Xlence Forex broker review — Everything you need to know

Xlence is a forex broker that offers access mainly to CFDs. It is registered in Seychelles and offers higher leverage of up to 1:1000, making it an interesting broker to review. It was launched in 2024, making it a relatively young broker.

Let’s briefly overview Xlence broker to assess its safety, accounts, trading costs, profit withdrawal procedures, platforms, support, and more.

Xlence Overview of the website

The XLence website is modern in design and responsive, meaning it is a fast and convenient process to navigate around and find out more about trading conditions. The top menu offers a well-ordered way to find what users might be looking for, including accounts, platforms, tools, support, markets, and so on. This is crucial in forex trading as traders need to find out about account types, spreads, leverage, and other crucial details before signing up for any broker. The website is not overcrowded with unnecessary media, which is a good sign.

Live chat is available via a plugin that is built into the website, enabling quick support when needed. The website is also mobile-friendly, and so is the live chat plugin.

Xlence Safety and Licenses

Xlence is a broker that is based offshore in Seychelles. The broker is also overseen by the Seychelles Financial Services Authority or FSA. This is a popular regulator among many forex and CFD brokers. However, it is less stringent than many other reputable regulators out there, and traders still have to be cautious. As a regulated broker, Xlence keeps trader funds in segregated bank accounts, which is an important safety policy for trader fund protection.

Xlence does provide a Negative Balance Protection policy, which ensures you can never lose more than what you deposited in a trading account. This policy is especially critical when dealing with high-leverage brokers. If a trader’s balance falls below zero dollars, it is automatically reset to zero.

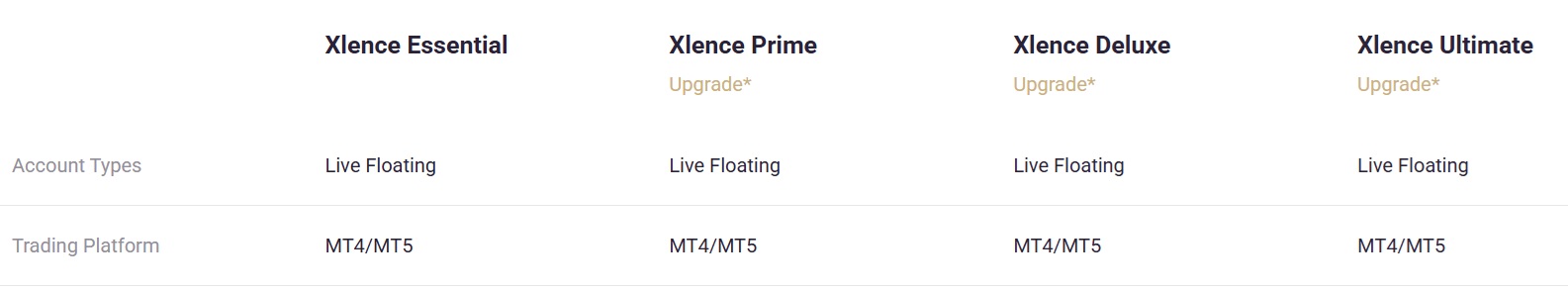

Xlence Accounts Reviewed

Xilence trading accounts are diverse, as the broker offers: Essential, Prime, Deluxe, and Ultimate account types. Despite different names, all accounts are STP accounts as there are no commissions charged. However, we can imagine these accounts as tiered accounts where higher-tiered ones come with lower spreads on major pairs. Let’s briefly review each account below to define how competitive this broker truly is. The accounts and their minimum deposits are Essential, Prime, Deluxe, and Ultimate, first up to 100, second up to 500, third up to 1000, and fourth up to 10000. We had to contact the support to get these details, as there is no information about minimum deposits on the website.

