KAMA Capital Forex broker review — Everything you need to know

KAMA Capital is the company’s trade name, and Kama Capital Securities Broker LLC is the full name of the entity that owns both the name and website. The broker has been around since 2022, making it a decently experienced FX and CFD broker. Traders can access popular assets like Forex and stocks, but there is no crypto trading available.

In this full review of the Kama Capital broker, we will assess its most important features, including safety, accounts, spreads, leverage, withdrawal procedures, support, and many more.

KAMA Capital Overview of the website

The website of Kama is modern-looking, and the broker did a good job of enabling fast navigation. The website is responsive and user-friendly. Most of the important details are clearly described, which is crucial in Forex trading. This way, traders can just navigate around to find all the necessary details like account types, available markets, platforms, and so on.

The live chat plugin is built directly on the main page, making it easy to contact the broker in case issues arise during trading.

Overall, the website offers a satisfactory experience and enables anyone to find everything about the broker’s offered services.

Safety and regulations

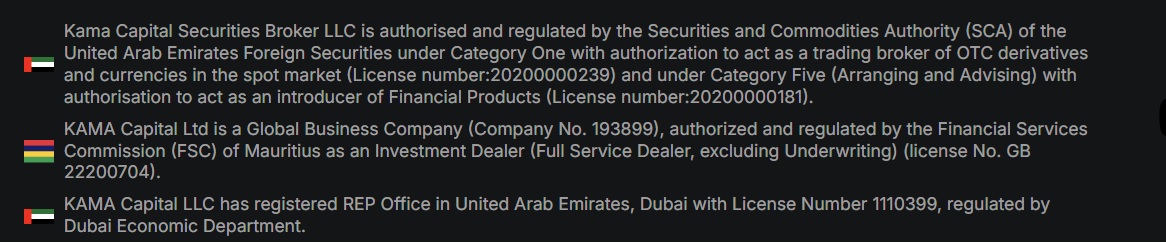

Safety is the most critical part of the broker analysis. Without proper regulations, chances are high that you are dealing with a scam. In the case of Kama Capital, there are several licenses:

- Kama Capital Securities Broker LLC is authorised and regulated by the Securities and Commodities Authority (SCA) of the United Arab Emirates

- KAMA Capital Ltd is a Global Business Company that is authorized and regulated by the Financial Services Commission (FSC) of Mauritius

- KAMA Capital LLC has registered a REP Office in the United Arab Emirates and is regulated by the Dubai Economic Department

The broker is also incorporated in St. Vincent and the Grenadines, but is not overseen there by the local authority. Kama Capital does offer Negative Balance Protection, which is a crucial safety policy for retail traders to prevent them from losing more than their initial investment. With this policy, the balance is reset to zero if it falls below 0 USD.

Segregated bank accounts are used to keep trader capital on separate accounts from the broker’s operational funds, which is a standard security policy required by regulators worldwide.

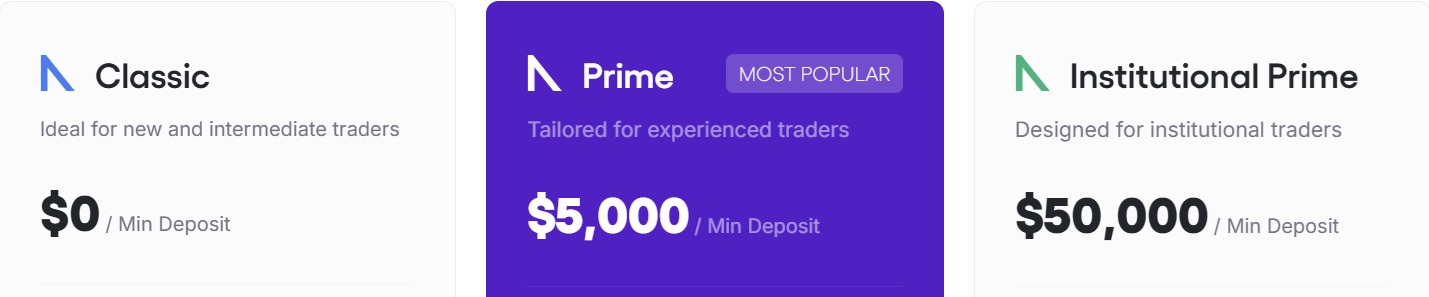

KAMA Capital Accounts Reviewed

Kama Capital offers a wide range of trading accounts and tries to be as beginner-friendly as possible. As a result, the minimum deposit starts from just 0 USD on its classic account. Let’s analyze the full offerings of the broker to see if it’s truly competitive and attractive.

