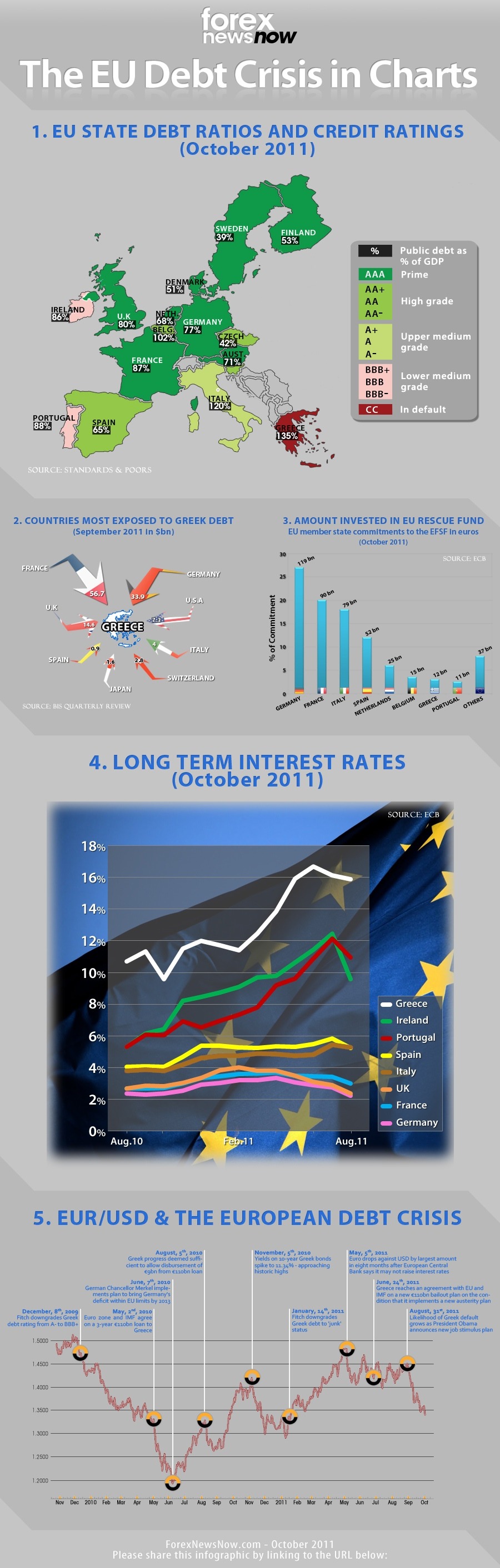

Infographic: The EU Debt Crisis in Charts

ForexNewsNow – With all of the recent news surrounding the ongoing European Monetary Union debt crisis and the growing possibility of a Greek default, ForexNewsNow has compiled a detailed infographic in an effort to visually lay out the current financial state of individual EU member states as well as the region as a whole.

https://forexnewsnow.com/infographic-the-eu-debt-crisis-in-charts

Legend:

1. The first map shows both each European state’s Standard & Poor’s credit rating and each state’s ratio of public debt to GDP.

2. The second graph underlines which countries are directly exposed to the risk of a Greek default. As is clear, France and Germany are the most exposed European countries; it’s also interesting to note the level of involvement of the US and Japan.

3. The third graph measures the participation of EU member states in the European Financial Stability Facility (EFSF) – which is the EU’s financial rescue mechanism. Once again, the Franco-German couple is at the forefront of the struggle with the largest contributions to the fund.

4. The fourth image shows how long-term interest rates of various individual EU member states and the UK have fluctuated over the past year. As is clear, Greek, Portuguese and Irish interest rates are much higher than average.

5. The last graphic shows the exchange rate of the EUR/USD and how it has been affected by some of the larger political and economic developments that have taken place in and around the euro zone in the past two years.

Looking for a Forex broker? Find the best French brokers here!

Comments (0 comment(s))