AlphaTick Forex broker review — Everything you need to know

AlphaTick is the company’s trade name, AlphaTick LLC is the company’s name, and it also operates with the AlphaTick (Pty) Ltd brand name for South African clients. The broker is registered in three different jurisdictions and offers diverse accounts, and traders can access various markets.

In this full review of Alpha Tick Forex broker, we will assess its safety features, account types, spreads, leverage, platforms, support, education, and more.

AlphaTick Overview of the website

The website of AlphaTick broker is user-friendly and responsive. Traders can easily navigate around and find almost all crucial details about trading services. The broker mainly focuses on the term “investing,” when in fact it only provides speculative services with its trading accounts. However, there are still some inefficiencies with the website: the broker lacks details about trading platforms, and deposit information and withdrawals are nowhere to be found. This is a serious issue as users need to check trading conditions before opening an account, and lacking one of the most important details is a serious red flag. The live chat plugin is directly built into the website and enables quick access to support, which is flexible.

Overall, the website of AlphaTick broker requires some major improvements to become excellent.

AlphaTick Review of Safety and Licenses

Safety is critical in FX trading, especially when we are dealing with young brokers such as AlphaTick. There are several entities operating the AlphaTick website. These entities are registered in different countries, and let’s list all the regulated ones below:

- AlphaTick (Pty) Ltd – the Financial Sector Conduct Authority (“FSCA”) of South Africa

There are two other entities, AlphaTick LLC, and Alphatik Ltd. They are registered in Saint Lucia and Cyprus, respectively, and provide some services for the broker. However, the license is only from the FSCA of South Africa, and the broker is not allowed to operate in the EU zone.

As a regulated broker, Alpha Tick keeps trader funds in segregated bank accounts, ensuring trader funds are in separate accounts from its operational funds.

AlphaTick broker provides a negative balance protection policy, ensuring traders can not go into negative, and it is always reset to zero. This policy is critical for beginners, especially when the broker offers high leverage levels.

AlphaTick Accounts Reviewed

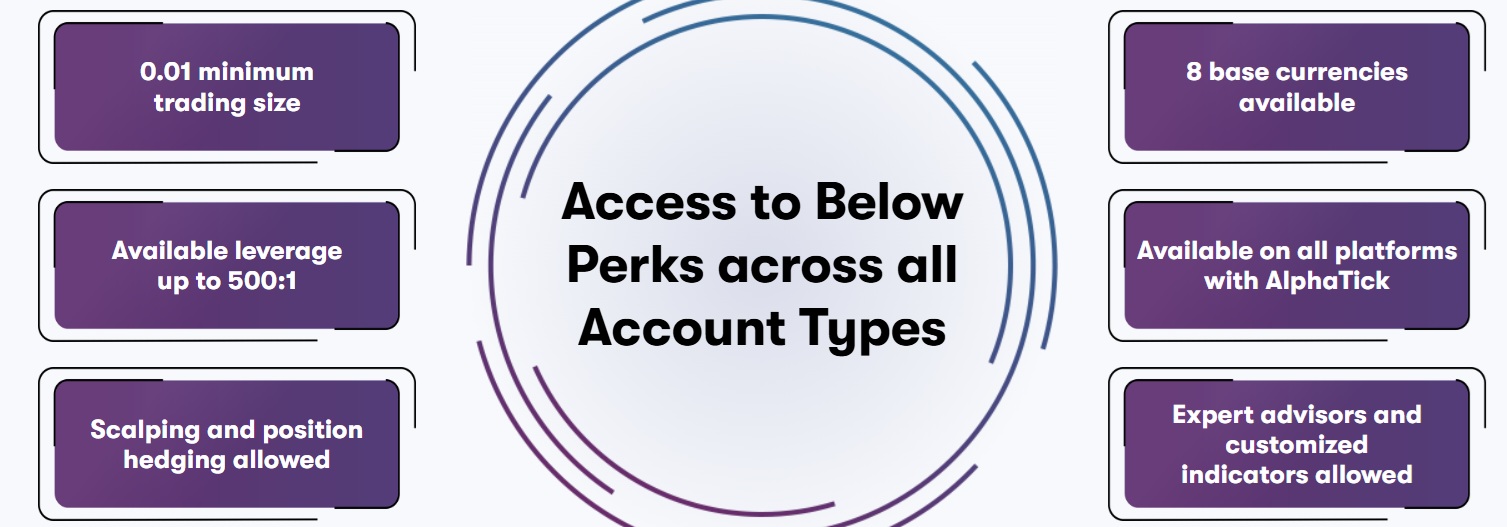

AlphaTick offers several account types, allowing traders to select spreads that suit their trading strategies and styles. There are AlphaTick Standard STP, Alpha ECN, and Alpha Pro. STP accounts have spreads but charge no commissions, while ECN accounts have lower spreads but charge fees. Let’s briefly review each of these accounts to define whether the broker is truly competitive.

