FairMarkets Forex broker review — Everything you need to know

FairMarkets is a Forex and CFDs broker that was launched in 2021. It offers access to several markets and accounts on advanced trading platforms MT4 and MT5.

In this unbiased review of FairMarkets, we will analyze the broker’s main features to assess its safety, accounts, platforms, spreads, leverage, profit withdrawals, support, education, and more.

FairMarkets Overview of the website

The website of FairMarkets is simplistic but responsive, and traders can quickly navigate through pages using the menu bar, which offers all the necessary information. There are details about accounts, platforms, trading assets, and more. All these details are crucial for traders to check available assets and conditions before registering an account, and the broker offers a user-friendly design.

The website is also mobile-friendly and enables traders to access it from mobile phones and tablets. The website lacks a live chat plugin, and traders have to use the send message feature to contact the broker or phone number.

FairMarkets Safety and Regulations

FairMarkets is a regulated broker. It is overseen by the Australian Securities & Investments Commission, which is among the most reputable regulators for forex brokers. The broker is also overseen by the Mauritius FSC, which is a Financial Services Commission.

As a regulated broker, FairMarkets keeps trader funds in segregated bank accounts to keep them separate from its own operational funds. This is a crucial safety policy.

All accounts are also protected using the negative balance protection, which prevents traders from going into the negative. This is especially crucial for beginner traders.

FairMarkets Accounts Reviewed

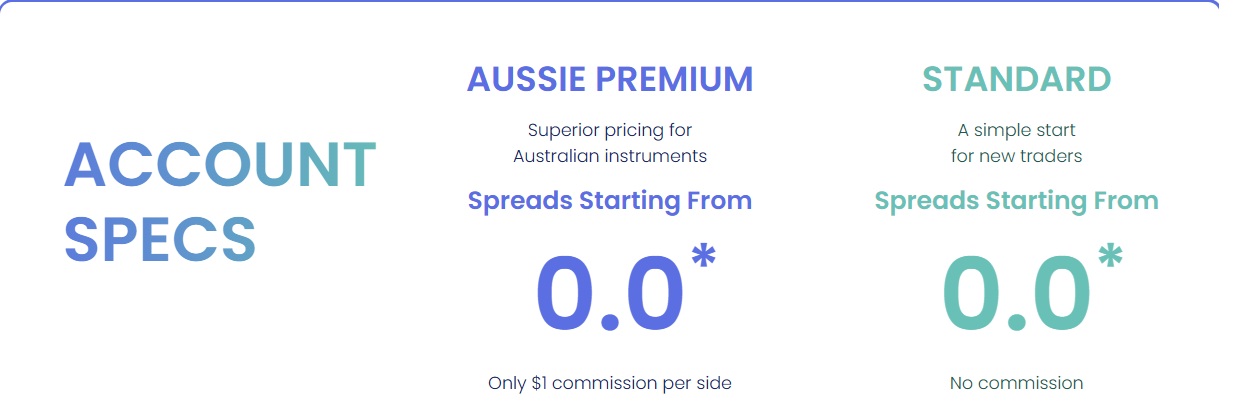

The broker offers several trading accounts, and all details are transparently provided on the website. The three Fairmarkets accounts are Aussie Premium, Standard, and Pro. The Pro account is a professional-grade account that offers premium features and higher leverage. Let’s briefly review each of these accounts to see how competitive the broker truly is.

FairMarkets AUSSIE PREMIUM Account

The Aussie premium trading account has favorable conditions because its spreads are from 0.0 pips, and commissions are super low at 1 USD per side per lot. This is very attractive and enables traders to deploy scalping strategies profitably, as the commission is very low and spreads are from zero.

The minimum deposit is 1 dollar, which makes it very attractive for beginners. The minimum lot size is 0.01 lots. The broker does not charge commissions on AUD crosses, which is very competitive.

FairMarkets STANDARD Account

The standard account is for general trading purposes and is commission-free. The broker claims spreads from 0.0 pips, but we can not confirm the spreads are this low without commissions. Here, the broker does not ask for a certain minimum deposit requirement, meaning traders can deposit from 1 dollar, which is very flexible. This minimum deposit requirement policy makes FairMarkets perfectly suited for beginners who want to test live markets on a budget.

FairMarkets Pro Account

The pro account is where traders can get higher leverage, even under the ASIC jurisdiction. Professional traders are not required to follow strict leverage regulations, which enables brokers to provide up to 1:500 leverage on this account. All other conditions are similar to other accounts with a spread from 0.0 pips and no minimum deposit requirements. Traders will have to show evidence that they have experience trading professionally.

Deposit and withdrawal options at FairMarkets

The broker allows traders to use several payment options, including bank cards, wire transfers, and e-wallets. However, traders can only use wire transfers and bank cards like Visa and MasterCard for withdrawals, and they can not use e-wallets. However, we have no data about transaction fees and processing times, which is a considerable drawback.

Overall, the profit withdrawal experience is not satisfactory at FairMarkets.

FairMarkets Assets — What can you trade?

The broker offers a wide range of instruments in popular asset classes like equities, Forex pairs, commodities, and index CFDs. The majority of assets are CFDs, but there are many spot assets offered as well, which is flexible. The broker also offers dividend-generating stock trading and investing. The leverage is flexible, and spreads are competitive.

Trading platforms of FairMarkets

When it comes to trading platforms, FairMarkets is a very competitive broker. It offers access to two of the most advanced and popular trading software, MT4 and MT5. Both platforms allow custom indicators and Expert Advisors, or EAs, for automated trading, and the broker does not prohibit traders from deploying any of those tools. Mobile trading and web trading are also available via the MT4 and MT5 apps, which are accessible on both iOS and Android.

Education at FairMarkets

FairMarkets is a solid broker that offers educational resources. There are e-books and educational materials for beginners. Books are a great source for trading knowledge and wisdom, and they are absolutely recommended for beginner traders. Together with educational resources, the broker also provides trading tools access such as an economic calendar and calculators. The economic calendar is useful to monitor macroeconomic news, while calculators help traders calculate pip value and position sizing.

FairMarkets Customer Support

Customer support is the second most important aspect in financial trading after regulations. The broker offers only email and phone support options. There is no live chat available, which is a serious downside. This is true only for Australian websites, and international traders can get live chat support as well.

The broker is not multilingual, which is a minor drawback.

Is FairMarkets your broker? Final verdict

FairMarkets is a regulated FX broker offering strong account options, excellent platforms (MT4 and MT5), and beginner-friendly features like a 1 USD minimum deposit. While spreads and leverage are very competitive, the lack of transparent withdrawal policies and no live chat for Australian clients is a considerable drawback.

Overall, it is a relatively trustworthy broker, but support and fee transparency could be improved.

FAQs on the FairMarkets broker

Where is FairMarkets based?

FairMarkets is based in Australia and Mauritius, but it offers trading services to global audiences.

Can you withdraw from FairMarkets?

Yes, withdrawals are possible via bank cards and wire transfers, but the details about processing times and fees are unclear.

Comments (0 comment(s))