Emarlado Forex broker review — Everything you need to know

Emarlado is the company’s trade name, and the website is operated by StarLight Wave Ltd, a Forex and CFDs broker offering trading services globally. The broker has been in operation since 2023, making it a relatively young entity.

In this unbiased review of Emarlado broker, we will analyze its most critical features to evaluate its safety, spreads, accounts, platforms, commissions, profit withdrawals, support, educational offerings, and more.

Emarlado Overview of the website

The website of the Emarlado broker is responsive and enables quick navigation around using menus and a user-friendly interface. However, the broker lacks many crucial details like minimum deposit requirements, and there is no dedicated button or section where it provides information about deposits and withdrawals. This is a serious issue, and the website can not be called a professional website. There is no live chat plugin built inside the website, either, which is also a serious drawback.

Overall, Emarlado’s website lacks professionalism as there are no details provided for some of the most crucial trading conditions, and there is no live chat plugin either.

Emarlado Safety and Regulations

Safety is paramount in FX trading. The company behind Emarlado is StarLight Wave Ltd, which is a broker registered in Saint Lucia. However, the broker is overseen by the Mwali International Services Authority in Comoros. This regulator is not very strict and leaves plenty of room for scams and fraud, and coupled with a lack of a live chat, Emarlado does not seem like a regulated broker that is also safe.

Emarlado Accounts Reviewed

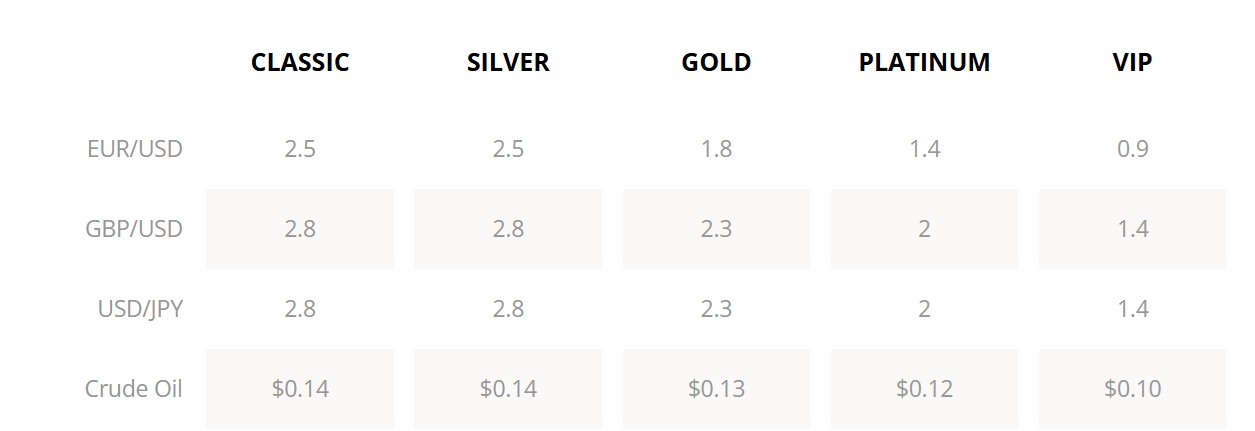

The broker offers a wide range of different trading accounts, such as Classic, Silver, Gold, Platinum, and VIP. This is more like a tiered account rather than different types of accounts, such as STP and ECN. Let’s briefly overview each of them to see how competitive the broker actually is. The leverage is different depending on the trading assets. FX pairs have up to 1:400, commodities up to 1:200, indices up to 1:200, commodities up to 1:200, and stocks have up to 1:5.

Emarlado Classic Account

The classic trading account is an entry-level trading account that is for general trading purposes and has the following conditions:

- Minimum deposit – 1 USD

- Maximum leverage – Up to 1:100

- Spreads from – 2.5 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

Emarlado Silver Account

The silver account offers almost the same conditions as the classic account and offers the following conditions:

- Minimum deposit – Unknown

- Maximum leverage – Up to 1:100

- Spreads from – 2.5 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

There is no data about minimum deposit requirements for this account, which is a serious drawback.

