Contents

It’s amazing how the country with the most dominant currency in the entire Forex market can have so few US regulated Forex brokers. Ever since the laws regarding Forex trading were repealed in 2011, many Forex brokerages left the country’s market for other pastures. Today, the National Futures Association (NFA) is in charge of overseeing only a handful of US-based Forex brokers. There is an advantage to this for US Forex traders because there aren’t many options to choose from. Add to that, the NFA is a very effective financial regulator and has been able to clamp down on Forex fraud, and continues to do so even to this day.

There are only a few key factors to consider when selecting a Forex broker, but the main ones are regulation and trading conditions. We shall look at regulations more deeply in the next sections, but trading conditions are a bit subjective. These come down to tiny details that you may overlook like customer support. Most of us only discover the importance of customer assistance when we are already stranded, but you should consider this earlier on just to be safe. Do not be afraid to give them a call to get a feel of how informed the staff is and how willing they are to help.

Then consider if they can offer you all the trading instruments you want to work with. The best US CFDs brokers will provide you with more than just the forex pairs to trade, and provide even more instruments like commodities, ETFs, and stocks. All the other trading conditions are moot, such as leverage, spreads, and commissions, since all Forex brokers are almost the same in this regard. Furthermore, where one Forex broker appears to have an advantage, they suffer in another area. As such, you should not be bogged down with such details.

On the most recent report by the Bank for International Settlements (BIS), the US market accounted for 19% of all the Forex trading volume. Considering that the Forex market is a $5.1 trillion a day behemoth, then you can bet NFA regulated Forex brokers handle a lot of trading volume. As previously mentioned, only a few Forex brokers operate in the US, in fact, only two companies remain in the US forex market, OANDA and Forex.com. The latter, Forex.com remains to be the largest Forex broker in the US, but that is only because Forex Capital Markets (FXCM) was banned by the CFTC from operating in the US.

One of the main reasons only the two largest Forex brokers in the US remain to cater to the North American market is capital requirements. The NFA requires the broker to have $20 million in the capital, only for it to be locked in just in case of a legal suit. Contrary to what you may believe, retain Forex brokers do not make a lot of money. GAIN Capital, operating as Forex.com, made $35 million in net income in 2016, yet they are among the top Forex brokers in the world with over 200,000 clients. Many Forex brokerages don’t have that kind of money, nor a number of clients, and they decided to simply exit the US Forex market.

250$

FCA, NFA

N/A

1:200

1999

MT4

Regardless of the current situation, the few brokers that remained have proven, more often than not, to be reliable. A gander at US Forex broker reviews clearly shows an overwhelmingly positive reaction to the Forex trading services. Only a few bad apples may have tarnished the overall image in the past, but compared to other regions in the world, the positive reviews are well-deserved.

In charge of overseeing Forex market activities is the NFA. However, the NFA is just a ‘branch’ of the Commodity Futures Trading Commission (CFTC). The CFTC subsequently created the NFA to oversee the Forex market in particular. All the Forex brokers that operate in the US are required to be registered by the CFTC and also become a member of the NFA.

The CFTC was created back in 1974 by an act of Congress to oversee the futures and options markets. Prior to this date, the Securities Exchange Commission (SEC) had been responsible for all financial markets, but the financial industry was growing rapidly in the US. Therefore, the CFTC was formed specifically to monitor the options and futures markets. As the Forex market also became more mainstream, there was a need for closer supervision. Since the CFTC has the mandate to create futures association, it created the NFA in 1982. The CFTC then monitors the NFA through its Division of Swap Dealer and Intermediary Oversight (DSIO).

By law, only those brokers registered with the CFTC are supposed to solicit clients residing in the US. Nevertheless, if you are a US resident, you might still receive offers to join an offshore broker, one that is not regulated by the NFA. Most of the time, these brokers will seem to have even better offerings than the ones that are regulated, but that’s the catch. Remember that, when the deal is too good.

Such a situation can be observed in the case of IB Capital FX, which operated under the website IBFX.com. They had operated in the US since 2010 when the company was founded and continued to do so until 2015. By then, they had more than $50 million in client assets, even though they were not registered with the CFTC. After the case, the company was forced to return $35 million of its clients’ funds. As it turned out, IBFX was a subsidiary of Monex Group Japan, but after the case, IBFX’s 2,000 clients were handed over to OANDA.

To be frank, Forex regulations in the US are pretty brutal to a retail trader. Limits on leverage and hedging can limit the flexibility of your trading, but the important thing to remember is that there is a reason. Perhaps you could even say that the NFA is ahead of the curve. Consider that other Forex regulators around the world are also moving to curb runaway levels of leverage and promotions. It can only mean that the NFA had already foreseen the damage these lucrative features can have on the industry in the long run.

