Forex Brokers Begin To Restore Leverages Following A Cut Ahead Of The U.S. Election

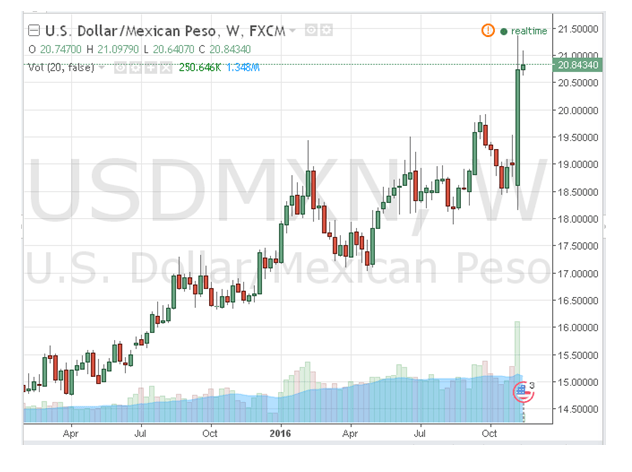

Donald Trump astonishingly won the U.S. presidential election and Mexican peso sank nearly 8% against the greenback. Ahead of the election, several forex brokers cut leverages on certain currency pairs that they suspected would be significantly impacted by the outcome of the election. But brokers are now beginning to restore leverages, a sign that the pressure on the U.S. election on currency market is easing.

Saxo Bank is one of the major forex brokers leading the return to default margins after the surprise victory of Trump in the November 8 election. The brokerage has reset its margin requirements for almost all currency pairs to the default level, thus reducing the cost of forex trading for its clients. However, Saxo Bank still appears concerned with the prospects of the U.K.’s pound. The brokeraga plans to raise the required margin for GBP pairs to 3% this week and margins could rise to 7% depending on the size of the position an investor is taking.

Going into the U.S. election, Saxo Bank raised margins or cut leverages on nearly all currency pairs on its platform. The most affected currencies were Mexican peso (MXN) and Russian ruble (RUB) pairs. The broker altered Mexican peso to 10%, up from 2%, while RUB margin increased to 15% from the normal 3%.

The reset of margins to the default levels should be a reprieve for forex traders because the higher margins increased the cost of trading. Nevertheless, the decision to cut leverages on volatile currencies saved traders from heavy losses, especially considering that the election outcome was no what many expected. The surprise outcome of the U.S. election also excited cryptocurrency market with Bitcoin (BTC) rising to new highs in the recent months against the dollar.

Trump turns tables on Clinton

Ahead of the election, most opinion polls showed Democrat’s Hillary Clinton modestly ahead of her Republican rival Trump. But Trump made significant gains in key battleground states and eventually turned tables on Clinton. Markets plunged in Asia and Europe as the election results started streaming in and Trump appearing to be leading. In the currency market, Mexican peso was among the most battered currencies given the tough stance that Trump has shown on the matter of illegal immigrants and building of a wall along the U.S. border with Mexico.

Besides Saxo Bank, other large forex brokers that cut leverages on currency traders ahead of the U.S. election included Oanda and XM.com. Oanda in particular trimmed leverages for GBP pairs at 20:1. MX.com on the other hand capped maximum leverage on several currencies on its platform to 100:1.

Though market reaction to Trump’s election was initially negative, markets have rebounded amid hopes that Trump’s aggressive policy proposals could produce positive results for the investing community. For instance, a swift move to interest rate hike could boost banks’ profits and increased infrastructure spending could benefit several industries. The prospects of rising bond yields is another bright spot. Trump also signaled that he could allow a one-time tax break for U.S. companies with profits stashed in offshore accounts to repatriate the cash and a lower tax penalty of only 10% instead of nearly 40% today.

Apple (AAPL), General Electric (GE), Microsoft (MSFT) and Alphabet (GOOGL) are some of the American multinationals with more than a trillion dollars collectively kept in overseas accounts. If the money is brought back to America, it could be spent on R&D, M&A and hiring, thus stimulating the economy. As for now, these companies with billions of dollars in offshore accounts have resorted to borrowing to pay dividends, fund projects and buy back stock. Occasionally they use the money for strategic acquisitions abroad.

Comments (0 comment(s))