KAMA Capital Classic Account

The classic trading account from Kama is designed for everyday trading experience and offers very low deposit requirements:

- Minimum deposit – 0 USD

- Maximum leverage – 1:400

- Spreads from – 0.8 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots allowed

The account also allows traders to use Expert Advisors or EAs, and there is 24/5 technical account support available, and one-click trading is enabled as well. There is also an Islamic account variant for the classic account.

KAMA Capital Prime Account

This account is for traders who have some experience and can deposit substantial capital in their accounts. The conditions are as follows:

- Minimum deposit – 5,000 USD

- Maximum leverage – 1:400

- Spreads from – 0.5 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

These spreads are super competitive and enable traders to trade at very low cost without commissions. One-click trading, EAs, and Islamic accounts are also offered.

KAMA Capital Institutional Prime Account

This account is designed for institutional traders and offers very competitive conditions for a higher minimum deposit. Here are all its important specs:

- Minimum deposit – 50,000 dollars

- Maximum leverage – Up to 1:200

- Spreads from – Raw

- Commissions – Institutional

- Minimum lot size – enabled

This account offers all the benefits and features of previous account types, while offering very low commissions and zero spreads.

Overall, Kama Capital is truly competitive and offers very attractive conditions. The only minor drawback is that its spreads are more suited for swing traders and trend traders, and scalpers might find it difficult to generate profits due to higher trading costs.

Deposit and withdrawal options at KAMA Capital

The tendency continues with deposit and withdrawal procedures. The broker is very competitive. Both deposits and withdrawals are commission-free. Available methods for deposits include wire transfers (2 days processing time for both deposits and withdrawals), bank cards (Visa and MasterCard), and E-wallets. The withdrawals are only allowed using wire transfers and e-wallets, and e-wallet withdrawals are instant, which is super competitive in the scene right now.

KAMA Capital Assets — What can you trade?

Kama Capital FX broker enables access to a wide range of different asset classes, including Forex pairs (majors, minors, exotics), commodities, indices, and even stocks. However, there are no cryptos offered for trading, which is a drawback for sure. Spreads are competitive, and leverage is more than enough to control sizable trading positions, making Kama Capital a truly competitive broker with several licenses.

Trading platforms of KAMA Capital

Kama Capital offers one of the best trading platforms in the market right now: MetaTrader 5. The broker enables traders to use both custom indicators and Expert Advisors, which makes it possible to use MT5 to its full potential. Mobile trading is available via the MGT5 mobile app, allowing trading on the go, and it is a very flexible mobile trading app, one of the best in the scene.

Education at KAMA Capital

The broker offers a learning lab, which is a dedicated section for market research. However, there are only the Signal Center Tool and the economic calendar. There are no trading courses, webinars, or video tutorials offered, which is a drawback. However, signals and the economic calendar enable traders to make more informed decisions, which is advantageous.

KAMA Capital Customer Support

Kama Capital is a complete forex broker as it offers all three major customer support options: email, live chat, and phone support channels. The website and support are both multilingual, making the broker attractive for an international audience of traders.

KAMA Capital bonuses and promotions

Kama Capital does not provide any type of bonuses or promotional events. The broker has very competitive conditions, and bonuses and promos would attract many traders to its platforms. This is a minor drawback as the 0 USD minimum deposit and 1:400 leverage make it possible to start with a very low trading budget anyways.

Is KAMA Capital your broker? Final verdict

Kama Capital is a very well-regulated Forex and CFDs broker that offers very competitive conditions, including 0 USD minimum capital requirements, up to 1:400 leverage, and commission-free trading with low spreads. Its strong regulations, NBP policy, and segregated accounts make it a safe choice for retail traders. While the lack of crypto trading and educational resources are its drawbacks, its MT5 platform, fast withdrawal processing, and multilingual website and support make it a solid option for both beginners and experienced traders.

FAQs on the KAMA Capital broker

Where is KAMA Capital based?

KAMA Capital is based in the UAE, regulated by the SCA, with additional regulation from FSC Mauritius, and a registered office in Dubai. The broker is also incorporated in Saint Vincent and the Grenadines.

Can you withdraw from KAMA Capital?

Yes, withdrawals can be made via bank wire and e-wallets. E-wallet withdrawals are instant and fee-free, while bank wires require 2-day processing time.

Comments (0 comment(s))