CA Markets Forex broker review — Everything you need to know

CA Markets is the company’s trade name, which was established in 2015. It is a global FX trading platform and offers brokerage services to international clients. The broker consists of multiple companies registered in various jurisdictions, making it important to thoroughly assess its safety and attractiveness for online financial traders.

In this unbiased review, we will explore CA Market’s security, accounts, fees and spreads, support, platforms, and more.

CA Markets Safety Reviewed

CA Markets is a trading name of a broker that consists of several brokerage companies registered and regulated in different jurisdictions:

- Camarkets.com provides services globally

- camarkets.com is owned and operated by CA Markets Limited – Regulated by the Vanuatu Financial Services Commission (VFSC)

- Australian Securities and Investments Commission (ASIC)

- New Zealand Financial Service Provider (FSP)

As we can see, CA Markets is regulated by ASIC, VFSC, and FSP, making it a very well-regulated financial broker. This is critical for safety and ensures that the broker has to follow high ethical standards and protect its customers to maintain its licenses.

CA Markets keeps trader funds separate from its own operational funds using segregated bank accounts with top-tier banks.

The broker does not provide a negative balance protection even for retail clients, which is a serious drawback as traders can become liable for losses beyond their initial investment.

CA Markets Overview of the website

The website of CA Markets is very well-ordered. It offers a simplistic website but it provides all the necessary details regarding the broker’s conditions such as accounts, deposits, withdrawals, platforms, assets, and so on. The website is very responsive and not laggy at all. Everything is very clearly and transparently disclosed, which is always a green flag.

Overall, the website of CA Markets offers excellent experience and makes it super easy to find all important details about the broker’s services and conditions.

CA Markets Accounts Reviewed

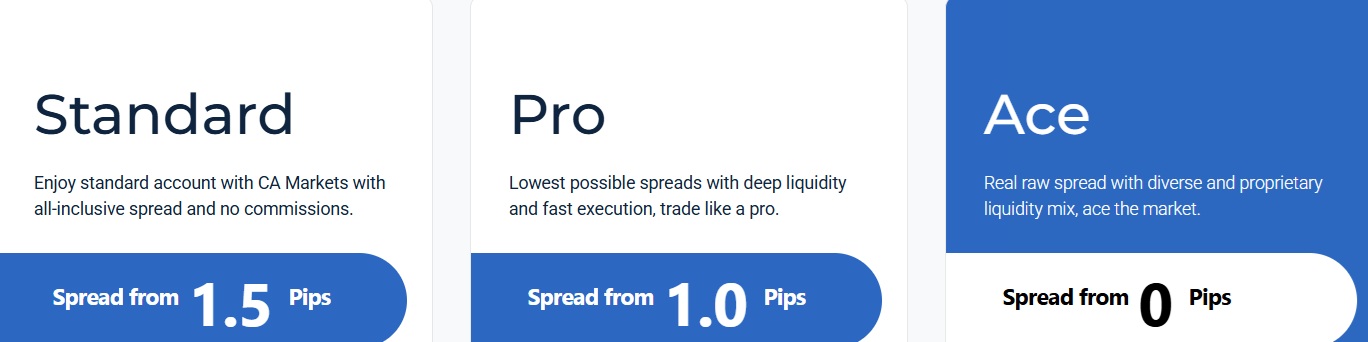

The broker offers several account types like Standard, Pro, and Ace. Each account has its unique offerings and let’s briefly review each of them to see whether the broker is suitable for our readers’ needs.

CA Markets Standard Account

The standard account is for general FX trading and offers a commission-free trading experience. The exact conditions include:

- Minimum deposit – 20 USD

- Maximum leverage – 1:500

- Spreads from – 1.5 pips

- Commissions – 0 USD

- EAs allowed – Yes

- Hedging – Yes

As we can see, the broker has pretty expensive spreads on its standard accounts, which are considerably higher than the industry-standard 1 pip.

CA Markets Pro Account

The Pro account has lower spreads and charges no commissions either. It is a relatively more attractive account with the following conditions:

- Minimum deposit – 20 USD

- Maximum leverage – 1:500

- Spreads from – 1 pip

- Commissions – No

- EAs allowed – Yes

- Hedging – Yes

With lower spreads, 0 commissions, and a minimum deposit requirement of just 20 bucks, the CA Markets Pro account is a much more attractive offering than a standard account.