Emarlado Gold Account

The Gold account has slightly cheaper spreads, but it is still expensive and does not offer minimum deposit information. Here are its specs:

- Minimum deposit – Unknown

- Maximum leverage – Up to 1:100

- Spreads from – 1.8 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

Emarlado Platinum Account

The platinum account has even lower spreads but is still expensive and provides no details about minimum deposit requirements. Here are its conditions:

- Minimum deposit – Unknown

- Maximum leverage – Up to 1:100

- Spreads from – 1.4 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

Emarlado VIP Account

The VIP account is the only account that offers spreads near the industry-average, but deposit requirements are not clearly given. Here are its main specs:

- Minimum deposit – Unknown

- Maximum leverage – Up to 1:100

- Spreads from – 0.9 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

Overall, Emarlado is an expensive broker that has very high spreads on all accounts except for the VIP, where it requires a high minimum deposit, which is not disclosed transparently.

Deposit and withdrawal options at Emarlado

The accepted payment options include Credit/Debit Card, E-wallets, and Wire Transfer. However, the processing time for withdrawals is enormous; traders have to wait for 8-10 days, which makes the broker a scam. There are no details disclosed regarding fees. This is a serious red flag. Making withdrawals is lengthy and uncomfortable is a primary sign of scams and fraudulent brokers. Stay away.

Emarlado Assets — What can you trade?

The broker enables access to a wide variety of trading asset classes, including FX pairs, commodities, indices, and stocks. Most of these assets are CFDs. From commodities, traders can access metals and energy products only, and there are no agricultural products. The broker does not provide access to cryptocurrencies, which is a serious drawback for traders. With a leverage of 1:400, it is possible to operate large trading positions, but spreads are too expensive to recommend this broker to anyone.

Trading platforms of Emarlado

The broker lacks an advanced trading platform and offers its own proprietary trading platform. This is a web-based platform, which is far inferior to popular, advanced software like MT4 and MT5. There is also a mobile trading app based on this web platform, but it is not very useful either, as it lacks many tools and built-in indicators. Overall, the trading platform experience requires immediate attention from the broker as it is not competitive in its current form.

Education at Emarlado

The broker offers an educational center and an FAQs section, where it provides both education and answers to the most frequently asked questions. There is only one trading course available, which requires traders to open an account to apply. This is a minor drawback, as not everyone can get an education. The FAQs section is useful, but the broker should be offering the main details on its website and not in the FAQs.

Emarlado Customer Support

Customer support is critical in online financial trading, and Emarlado offers only email and phone support options. While these channels are very potent, the lack of live chat is a serious drawback, as it is the fastest way to contact your broker and resolve any issues. As a result, the support experience at Emarlado is at least unsatisfactory, as traders have two options: spend a lot of money and call the broker or wait for an email response, which takes some time. The support as well as the website of Emarlado is available in 2-3 languages, which does not make the broker a multilingual brand.

Emarlado bonuses and promotions

Emarlado does not provide any bonuses at the moment. There are no deposit bonuses or welcome bonuses available, which is a minor drawback. There are no promotions available as well. Overall, the broker lacks incentives for new traders to sign up for its accounts, which is actually a positive thing, as the broker seems like a scam.

Is Emarlado your broker? Final verdict

Emarlado is a high-risk, offshore Forex broker with limited transparency, poor withdrawal terms, and no live chat support option. While it offers tiered accounts and access to major asset classes, the spreads are too high, the platform is web-based, and key details are missing about deposit requirements and fees.

FAQs on Emarlado broker

Where is Emarlado based?

The broker is registered in Saint Lucia and claims regulation under MISA (Mwali) in the Comoros.

Can you withdraw from Emarlado?

No, the broker has 8-10 days of processing times for withdrawals, which makes it a painful process to even try and withdraw profits.

Comments (0 comment(s))