OFinancial Forex broker review — Everything you need to know

OFinancial is the company’s trade name and website name, which is owned and operated by OMNI Markets LLC, which is a brokerage company registered in Antigua. The broker offers several accounts and advanced platforms, but we have detected several severe issues.

In this unbiased and full OFinancial broker review, we will assess its safety, accounts, trading costs, profit withdrawals, support, and much more.

OFinancial Overview of the website

The website of OFinancial is modern-looking and enables users to quickly navigate around. It is responsive and is not laggy or heavy. The interface is very user-friendly and not overcrowded by unnecessary information and media. This is crucial as users need to check trading conditions before opening an account, and OFinancial does a good job of providing important specs and conditions about its service on its website. The website is also mobile-friendly, making it easy to access it from mobile devices, which is important as well.

The live chat is built directly on the website, enabling quick contact with the support, and traders can choose between live chat via website plugin and WhatsApp.

OFinancial Security and Safety Policies

Safety is critical in trading, and regulated brokers are usually safer choices. In the case of OFinancial, the broker is only registered in Antigua and is not overseen by any major authority, making it a very risky broker. As an unregulated broker, OFinancial is a risky broker as it is difficult to define whether it follows ethical and regulatory standards to protect its clients’ rights.

As a result, it is difficult to confirm whether it keeps client funds in segregated bank accounts to ensure fund safety. The broker mentions KYC policies, but it is not enough for proper security and reliability.

An OFinancial broker offers negative balance protection to retail traders for metals and forex pairs, which is crucial to avoid losing more than the trading account balance, which can occur if traders fully employ the high leverage the broker offers.

OFinancial Accounts Reviewed

When it comes to trading account types, OFinancial offers the following account types: Classic, Premier, Elite, Social Classic, and Social Premier. Classic accounts have lower minimum deposit requirements, while higher-tier accounts require higher capital to start trading. The conditions are also different between the accounts, and we are going to briefly review each of them below.

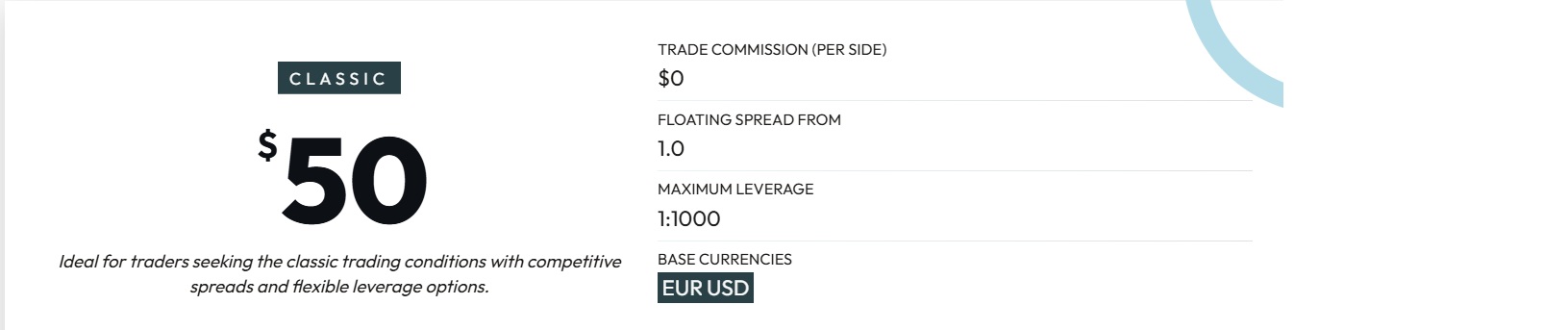

OFinancial Classic Account

The classic trading account has low minimum deposit requirements and has 0 commissions:

- Minimum deposit – 50 USD

- Maximum leverage – 1:1000

- Spreads – From 1 pip

- Commission – 0 USD

- Minimum lot size – 0.01 lots

OFinancial Premier Account

The premier account has higher minimum deposit requirements, and it is an ECN account designed for scalpers:

- Minimum deposit – 1,000 USD

- Maximum leverage – 1:1000

- Spreads – From 0.0 pips

- Commission – 3 USD per side per lot

- Minimum lot size – 0.01 lots

OFinancial Elite Account

The Elite account is also ECN, which requires an even higher minimum deposit, but commissions are even cheaper:

- Minimum deposit – 5,000 USD

- Maximum leverage – 1:1000

- Spreads – From 0.0 pips

- Commission – 2.5 USD per side per lot

- Minimum lot size – 0.01 lots

OFinancial Social Classic Account

Social accounts are dedicated social trading accounts where traders can copy other traders’ strategies, and there are classic and premier account types here. The classic one has the following trading conditions:

- Minimum deposit – 50 USD

- Maximum leverage – 1:500

- Spreads – From 1 pip

- Commission – 0 USD

- Minimum lot size – 0.01 lots

OFinancial Social Premier Account

The social premier account is an ECN account with commissions but low spreads:

- Minimum deposit – 1,000 USD

- Maximum leverage – 1:500

- Spreads – From 0.0 pips

- Commission – 3.5 USD per side per lot

- Minimum lot size – 0.01 lots

Overall, the offerings of Financial Broker seem very cheap and attractive. However, in most cases, unregulated brokers offer very good conditions on paper, which are usually quite different once a trader funds their account and starts trading.

Deposit and withdrawal options at OFinancial

When it comes to deposits and withdrawals, the broker supports many popular payment options. Traders can deposit and withdraw using wire transfers with multiple banks, bank cards (Visa and Mastercard), a multitude of different e-wallets like Skrill, and so on. Both deposits and withdrawals are free of charge. Deposits are mostly instant, while withdrawals are processed within one business day, which is competitive.

OFinancial Assets — What can you trade?

OFinancial provides access to a diverse set of trading asset classes, including Forex pairs, commodities, indices, stocks, ETFs, and cryptos. From forex pairs, traders are offered access to major pairs, minors, and even exotics. The leverage is very high, enabling the deployment of large position sizes and spreads, and commissions are well within industry standards, making the broker very competitive.

Trading platforms of OFinancial

OFinancial trading platform is advanced MT5 trading software. It is available on both Android and iOS, and there are both desktop and browser versions offered. WebTrader 5 is the browser version of MT5. The platform enables custom indicators and Expert Advisors, enabling traders to fully automate their trading systems.

Education at OFinancial

Educational resources at Financial are very limited, as there are no trading courses, articles, or webinars offered. As a result, absolute beginners will have to search for education elsewhere. There is a trading bonus available for the first deposit only. This bonus is a 50% deposit bonus. There are details provided about social trading services, but they can not be used as a substitute for a trading education.

OFinancial Customer Support

Customer support options at OFinancial are diverse and provided via email, live chat, and phone support. The phone support is provided via WhatsApp, which is a popular messenger app, while live chat is an advanced plugin built into the website directly. Both the website and support options are provided in 4 different languages.

Is OFinancial your broker? Final verdict

OFinancial offers multiple trading account types, low spreads and fees, and access to the advanced MT5 app with social trading features. However, the broker is unlicensed and registered in Antigua, which is a serious safety risk for traders. While deposits and withdrawals are free, trading costs are very attractive, but the lack of oversight makes this broker unsafe for the moment being.

FAQs on OFinancial broker

Where is OFinancial based?

OFinancial is registered in Antigua under OMNI Markets LLC but is not licensed there.

Can you withdraw from OFinancial?

Yes, the broker processes withdrawals within 1 business day and does not charge fees.

Comments (0 comment(s))