Edge Hound Review: Does AI Really Help Traders Make Smarter Decisions?

What Is Edge Hound?

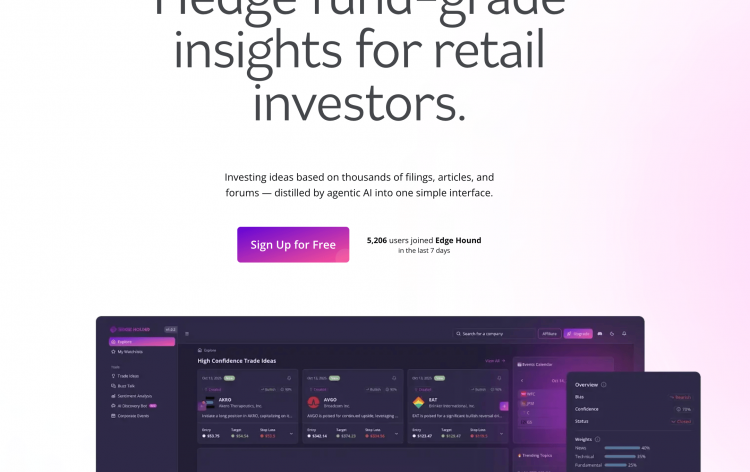

Edge Hound is an AI-based tool designed to help investors and traders make informed decisions through its multi-layered market analysis. It combines artificial intelligence with real-time financial data to uncover trends, detect sentiment shifts, and highlight opportunities before they become obvious to the wider market. The platform’s mission is to bridge the gap between human psychology and data-driven decision-making, giving traders insights that go beyond charts and price movement.

Core Functionality and How It Works

At its core, Edge Hound processes large volumes of information from across the web. It tracks financial news, social media discussions, and public forums to identify early signals that could influence prices. By analyzing these sources simultaneously, it helps users understand how crowd psychology and sentiment evolve over time. This provides traders with a more complete view of what drives markets, not just what moves them.

Key Features of Edge Hound

Trade Ideas:

One of the standout features is Trade Ideas, which delivers comprehensive market analysis and alerts about potential price shifts. It filters through market noise to pinpoint where attention is building, and which assets might be ready to move.

Buzz Talk:

The Buzz Talk feature constantly monitors news and social media channels, identifying market-moving discussions and assessing their possible impact on asset prices. It essentially allows traders to see which topics are gaining traction before they hit mainstream headlines.

Sentiment Analysis:

Through Sentiment Analysis, users can measure real-time market moods and understand the tone behind major news stories or investor reactions. This makes it easier to identify emotional triggers that often drive short-term volatility.

Discovery Bot:

Another advanced tool is the Discovery Bot, a multi-agent AI system that keeps track of macroeconomic trends and hidden correlations between assets. It uses knowledge graphs to uncover connections that might not be visible through standard technical analysis. The integrated AI investing chat provides context-rich insights, helping users interpret market data, spot early opportunities, and identify unseen risks.

Upcoming Features

Edge Hound is also expanding its toolkit with several upcoming features. The development roadmap includes a Screener, Portfolio Analysis and Monitoring, and a Risk Management Screener. These will allow traders to evaluate multiple assets at once and manage exposure with better precision. Another planned feature, Natural Language Search, will enable users to query the platform in plain English and instantly receive relevant market insights, making research faster and more intuitive.

User Experience and Accessibility

The platform’s interface is clean, modern, and designed for ease of use. Even though it offers powerful analytics, navigation feels straightforward. Data loads quickly, charts are easy to read, and settings can be customized without much effort. Both beginners and seasoned traders can adapt to it after a short learning curve.

During testing, the system’s responsiveness stood out. Market sentiment indicators update in near real time, making it possible to follow market shifts as they happen.

Strengths and Limitations

Edge Hound’s main strength lies in how it merges news-driven sentiment with quantitative analysis. Traders no longer have to manually monitor dozens of feeds or social channels to stay informed. However, with so much information available, the platform can feel dense at first, especially for users unfamiliar with sentiment-based trading. While the AI simplifies research, interpreting the data effectively still depends on user experience and strategy.

As with any analytical tool, Edge Hound cannot guarantee profits. Its purpose is to support informed decision-making rather than automate trades. Those who use it alongside solid risk management and disciplined execution are more likely to see consistent value.

Reputation and Market Position

Edge Hound has been gaining traction among retail traders and investors looking for more intelligent market insights. Reviews often highlight its sentiment accuracy, clarity of interface, and speed of updates. Compared to traditional terminals, it feels approachable and designed for modern traders who value simplicity without sacrificing depth.

Final Verdict

Edge Hound stands out as one of the more advanced AI-powered research tools currently available. It combines sentiment detection, social data analytics, and macroeconomic modeling in a single system. For traders who want to understand why the market is moving, not just where, it offers a clear advantage.

With upcoming features like risk management, portfolio tracking, and natural language search, the platform is set to become even more powerful. It may not replace experience or intuition, but it enhances both by turning complex data into actionable insight.

If you are serious about trading and want to stay ahead of market sentiment, Edge Hound is definitely a platform worth trying. It is intelligent, data-rich, and forward-thinking, offering a glimpse into what the future of AI-assisted investing might look like.

Comments (0 comment(s))