CapitalXtend Forex broker review — Everything you need to know

CapitalXtend is the company’s trade name CapitalXtend LLC, which owns and operates the website. It is a regulated broker offering access to advanced platforms and diverse account types.

In this unbiased review, we will assess all the key features of CapitalXtend to determine whether it can be trusted with your trading capital.

CapitalXtend Safety and Licenses

CapitalXtend is a regulated broker. The one license is from the Financial Commission, a self-regulatory organization that resolves disputes within the financial services industry and the forex market. This license is not very powerful when compared to reputable regulators. The broker also holds another license. CapitalXtend is regulated by the Financial Services Commission of the Republic of Mauritius with an Investment Dealer License.

The broker keeps traders’ money in segregated bank accounts, ensuring they are separate from the broker’s own operational funds, which is a crucial safety feature.

The broker offers negative balance protection, ensuring that traders’ losses do not exceed their account balances, which is an important safety feature, especially for beginner traders.

CapitalXtend Overview of the website

The website of CapitalXtend is very well-built. It is responsive and full of important information about the broker’s services and safety features. There are details provided about accounts, regulations, fees, and more in a well-ordered fashion, which is crucial.

Traders can quickly navigate through the menus to find all details about promotions and other services and there is also native live chat support, a plugin built into the website directly, making it very fast and responsive.

Overall, the website truly offers a professional experience and does not miss any crucial details about spreads and payment options.

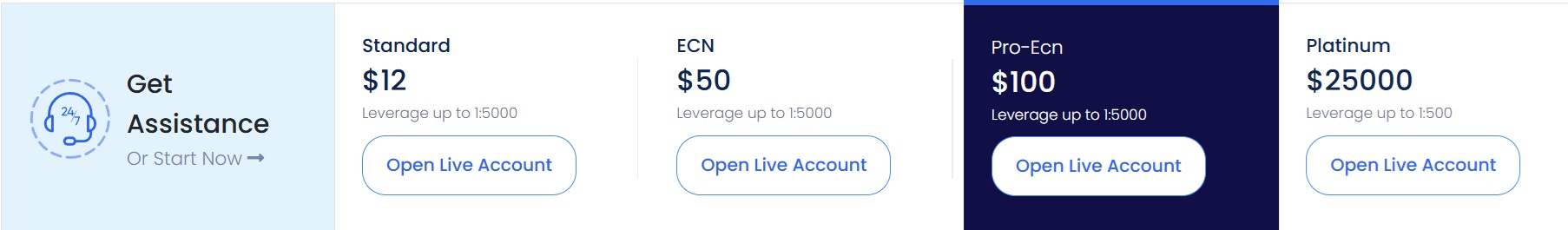

CapitalXtend Accounts Reviewed

CapitalXtend offers a diverse set of different trading account types. There are standard, ECN, platinum, and Pro-Ecn options and traders can select preferable accounts depending on spreads, deposits, and commissions.

CapitalXtend Standard Account

The standard account has the lowest minimum deposit requirement of 12 USD but has expensive spreads:

- Account currency – USD

- Minimum deposit – 12 USD

- Maximum leverage – 1:5000

- Spreads from – 2 pips

- Commissions – 0 USD

- Swap-free option – Available

- Minimum lot size – 0.01 lots

- Trading platform – Only MT4

CapitalXtend ECN Account

The ECN is a cheaper account when it comes to spreads but the minimum deposit requirement is higher:

- Account currency – USD

- Minimum deposit – 50 USD

- Maximum leverage – 1:5000

- Spreads from – 1.2 pips

- Commissions – No

- Swap-free option – Available

- Minimum lot size – 0.01 lots

- Trading platforms – MT4 and MT5

CapitalXtend Platinum Account

The platinum trading account is a VIP account that offers the lowest spreads without commissions but the minimum deposit requirement is much higher than the previous two accounts:

- Account currency – USD

- Trading platform – Only MT4

- Minimum deposit – 25,000 USD

- Maximum leverage – 1:500

- Spreads from – 0.0 pips

- Commissions – 0 USD

- Swap-free option – No

- Minimum lot size – 0.01 lots

CapitalXtend Pro-Ecn Account

The Pro-Ecn account is for scalpers as it has the lowest number of accounts, competitive commissions, and requires a low minimum deposit:

- Account currency – USD

- Platform – MT4 and MT5

- Minimum deposit – 100 USD

- Maximum leverage – 1:5000

- Spreads from – 0.0 pips

- Commissions – 3 USD per side per lot

- Swap-free option – Available

- Minimum lot size – 0.01 lots

Overall, the broker offers diverse and competitive choices for all kinds of trading styles and budgets, which makes it suitable for both beginners and pros.

Deposit and withdrawal options at CapitalXtend

The broker allows traders to use a wide range of funding options including Visa & MasterCard, Paylivre, cryptos (Bitcoin, Ethereum, USDT-OMNI, USDT-ERC20, Doge, Litecoin, BSC, SDT-TRC20), ThunderXPay, wire transfers, local transfers, and online banking. The broker is different from others as it claims to process both deposits and withdrawals within 24 hours. Many brokers typically allow instant deposits and then have lengthy times like 2-4 business days for withdrawals, while CapitalXtend has quicker withdrawals but slower deposits.

