InTrade Forex broker review — Everything you need to know

Intrade Finance is a young Forex and CFDs broker, offering its trading services worldwide. The broker has several account types and promises an institutional-grade trading environment. However, we have found some red flags.

In this unbiased review of InTrade broker, we will analyze its services in great detail to evaluate its safety, spreads, accounts, platforms, profit withdrawals, leverage, commissions, support, and more.

InTrade Overview of the website

The InTrade website is looking more like a PowerPoint translated into a web page than a professional broker website, which is a downside and a red flag. While it is responsive when trying to access different pages, it overall feels heavy. There is no dedicated, well-sorted section for accounts where traders could compare different accounts. Instead, account types are listed on the website under a menu, and traders have to click on them separately to check conditions for each one. There is no direct menu or button to check conditions regarding deposits and withdrawals, which is a downside. There is a live chat plugin built directly into the website, which is useful.

Overall, the website feels rushed and lacks some crucial features and information about the core trading services, which can not be underestimated.

InTrade Safety and License

Security starts from regulations, and unregulated brokers are mostly scams. InTrade claims to be a member of an international self-governing organisation for disputes between brokers. “The Financial Commission” is an independent dispute resolution agency (EDR) for investors who cannot resolve disputes with financial service providers. As we can see, this is not a proper regulatory organization, and while providing some basic feel of security, the broker is not truly licensed. This is a major red flag for safety and makes the broker unreliable.

InTrade Accounts Reviewed

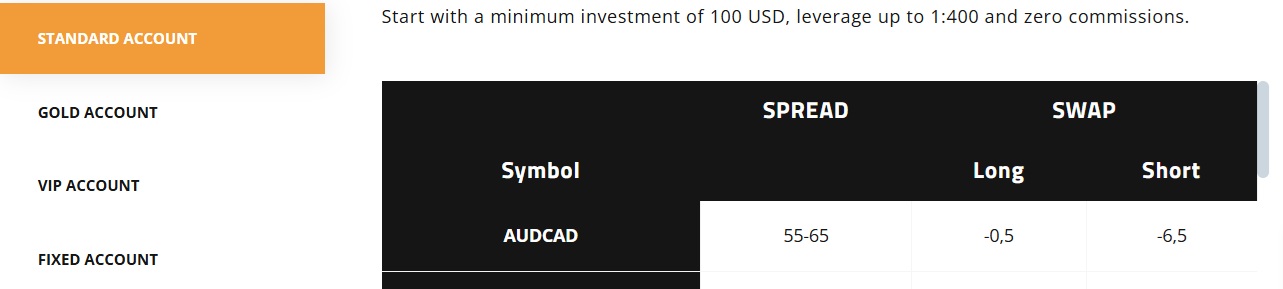

Trading accounts at InTrade are diverse and include Standard Account, Gold Account, VIP Account, and Fixed Account. Each of these accounts offers slightly different features, which are useful for different kinds of trading styles. To compare them better, let’s briefly review each account.

InTrade Standard Account

The standard trading account from InTrade is for general FX trading purposes, and it has spreads over commissions. Here are some of the main specs of this account type:

- Minimum deposit – 100 USD

- Maximum leverage – 1:400

- Spreads from – 1 pip

- Spread type – Floating

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

InTrade Gold Account

The Gold trading account offers slightly lower spreads on major pairs, but the minimum deposit is much higher. Here are all the important conditions of the InTrade Gold account:

- Minimum deposit – 5,000 USD

- Maximum leverage – 1:400

- Spreads from – 0.9 pips

- Spread type – Floating

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

InTrade VIP Account

The VIP account is usually the best offering from brokers where traders need to deposit large sums of money, but get the best conditions out there. In the case of InTrade FX broker, the minimum deposit is 20,000 bucks, and the conditions for this large minimum deposit requirement are as follows:

- Minimum deposit – 20,000 USD

- Maximum leverage – 400:1

- Spreads from – 0.7 pips

- Spread type – Floating

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

InTrade Fixed Account

The Fixed account offers fixed spreads, meaning the spreads always stay the same even during highly volatile times. This account, therefore, is suited for news trading and other types of strategies aimed at highly volatile markets. Here are its conditions:

- Minimum deposit – Unknown

- Maximum leverage – 1:400

- Spreads from – 1.1 pips

- Spread type – Fixed

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

1.1 pips for a fixed type of spreads is really competitive, as fixed spreads are generally higher than standard accounts.

Deposit and withdrawal options at InTrade

Deposits and withdrawals are a critical part of financial trading. The faster the withdrawals, the more legit and reliable the broker is. In the case of the InTrade broker, there are no details provided regarding payment methods and processing speeds. There are no details about fees either, which is a serious downside. The broker claims fast withdrawal processing, but we can not trust it by the world as the details are missing on its website.

Overall, InTrade falls short when it comes to reliable and safe deposits and withdrawals, and traders should be extra careful.

InTrade Assets — What can you trade?

When it comes to trading assets of InTrade, the broker offers access to diverse markets such as FX pairs, commodities, indices, cryptos, and shares. Most of these assets are provided in the form of CFDs, meaning traders can quickly initialize both buy and sell positions, which is flexible in the case of cryptos and shares. The leverage is more than enough to control large trading positions. The spreads are competitive, and traders can choose between fixed and floating spreads, giving them diverse opportunities. However, the lack of 0-pip accounts is a drawback for scalpers.

Trading platforms of InTrade

When it comes to trading platforms, the broker falls short once again. There is only a custom web trading app provided for trading from the browser. However, there is no access to advanced trading platforms like MT4 and MT5, which is a serious red flag for this broker. Mobile trading apps are yet another drawback, as the broker does not provide any useful apps to make trading on the go convenient. Overall, trading platforms are the worst among InTrade services, and they need immediate improvements.

Education at InTrade

The broker lacks educational resources. There are no webinars, trading courses, or video content available, which is a drawback. Lack of educational materials makes the broker unsuitable for beginners. There are no market analysis tools available either, which is also disadvantageous.

InTrade Customer Support

Customer support experience at InTrade is provided via several channels, like live chat and email. There is no phone support offered, which is a red flag for sure. There is no address disclosed either, making the broker risky to sign up for. Both the website and support options are only available in English, which is also a minor drawback.

InTrade bonuses and promotions

While the broker lacks educational resources and market analysis tools, there are plenty of promotional offerings available. There is a 30% welcome bonus on the first deposit. For traders who deposited more than 1,000 dollars, the bonus is increased to 40%. However, conditions apply, and traders should carefully read all the terms before using bonuses.

Is InTrade your broker? Final verdict

InTrade is a young broker with several account types and competitive spreads. However, it is not regulated, lacks transparency on deposits and withdrawals, and offers only a web trading platform. Its promotional bonuses can be attractive, but the absence of overriding and advanced platforms is a serious drawback.

The broker’s lack of educational resources and unverified withdrawal claims make it difficult to recommend this broker to anyone.

FAQs on InTrade broker

Where is InTrade based?

InTrade does not disclose a clear physical address on its website, which is a major red flag. It is not regulated.

Can you withdraw from InTrade?

InTrade claims to offer fast withdrawals, but no specific details are given transparently about payment methods, processing times, and fees.

Comments (0 comment(s))