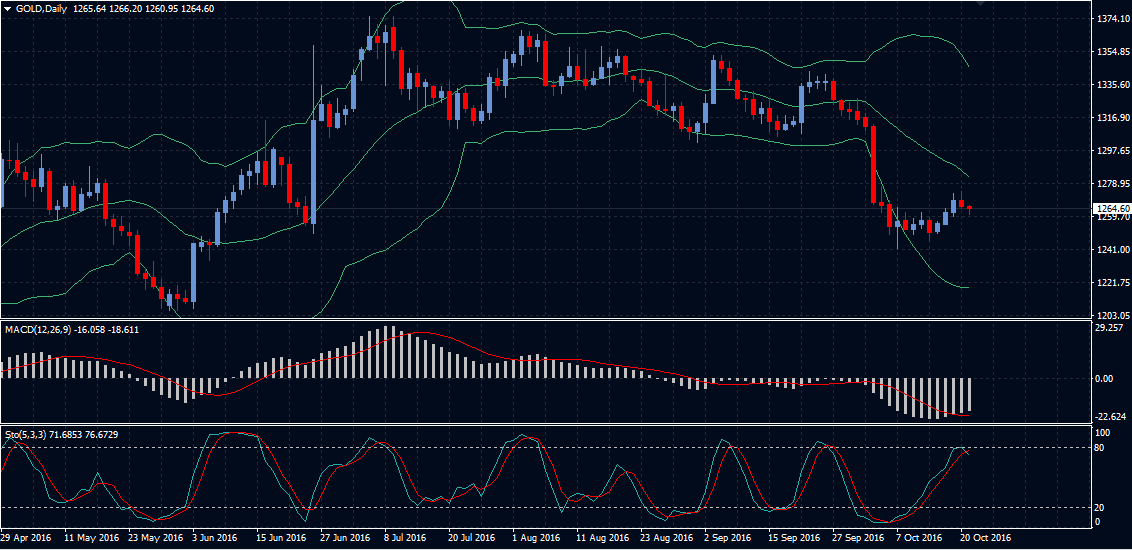

Looking at the Bollinger Band indicator on the daily chart, it has an overall downward inversion as the price range continues to narrow. The MACD is climbing while giving a very strong buy signal. The Stochastic is turned down as it recently bounced off the border of the overbought zone.

The indicators recommend waiting for a clearer trading signal.

Support/Resistance Levels

Support levels: 1261.41 (local low), 1256.12, 1251.00, 1245.94 (14 October low), 1241.21 (7 October low).

Resistance levels: 1264.67 (local high), 1270.00, 1274.27 (local high), 1282.01, 1289.57, 1300.00 (4 October high), 1306.06, 1313.02, 1317.77, 1324.65, 1331.02 (27 September high).

Trading tips

A BUY position can be opened after the breakout of the level of 1265.70 (with the appropriate indicators signals) with targets at 1274.00, 1279.00 and stop-loss at 1260.00. Validity – 2-3 days.

A SELL position can be opened after the breakdown of the level of 1258.00 with targets at 1250.30, 1245.94 and stop-loss at 1264.00. Validity – 2-3 days.

Comments (0 comment(s))