CapitalXtend Assets — What can you trade?

Traders can access a wide range of markets at CapitalXtend including Forex pairs, commodities, indices, and crypto pairs. Indices are offered as CFDs enabling quick buy and sell execution and commodities consist of spot metals and spot energies. There is a contract specifications page where the broker provides details about each instrument it offers, allowing traders to know contract size, average spreads, and more. This page is especially important for swing traders as it provides details about swaps which typically change and traders who trade overnight need to check them constantly to calculate exact trading costs. The leverage is more than enough to allow traders to control large positions and beginners should be careful not to take excessive risks.

Trading platforms of CapitalXtend

CapitalXtend allows access to two most popular advanced trading platforms, MetaTrader 4 (MT4), and MetaTrader 5 (MT5). Both of these platforms are standalone software that allows custom indicators, automated trading (EAs), and many more advanced technical analysis tools. The broker does not prohibit EAs, which is flexible for algorithmic traders. Mobile trading is also available via the MT5 mobile app, which is one of the most advanced for mobile devices like iOS and Android tablets and smartphones.

Education at CapitalXtend

When it comes to educational resources, the broker offers an academy where traders can access tutorials in the form of articles consisting of many important aspects and concepts in trading. The page is well-ordered and traders can choose between different categories like Forex, spot energies, and all other assets coupled with trading platform tutorials and extras. There is also a guide to joining CapitalXtend’s “spin and win” trading contest. There are no webinars offered currently nor are there any video tutorials or guides, which is a drawback. Otherwise, the broker really does a good job when it comes to educational articles and posts.

Extra features

CapitalXtend provides several extra features like VPS services, social trading, copy trading, and PAMM accounts. Copy trading can be very useful for traders as it allows them to copy trades from experienced traders and replicate their performance.

CapitalXtend Customer Support

Customer support is responsive and provided via live chat, email, and phone support options at CapitalXtend. Traders can access live chat directly via a plugin or navigate to the Contact Us section to see all the support options. The website as well as support options are available in a multitude of different languages, which makes the broker multilingual.

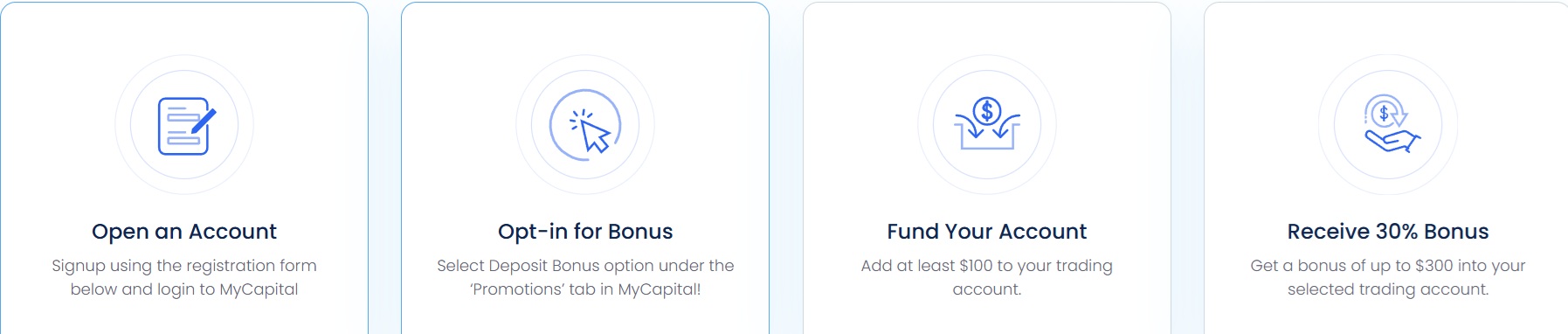

CapitalXtend bonuses and promotions

The broker offers several promotions including trading contests, a 30% deposit bonus which is heavily advertised on its website, and a cashback program. The bonus is up to 300 dollars and is only credited to MT4 accounts. A minimum of 100 dollars is required to be eligible for this bonus.

Is CapitalXtend your broker? Final verdict

CapitalXtend offers diverse account types (Standard, ECN, Platinum, Pro-ECN) with very low minimum deposit requirements (just 12 dollars), and exceptionally high leverage (up to 1:5000), attracting traders at all experience levels. The main strengths of the broker include MT4&5 access, negative balance protection for all retail clients, segregated funds, a well-designed website, and fast withdrawals under 24 hours.

However, its regulation (MU FSC and FC SRO) is less stringent than top-tier regulators and educational materials lack videos and webinars. The broker is mostly suitable for beginners for low entry barriers but traders should carefully consider the regulatory status and inherent risks of high leverage of the broker.

FAQs on CapitalXtend broker

Where is CapitalXtend based?

CapitalXtend LLC is registered and regulated in Mauritius by the FSC, offering services globally.

Can you withdraw from CapitalXtend?

Yes, the broker claims quick withdrawal processing under 24 hours, which is very competitive.

Comments (0 comment(s))