Nash Markets Forex broker review — Everything you need to know

Nash Markets is the company’s trade name and also the trading name of the website of the broker with the same name. It offers Forex trading services with multiple trading account types and TradeLocker platform support.

In this unbiased broker review of Nash Markets, we will assess its security, accounts, spreads, profit withdrawal policies, support, overall trading costs, and much more.

Nash Markets Overview of the website

The website of the Nash Markets Forex broker is user-friendly and modern-looking. The navigation is simple, and the website is very responsive, enabling users to quickly navigate around to see exact trading conditions, which is crucial. While the website is not very well-ordered, it is simplistic. There are menus to easily find details about various trading conditions like accounts, platforms, and markets.

The live chat plugin is directly built inside the website, making it convenient for users to instantly contact the broker representatives and get the needed information and assistance on various trading needs.

Overall, the website is satisfactory as it offers all basic information and details about important conditions, coupled with a live chat plugin.

Nash Markets Accounts Reviewed

Nash Markets provides traders with a wide range of different account types, targeting traders at all experience levels. There are accounts for cent trading for lower budgets, and there are accounts for the lowest spreads. There is also an affordable crypto trading account available for crypto enthusiasts. There are Standard, Pro, Var, Mini, and Cryptos trading accounts. Below is the brief specs list of each account to evaluate how competitive the broker truly is.

Nash Markets Standard account

Nash Markets Standard account

The standard account is a general trading account where commissions are charged for competitive spreads. The commission is 7 dollars per lot round-trip, and spreads start from 0.5 pips, which makes this account fairly expensive to operate. The minimum deposit requirement is rather high at 200 dollars. The minimum lot size is 0.01 lots. Overall, this account is not competitive and requires a high deposit and expensive trading costs.

Nash Markets Pro Account

This account offers lower spreads but charges higher commission per lot, making it also slightly more expensive than the competition. The minimum deposit is also 200 dollars on the pro account, spreads are from 0.0 pips, and commission is 10 dollars per lot traded. This account is less expensive than the standard account, and it is unclear why someone would choose the standard instead of the Pro account with the same deposit requirements.

Nash Markets Var account

The Var account is a commission-free trading account that has only spreads, which is actually competitive. The minimum deposit is also 200 USD on this account. Spreads are from 1 pip on major pairs, and the maximum leverage is up to 1:500. This account is actually the standard account type with its commission-less offerings. Minimum lot size is also 0.01 lots on this account.

Nash Markets Mini account

The Mini trading account is where low-budget trading is possible, as it has a 50 USD minimum deposit requirement. There are commissions charged here of 1 USD per lot, and spreads start from 1.2 pips. As a result, this trading account is also expensive and unattractive for beginners.

