DLSM Forex broker review — Everything you need to know

DLSM is the company’s trading name and website name, and the company behind them is DLS Markets Limited, which is a securities dealer, meaning it is a forex and CFDs broker. It offers several account types and diverse market access.

In this compact but uncompromised review of DLSM, we will assess its safety, account types, spreads, leverage, profit withdrawals, platforms, customer support experience, and more.

DLSM Overview of the website

The website of DLSM is super snappy and enables very fast navigation. It is very responsive, and pages are opened instantly upon mouse-click. This makes it a very convenient experience to browse the website of this broker. All crucial details are given in well-sorted menu items, and traders can quickly check accounts, platforms, and other crucial information.

The website incorporates a live chat plugin, which enables users to quickly contact the broker and get assistance, which is very flexible. The website is also mobile-friendly and, despite being modern in design, is not crowded by unnecessary media and colors.

Overall, the website of DLSM is professionally built and does its job very well.

DLSM licenses and safety policies

Safety is critical in forex trading, and DLSM is a regulated broker. Despite being relatively young, as it was established in 2023, it has already managed to get two licenses, which is important. However, we have found several negative trader comments, indicating that the broker declines withdrawals and freezes traders’ money. While these few comments are not a direct indication of a scam, they still show some real red flags.

DLS Markets Limited is a broker regulated by the Vanuatu Financial Services Commission, and DLS Markets Limited is a member of The Financial Commission. It has to be noted that this FC is not a regulator and more like a self-governing organization, meaning the 2nd license is not truly a license. However, the broker still has a Vanuatu license, which is an offshore regulator known for its less stringent requirements. The broker claims to keep user funds in segregated bank accounts.

However, there are no details about the negative balance protection (NBP) policy, which is a considerable drawback for this broker.

In the end, DLSM offers mediocre reliability due to negative trader feedback and weak licenses, plus the absence of an NBP policy.

DLSM Accounts Reviewed

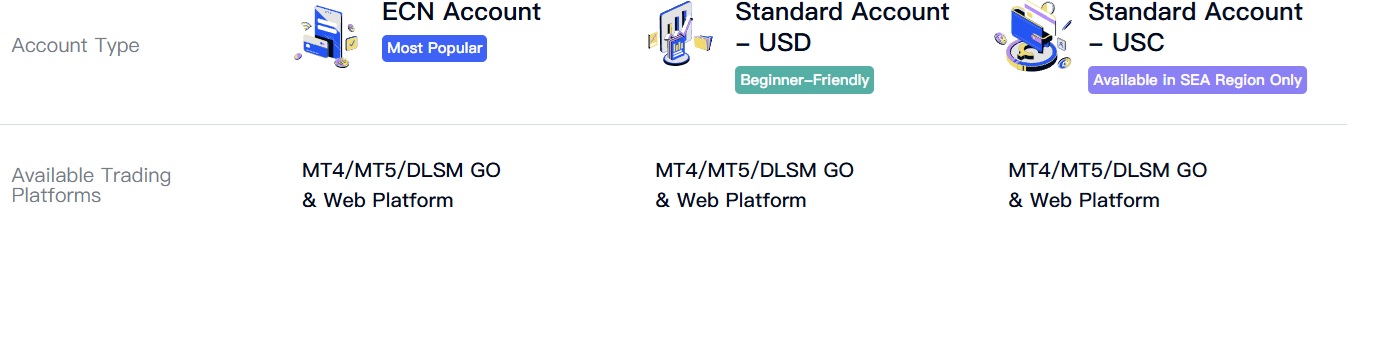

DLSM presents an interesting case when it comes to trading accounts. The broker offers three account types, two of which are available globally, while the third is only for the SEA region. The accounts are ECN, Standard USD, and Standard USC. Below, we will briefly review each of these accounts to define how competitive the broker is and whether it is a cheap broker.

DLSM ECN Account

The ECN account offers a 0-pip spread trading environment with competitive commissions. Here are the full specs:

- Minimum deposit – 100 USD

- Maximum leverage – 1:1000

- Spreads – 0 pips

- Commissions – 4 USD per lot per side

- Minimum lot size – 0.01 lots

DLSM Standard USD Account

The standard account has spreads which are slightly above the industry-average and offers a commission-free trading environment:

- Minimum deposit – 100 USD

- Maximum leverage – 1:500

- Spreads – From 1.2 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

DLSM Standard USC Account

The USC account requires the lowest deposit, which is very flexible, but it has regional restrictions:

- Minimum deposit – 10 USD

- Maximum leverage – Up to 1:1000

- Spreads – From 1.2 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

Overall, the account offerings are pretty competitive with this broker, enabling traders to select suitable accounts depending on their trading systems.

Deposit and withdrawal options at DLSM

When it comes to deposits and withdrawals, traders can use multiple methods such as bank cards (Visa and MasterCard), global wire transfers, multiple e-wallets (MYR E-Wallet, MYR Bank TF, IDR), and cryptos (USDT and USDC). Deposits are mostly instant, and no fees are charged from the broker’s side, but payment methods charge their own commissions. Withdrawals, on the other hand, are processed in 1-2 business days except for wire transfers, which usually require up to 4 business days to get completed. This is an inconvenience for sure, as faster profit withdrawals would be much better.

DLSM Assets — What can you trade?

When it comes to market access, DLSM allows traders to speculate on various markets, including forex pairs, commodities, indices, and stocks. From stocks, the broker offers only US stocks, and from commodities, gold and energies are offered. The lack of crypto assets is a serious drawback for this broker, especially because it enables crypto payments. Most of these instruments are CFDs, meaning that traders can instantly buy or sell short any instrument, which is very flexible. Trading conditions are competitive, and deposit requirements are also flexible.

Trading platforms of DLSM

There are a few advanced trading platforms available at DLSM, including MetaTrader 4 and MetaTrader 5. Both platforms offer custom indicators and Expert Advisors (EAs), and the broker does not prohibit them from using algorithms. Mobile trading is available via MT4 and 5 apps, and there is also a web trading terminal available, which is flexible.

Education at DLSM

The broker does not provide comprehensive educational materials, as there are no webinars, video guides, or trading courses available. There are no market analytics tools, but there are market updates and a trading blog. From extra features, the broker offers copy trading services, enabling traders to replicate other traders’ performance.

DLSM Customer Support

Customer support experience of DLSM is provided via live chat and email. There is no phone option available, which is a drawback and a red flag. The live chat is built-in directly into the website via the plugin, which makes it possible to instantly access broker representatives and get assistance.

DLSM bonuses and promotions

At the moment, the broker does offer a 50% deposit bonus of up to 1,000 USD. However, there are no other ongoing promotional events. The lack of comprehensive bonuses and promotional events is a downside for this broker. No events are offered either.

Is DLSM your broker? Final verdict

DLSM is a relatively new forex and CFDs broker with modern platforms, fast trade execution speeds, and flexible account choices. However, its offshore regulations, lack of negative balance protection, and mixed trader feedback raise some questions about its reliability. It might be suitable for pro traders seeking high leverage, but it is surely less ideal for beginners and traders who prioritize superior reliability.

FAQs on DLSM broker

Where is DLSM based?

DLSM is based in Vanuatu and operated by DLS Markets Limited, making it an offshore FX broker.

Can you withdraw from DLSM?

Yes, withdrawals are possible via cards, crypto, and bank transfers, though some users reported delays.

Comments (0 comment(s))