CA Markets Ace Account

The Ace account is a more premium offering with much lower spreads and commissions. This account is a zero-spread ECN account type with a slightly higher minimum deposit requirement but still competitive conditions:

- Minimum deposit – 100 USD

- Maximum leverage – 1:500

- Spreads from – 0.0 pips

- Commissions – 3.5 USD per side per lot

- EAs allowed – Yes

- Hedging – Yes

This account is designed for scalpers and it also allows algorithmic trading, which is flexible.

Deposit and withdrawal options at CA Markets

The broker supports a wide range of payment methods like UnionPay, ChipPay, 9Pay, Help2Pay, Crypto wallets, bank transfers, and broker-to-broker transfers. Deposits are processed instantly and there are no commissions charged. However, the broker only allows UnionPay, Crypto Wallet, and Bank Transfer. The processing times for withdrawals are also instant and commissions are waived back at traders, which is incredibly attractive. Supported currencies for withdrawals via wire transfers include EUR, GBP, AUD, NZD, USD, CAD, CHF, JPY, SGD, and HKD. Processing times are 2-4 business days for both deposits and withdrawals via bank transfers.

CA Markets Assets — What can you trade?

CA Markets provides access to a wide range of asset classes such as FX pairs, commodities, indices, cryptos, and treasuries. From commodities, the broker enables trading on precious metals, energies, and agriculture products, while FXpairs include majors, minors, and exotics. The treasuries include Euribor (EUR), UK_Gilt (EUR), and SONIA_3_Month (EUR). While the broker is not offering stock trading the availability of cryptos and treasuries makes it still a multi-asset broker. With a maximum of 1:500 leverage, traders can speculate with considerable position sizes even with small accounts.

Trading platforms of CA Markets

The broker provides access to the advanced MetaTrader 5 trading platform. The MT5 supports both custom indicators and trading robots (EAs) and the broker allows traders to use algorithm trading tools, which is advantageous. Mobile trading is supported via the MT5 mobile app, which is available on both iOS and Android in their respective online stores.

Education at CA Markets

When it comes to educational resources, CA Markets offers trading articles where it discusses important trading concepts like candlestick patterns and more. There are no webinars or trading courses available, which is a downside.

The broker offers market insights daily, where it provides market analysis for major assets like indices, FX, and more. As for the trading tools, the broker also offers a free economic calendar, which is available directly on its website, offering traders fundamental analysis capabilities. Copy trading and VPS services are offered as well.

CA Markets Customer Support

The customer support experience at CA Markets is provided via several popular channels like email and physical offices. Unfortunately, the broker does not offer crucial support channels like live chat and phone support. This is a serious issue and a red flag as traders will have a difficult time getting needed help in time as live chat is the fastest way to contact your broker and resolve issues during trading. The broker is not multilingual either as both the website and support are only available in 2 languages.

CA Markets bonuses and promotions

The broker lacks bonuses like deposit bonuses or welcome bonuses, which is disadvantageous. The only available promo offers VPS services, which are free. VPS services are crucial for algorithmic trading and if it’s truly free, with no strings attached, then it is really flexible.

Is CA Markets your broker? Final verdict

CA Markets offers a regulated and secure trading environment with entities overseen by ASIC, VFSC, and FSP. The broker features several account types with flexible conditions and low entry barriers from 20 USD minimum deposits. There is also a zero-spread account available for scalpers and the MT5 platform allows EAs. However, the lack of negative balance protection, limited support channels, and the absence of any bonuses are its drawbacks.

Overall, CA Markets could be a suitable choice for experienced traders who need low spreads and do not rely on fast customer support services.

FAQs on CA Markets broker

Where is CA Markets based?

CA Markets is a global brokerage operating in many jurisdictions with offices in Sydney, Melbourne, Toronto, and New Zealand.

Can you withdraw from CA Markets?

Yes, CA Markets allows withdrawals via UnionPay, crypto wallets, and bank transfers. The broker claims instant withdrawal processing times.

Comments (0 comment(s))