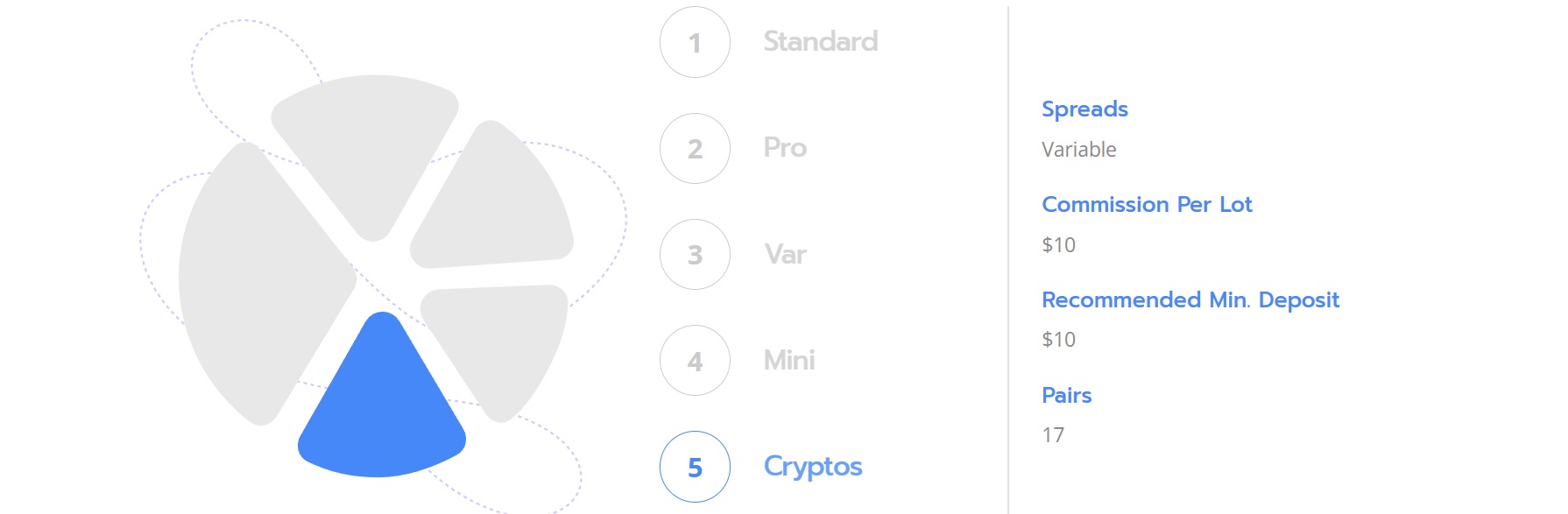

Nash Markets Cryptos account

The crypto trading account requires the lowest minimum deposit of 10 dollars, and spreads are variable. This account is designed for crypto traders, and it offers 17 different crypto pairs, including BTC and ETH.

Overall, most accounts are expensive and only a few of them are actually somewhat competitive, which makes the broker unattractive for most traders.

Deposit and withdrawal options at Nash Markets

Deposits and withdrawals are provided using several different payment methods, such as bank cards, wire transfers, and cryptocurrencies. There are no fees charged from the broker’s side itself and the minimum withdrawal amount is 100 dollars on all payment methods. Traders will need an activated account to withdraw profits.

Nash Markets Assets — What can you trade?

When it comes to trading assets, Nash Markets offers access to a wide range of trading asset classes, such as Forex pairs (majors, minors, and exotics), commodities, indices, cryptos, and stocks. From stocks, there are US and EU stocks to speculate on, and from commodities, traders can access gold. Spreads are expensive, and the broker charges both spreads and fees on most of its trading accounts, so traders have to be very careful.

Trading platforms of Nash Markets

Nash Markets offers access to the TradeLocker trading app, which is a young but advanced trading platform. It offers many advanced features and is mostly popular among prop firms. Mobile trading is also available via the TradeLocker mobile app, enabling traders to speculate on a wide range of markets seamlessly on the go.

Education at Nash Markets

The broker lacks comprehensive trading educational resources. There are no webinars, video guides, or trading courses available, which is a downside for complete beginners. The broker offers several tools for pip calculation and other types of calculators to use in trading for better risk management. There are no other tools or market insights provided.

Nash Markets Customer Support

The customer support experience is provided via several options, including live chat and email. There is no phone support option available, which is a serious drawback. Other than that, the live chat is an advanced plugin and offers quick assistance. The broker is not multilingual because its website and support are only offered in English.

Nash Markets bonuses and promotions

Nash Markets does not offer any useful promotions and bonuses. There are no deposit bonuses or welcome bonuses provided, and the only promotional event is the refer-to-friend event. As a result, the broker is not very competitive in this category.

Is Nash Markets your broker? Final verdict

Nash Markets, founded in 2020, provides multiple account type choice and the TradeLocker platform. However, it remains unregulated and expensive compared to industry standards.

FAQs on the Nash Markets broker

Where is Nash Markets based?

It is registered in Saint Vincent and the Grenadines, which is an offshore jurisdiction, but operates without license.

Can you withdraw from Nash Markets?

Yes, withdrawals are possible via bank cards, wire transfers, and crypto, but the broker fails to provide details about profit withdrawal policies.

Comments (0 comment(s))