According to CFTC regulations, the maximum amount of leverage allowed in trading forex pairs is 50:1. Yet that is in major currency pairs like the EUR/USD, GBP/USD, USD/JPY, etc. Across the Atlantic, in Europe, Forex brokers can offer as much as 1000:1 leverage on these major currency pairs. When it comes to the minors and exotics, leverage is tightened even further and capped at 25:1.

Add to this, trading strategies like hedging are not allowed by the NFA. Hedging typically involves taking an opposite trade just in case the first one doesn’t go your way. Imagine, as an example, if you went long on the USD/CHF pair while also being short the USD/JPY. In case the US dollar became strong and the USD/JPY trade started going south, the long position on the USD/CHF pair would bail you out. Typically, NFA regulated Forex brokers won’t allow this action, and even if they did, the profits would not be credited to your account.

On the other hand, there may be some limits that probably block a trader’s opportunities. For example, there are no NFA cryptocurrency brokers to date, simply because these cryptocurrencies are not considered to be financial instruments. As these cryptocurrencies cannot be recognized by the CFTC, so can’t they be offered by US regulated Forex brokers.

There is a reason why it is advisable to work with an NFA regulated FX broker, and that is mainly to protect yourself. Over the years, the NFA has worked to unravel some elaborate scams that had already defrauded investors of millions of dollars. Take FXCM, which was once the top US FX broker. In 2017, the NFA discovered that the company was intentionally breaking the rules, specifically in regard to the claim that they were a true STP Forex broker. Investigations later revealed that they were not, and instead were fixing market quotes to the detriment of their clients. Consequently, the company was banned from operating in the US and its clients were transferred over to another company without losing a thing.

There have been other US Forex scams too, and in most cases, the victims were compensated after the NFA and CFTC stepped in. That is why it is always advised to pick a broker from the NFA regulated Forex brokers list. Not only does the NFA monitor the brokers’ actions, but it can also compel the accused to compensate those that were harmed.

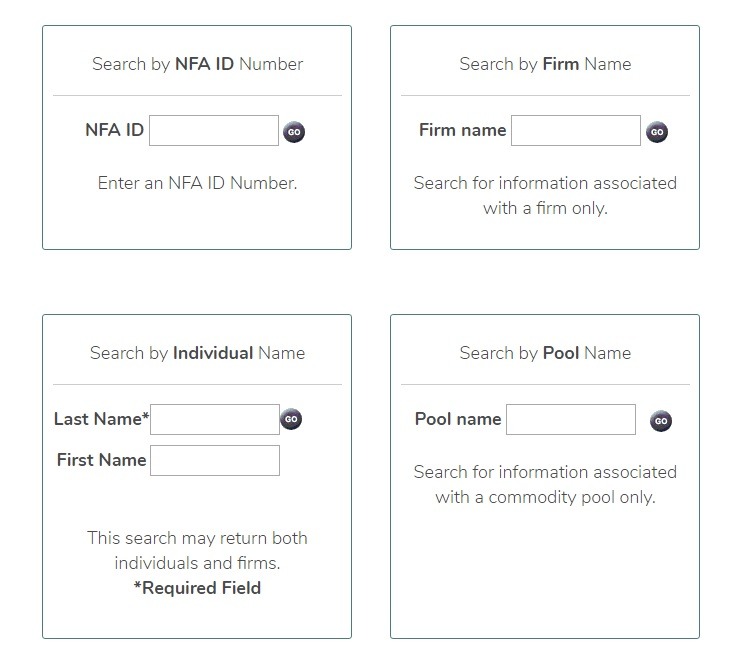

Before you settle on what you believe may be the best US FX broker, it is important to confirm their state of regulation. It is actually very easy to do once you know the steps, and it only takes a visit to the NFA website’s Background Affiliation Status Information Centre (BASIC) – https://www.nfa.futures.org/basicnet/

From this website, you should be able to search for a broker’s license status by name, ID number, or other parameters. Only the licensed brokers who are also members of the NFA, and will appear on the results page after a query.

On March 26, 2012, the US National Futures Association (NFA) began implementing some new directives that impose several requirements that US forex brokers will have to follow when executing a forex trade made by US clients. The new directive creates a more fair and secure trading environment to forex traders.

The new directive addresses the issues of forex broker requotes and forex broker slippage. These issues always represented a problem for most traders and allowed dishonest forex brokers to churn off additional money by abusing the lack of a clear regulation in this regard. The directive, entitled NFA Compliance Rule 2-36, was approved by the Commodity and Futures Trading Commission and was issued on January 26, 2012 but only became effective on March 26, 2012.

The first directive prescribes that all american forex brokers will from now on have to apply slippage uniformly. The rule also says that this has to be done regardless of the development of the market. The intention of this new rule is to standardize the way slippage is applied, what in the end will highly benefit the end-customer.