Xlence Essential Account

The essential account is an entry-level trading account that offers commission-free forex trading but comes with relatively higher spreads when compared to other accounts. Here are all the crucial conditions of this account:

- Minimum deposit – 100 USD

- Maximum leverage – Up to 1:1000

- Spreads – 1.1/1.4 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

- Dedicated Manager – No

Xlence Prime Account

The prime is a tier higher than essential and offers slightly lower spreads, but for a higher minimum deposit. Here are its conditions:

- Minimum deposit – 500 USD

- Maximum leverage – 1:1000

- Spreads – 0.9/1.2

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

- Dedicated Manager – Yes

Xlence Deluxe Account

The deluxe is an even higher tier than previous accounts and has lower spreads, but the minimum deposit is also higher than accounts below its tier:

- Minimum deposit – 1,000 USD

- Maximum leverage – 1:1000

- Spreads – 0.6/0.9

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

- Dedicated Manager – Yes

Xlence Ultimate Account

The Ultimate account by Xlence is the highest tier account with the lowest spreads but the highest minimum deposit requirements, making it suitable for experienced traders with high capital.

- Minimum deposit – 10,000 USD

- Maximum leverage – 1:1000

- Spreads – 0.4/0.7

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

- Dedicated Manager – Yes

As we can see, the broker offers a full range of accounts but with 0 commissions and spreads. While spreads are low on ultimate accounts, it requires a very high minimum deposit to start trading. The lack of ECN accounts with 0 pip spreads and affordable commissions is also a downside for this broker.

Deposit and withdrawal options at Xlence

Xlence allows many payment methods, such as wire transfers, bank cards, and several other e-wallets, which are flexible. The broker does not charge commissions for transactions itself, but payment providers will most likely do. The processing times for deposits are mostly instant, and withdrawals will take 1-3 business days to complete. This is slightly longer than some reputable brokers in the industry.

Overall, the broker has mostly satisfactory deposits and withdrawals, but it has lengthy profit withdrawal procedures, which make it relatively unattractive.

Xlence Assets — What can you trade?

Xlence is a multi-asset forex broker that enables access to forex currency pairs, commodities, indices, futures, and shares. Among commodities, traders can access metals as well as energies. There are no crypto pairs available, which is a drawback for sure. The leverage is high, but spreads are not zero, meaning scalping is not possible with this broker.

Trading platforms of Xlence

The broker offers both popular platforms, MT4 and MT5. These trading platforms are very advanced and support both custom indicators and Expert Advisors, and the broker does not prohibit traders from using these tools, which is flexible. Traders can use any of those platforms depending on their preferences. Mobile trading is also available via MT4 and 5 mobile apps, accessible on both iOS and Android devices.

Education at Xlence

Educational resources at Xlence are lacking, as the broker only offers market analysis and other various tools. The broker offers essential courses for trading, where beginners can learn basic concepts of financial trading and trading strategies. While this is crucial for beginners to gain a grasp of the absolute basics, it is still not enough, as the broker does not provide webinars or video guides to enable traders to get more information about proper professional trading.

Xlence Customer Support

The customer support experience at Xlence is provided via email and live chat. There are no other options available, which is a serious drawback. The lack of a phone support channel is a red flag, and all reputable brokers offer it to ensure their legitimacy. This option is more than just a legitimacy barometer; it enables traders to resolve issues in case they have internet connection issues and need to close open trades. The broker is multilingual as its website and support options are available in more than 5 different languages.

Xlence bonuses and promotions

The broker does not provide any promotional events at the moment. There are no bonuses like a welcome bonus or a deposit bonus, which is a downside. There are no trading competitions or other promotional events that would make it an attractive broker.

Is Xlence your broker? Final verdict

Xlence is a relatively new Forex broker launched in 2024 and regulated by the FSA of Seychelles, which is an offshore jurisdiction. It offers MT4 and 5 trading platforms, leverage of up to 1:1000, and multiple trading account types with commission-free trading. However, the lack of ECN accounts with zero spreads, bonuses, and phone support, along with longer withdrawal times, makes it more suitable for very experienced traders familiar with offshore brokers rather than complete beginners or scalpers.

FAQs on Xlence broker

Where is Xlence based?

Xlence is based in Seychelles and regulated by the Financial Services Authority (FSA).

Can you withdraw from Xlence?

Yes. Withdrawals are processed within 1–3 business days, but delays can occur depending on the payment method selected.

Comments (0 comment(s))