AlphaTick Standard STP Account

STP account, which enables traders to use the Straight Through Processing execution model in trading, offers zero commissions but typically has spreads. Here are all the specs of this account:

- Minimum deposit – 50 USD

- Maximum leverage – 1:500

- Spreads – 1 pip

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

AlphaTick Alpha ECN Account

The ECN account operates so that traders receive the lowest spreads possible, but typically charges commissions for providing traders with raw spreads. Here are the specs:

- Minimum deposit – 50 USD

- Maximum leverage – 1:500

- Spreads – 0.0 pips

- Commissions – 3 USD per side per lot

- Minimum lot size – 0.01 lots

AlphaTick Alpha Alpha Pro Account

The Pro account is also an ECN account, but it offers even lower commissions for zero spreads for higher minimum deposits. Here are its full specs:

- Minimum deposit – 10,000 USD

- Maximum leverage – 1:500

- Spreads – 0.0 pips

- Commissions – 1.5 USD per lot per side

- Minimum lot size – 0.01 lots

As we can see, Alpha Tick broker is very competitive because it offers low deposits for its STP and ECN accounts for a general trading audience. The spreads are 1 pip on standard and 0 pips on ECN accounts, and the minimum deposit is low at 50 USD. There is also a pro account that offers even lower commissions for higher minimum deposits. Overall, the broker is very competitive and attractive when it comes to trading accounts.

Deposit and withdrawal options at AlphaTick

Deposits, especially profit withdrawals, are critical in FX trading. AlphaTick accepts several payment options, including international wire transfers, bank cards (Visa and MasterCard), broker-to-broker transfer, and cryptos. From cryptos, the broker accepts popular coins like Bitcoin and Ethereum. Deposits are instant and fee-free. However, the broker does not provide details on withdrawals apart from the fact that the same payment methods are acceptable. This is highly suspicious and indicates that processing times are extremely long for withdrawals. Because of this, the broker can be considered super risky and unreliable.

AlphaTick Assets — What can you trade?

Alpha Tick trading assets are diverse and include commodities, FX pairs, indices, stock CFDs, and ETFs. However, there are no crypto pairs offered, which is a considerable drawback. ETFs enable traders to speculate on Exchange Traded Funds, which are flexible instruments. Many of the instruments are CFDs, enabling quick buy and sell operations. The leverage is high, and spreads are competitive, but profit withdrawal procedures are not transparently disclosed.

Trading platforms of AlphaTick

Trading platforms at Alpha Tick are not transparently disclosed. This indicates that the broker only provides access to a custom web trading platform that is inferior to advanced platforms like MT4 and 5. This is a serious drawback as traders can not employ advanced tools, and the broker’s platform is nowhere near the advanced platforms when it comes to security as well. We can not confirm that the broker does not manipulate prices, as it offers its own web trading app. Mobile trading is also inconvenient, as there is no advanced mobile app available to speculate on the go.

Education at AlphaTick

Educational resources at AlphaTick are also limited to market analysis and news. There are no webinars, trading courses, or video content provided to teach trading. The explanations of financial markets for each asset class are scarce as well. From market analysis tools, the broker offers calculators and an economic calendar. There are no additional tools provided, like indicators or market analysis tools.

AlphaTick Customer Support

Customer support experience at Alpha Tick is actually satisfactory as the broker offers advanced live chat, and there is also an email option. The broker does not provide a phone support option, which is a serious drawback. When it comes to multilingual capabilities, the broker offers a multilingual website and support, which is flexible.

AlphaTick bonuses and promotions

When it comes to bonuses and promotions, the broker only provides a deposit bonus and a cash rebate. The deposit bonus is 50% of the deposit, and terms and conditions apply. The cash rebate is 100%. Overall, there are no diverse promotional events and bonuses, which makes the broker even less attractive for beginners.

Is AlphaTick your broker? Final verdict

AlphaTick is a regulated broker with strong account offerings and competitive trading costs. It is licensed by South Africa’s FSCA and offers important safety policies such as negative balance protection and segregated accounts. Minimum deposit requirements are low. However, it does not offer advanced platforms or access to crypto markets. Its withdrawal details are unclear. While it may suit seasoned traders, this broker overall is not suited for traders who need quick and reliable profit withdrawals.

FAQs on AlphaTick broker

Where is AlphaTick based?

AlphaTick operates through entities in South Africa (FSCA), Saint Lucia, and Cyprus. Only the South African entity is licensed as a broker.

Can you withdraw from AlphaTick?

Withdrawals are supported using bank cards, wire transfers, crypto, and broker transfers, but the broker does not disclose withdrawal processing times, which is a red flag.

Comments (0 comment(s))