The second directive requires that if forex brokers are requoting prices when the market has moved against them, then they will also have to requote prices if the market moves in favor of them. This means that from now on forex brokers will also make requotes that would be to the advantage of traders. Up until now requotes were only made to the disadvantage of the trader.

The third directive prescribes that the us forex brokers will have to clearly state the manner they perceive slippage and apply requotes. This should be done in a manner that will be understood by all traders before they place a forex trade. According to the directive, brokers will also be obliged to notify existing clients regarding the way they handle price changes.

Forex brokers will also be obliged not to use any advertisement material that might mislead traders regarding the way the brokers handle price changes.

The new US forex broker regulations were created with the intention of making online forex trading more fair. The new directives are a long awaited change that will finally standardize the way regulated brokers handle the issues of forex broker requotes and forex broker slippage.

The new rule regarding slippage will ensure that the same procedures are followed in every situation. This creates more transparency making sure that the trader is always well-aware of every aspect of its bet.

The new directive regarding requoting is probably the biggest change introduced by the new regulation. It will make sure that forex brokers will also requote the client when the market moves to the benefit of the broker. So far, requotes were only done when the market moved to the detriment of the broker.

The final rule addresses transparency. This will make sure that forex brokers are always transparent and honest regarding the way they handle price changes. This will make sure that all the information regarding these issues will always be at hand to evaluate. Furthermore, no promotional material that might mislead the trader regarding the way a broker handles price changes shall be used.

Since President Obama signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act on July 21st, 2010, a slew of legislation was put into effect that addresses how online US Forex brokers with clients based in the United States must conduct themselves in order to continue executing forex trades for their U.S. based clientele.

The Dodd-Frank federal statute combined with the Food, Conservation and Energy Act of 2008 gives the Commodity Futures Trading Commission or CFTC broad authority in the regulation of off exchange retail foreign exchange transactions.

The National Futures Association or NFA follows CFTC regulations and requires US Forex brokers engaged in off-exchange retail foreign exchange transactions to be registered with the CFTC in a variety of capacities.

The CFTC and the NFA both require that an american forex brokers doing business for U.S. based customers must be registered with the CFTC as a futures commission merchant or FCM or a new category of registrant called an RFED or retail foreign exchange dealer.

Also, any online forex broker which opens an online trading account for a customer, solicits orders, operates a trading pool or trades for others in a discretionary account must also be registered with the CFTC as either an associated person or AP, an introducing broker or IB, a commodity pool operator or CPO or as a commodity trading advisor or CTA.

Other provisions of the Dodd-Frank Act oblige foreign exchange brokers from US to maintain accurate records, give full disclosure of trading and financial activities, and maintain minimum capital requirements and other operational and procedural standards.

The CFTC’s new capital requirement for an online forex broker that opens an online trading account for a U.S. based client in the capacity of a FCM or RFED is a minimum balance of $20 million dollars plus an additional five percent on retail forex customer’s liabilities in excess of $10 million.

Also, leverage for accounts are subject to a security deposit requirement that is set by the NFA within the parameters established by the CFTC. Disclosure and other account statements must be sent to clients to comply with the reporting and record keeping requirements.

In August of 2011, the CFTC approved amendments to the NFA requirements governing retail forex activities for NFA members. Under NFA Bylaw 306, NFA members are considered Forex Dealer Members if they are registered as RFEDs or FCMs with the CFTC and offer or act as counterparty to a retail forex transaction.

The new amendments also require US Forex Dealer Members or FDMs to maintain an office in the continental United States, Alaska, Hawaii or Puerto Rico. The U.S. office would be responsible for the preparation and maintenance of CFTC and NFA records and reports and would be under the supervision of a listed principal and a registered AP of the Forex Dealer Member residing at that office.

Other amendments cover Procedures for Bulk Assignment or Liquidation of Forex Positions: Cessation of Customer Business and the Supervision of the Use of Electronic Trading Systems. The amendments were first published in a March 3rd, 2011 submission letter from the NFA to the CFTC.

The new regulations due to the Dodd-Frank Act are being gradually implemented with the CFTC and the NFA carefully assessing every detail to avoid forex fraud and provide traders with a secure trading environment. Nevertheless, many U.S. based traders are not happy with the new changes.

The most recent report by the BIS showed a stagnating Forex market in the US that had remained unchanged between 2013 and 2016 at 19% of the market share. Clearly, there isn’t much progress in this industry, and that has been mainly due to the regulations imposed by the Dodd-Frank Act of 2011. However, the House recently voted to repeal Dodd-Frank in June and implementing the Financial Choice Act, which would give more freedom to financial institutions. In light of this, the US Forex industry is bound to spring back to life as offshore brokers scramble to carve out a share out of the 300 million population.

Get the most recent news at your inbox

Stay up to date with the financial markets everywhere you go. We won’t spam you.