Radex Markets Forex broker review — Everything you need to know

Radex Markets is the company’s trade name and brand name, which is a company owned by GO Markets International Ltd Co, which is a regulated broker as well. Radex Markets is a regulated offshore broker, offering services with a simplistic approach to a global audience.

In this comprehensive but compact review of Radex Markets, we will assess its main features like safety, regulations, accounts, trading costs, profit withdrawal policies, support, and more.

Radex Markets Overview of the website

The website of Radex Markets is modern in design and offers a user-friendly interface. It is simple to navigate and find what you are looking for, as there are several buttons and accounts, and many other details are directly available on the main page. However, this lack of buttons and a well-ordered menu is also a minor drawback for the website. There are several plugins built into websites, like live chat and feedback, enabling users quick access to customer support, which is very flexible. While there are some details missing, the website overall is satisfactory and responsive. It is not crowded with much unnecessary information or media, and responds quickly to user requests.

Radex Markets Safety and Licenses

Safety is a critical part of our broker reviews, and it starts with proper licenses, meaning unregulated brokers never get a high evaluation from our team. In the case of Radex Markets, the broker is owned by GO Markets International Ltd Co, which is a regulated broker, operating globally. Radex Markets is owned by this broker, but it still operates with this trading name. Radex Markets is overseen by the Financial Services Commission of Seychelles. The GO Markets International Ltd Co is regulated by this entity. Despite this, the broker’s page of safety and regulations is empty, which is suspicious.

Radex Markets keeps trader funds in segregated bank accounts, which is an important safety feature. The details about negative balance protection are lacking, making us think that the broker does not offer this crucial policy, and traders should be careful not to lose more than their trading balance.

Radex Markets Accounts Reviewed

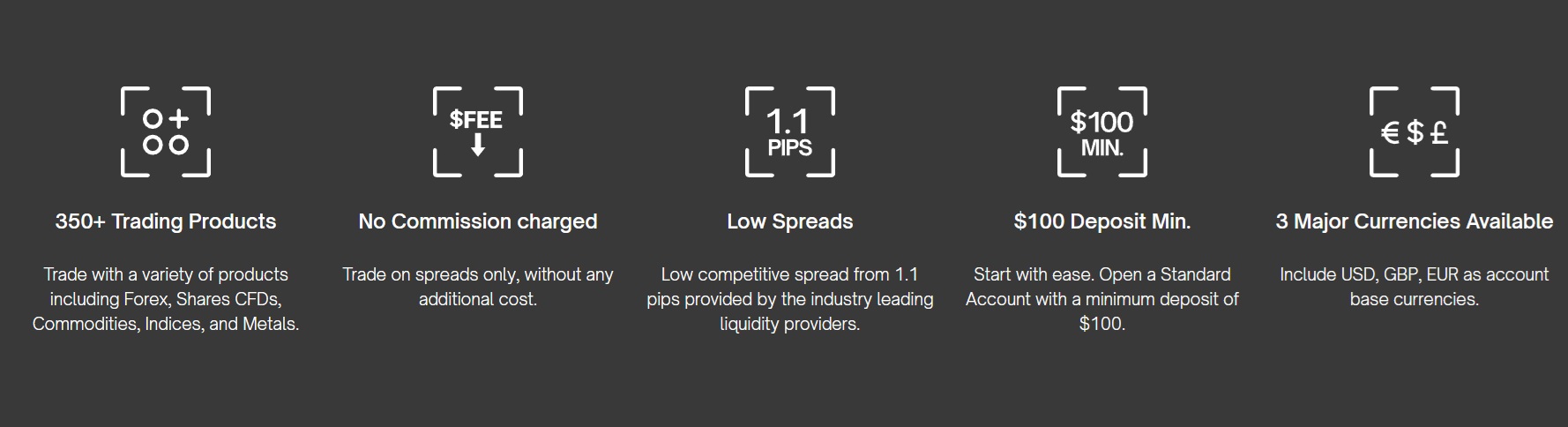

Radex Markets prefers a simplistic approach and offers two trading accounts: Standard and Raw. The standard account is a commission-free account with spreads, and the raw account offers low spreads but charges commissions. Let’s briefly overview each of them to conclude whether the broker is cheap.

Radex Markets Standard Account

The standard account has a $100 minimum deposit requirement, which is slightly above the competition. Spreads are from 1.1 pips, and trading commissions are zero. These spreads are competitive and slightly on the expensive side from the industry standard of 1 pip on standard accounts. This account includes USD, GBP, and EUR as account base currencies. The maximum leverage is up to 1:500, which is flexible.

Radex Markets Raw Account

The raw account offers spreads from 0.0 pips and charges commissions of 2.5 dollars per side per lot traded. This account is also competitive and more suitable for scalpers. The maximum leverage is 1:500, which is plenty to control large trading positions for quick scalps. The minimum deposit also starts from 100 dollars, which is actually competitive for 0 pips accounts.

Overall, Radex Markets offers competitive trading conditions, especially on its low spread account with 0 pips spreads and cheap commissions.

Deposit and withdrawal options at Radex Markets

When it comes to funding methods and withdrawal policies, Radex Markets does not offer details transparently on its website. This is a major red flag and makes the broker unreliable and risky. We do not know commissions, payment methods accepted, or profit withdrawal processing times, which makes it difficult to recommend this broker to our readers. Stay away.

Radex Markets Assets — What can you trade?

Radex Markets is mainly a CFD broker that enables access to diverse instruments in various markets like forex pairs, commodities, indices, shares, and cryptos. The majority of these asset classes are CFDs, which means traders can operate with very high execution speeds, which is a very needed feature for scalpers. Leverage is high, and spreads and commissions are competitive.

Trading platforms of Radex Markets

Trading platforms at Radex Markets are two: MT4 and MT5, and both of them are very advanced and pretty capable standalone trading platforms. These platforms support custom indicators and automated trading. The broker offers social trading through the MT5 trading platform. Mobile trading is available using the MT5 mobile app, accessible on both iOS and Android devices.

Education at Radex Markets

Educational resources such as webinars, trading courses, and video guides are lacking at Radex Markets. The broker does not offer any useful learning materials. However, there are a multitude of market analysis tools available, including Trading Central and other signals and tools. There are some articles for basic forex guides for absolute beginners, which are useful. Overall, the educational content of this broker is satisfactory.

Radex Markets Customer Support

The broker offers a very transparent and well-disclosed customer support experience. There are email, live chat, and phone support options all offered. The live chat is built into the website, and traders can also provide feedback, which helps improve the broker’s services. The broker is multilingual and it offers its services in a multitude of different languages, which is very flexible for international traders.

Radex Markets bonuses and promotions

Bonuses and promotions at Radex Markets are two: a cashback bonus and a deposit bonus. The cashback bonus is capped at 25% while the deposit bonus is higher at 40%. These bonuses are competitive and offer beginner traders a head start to maximize their trading volume potential, even with smaller accounts. However, terms and conditions apply, and traders must read those carefully before applying for any promotional events.

Is Radex Markets your broker? Final verdict

Radex Markets provides flexible trading through MT4 and MT5, competitive raw account conditions, and attractive bonuses. However, its offshore license, missing details about profit withdrawals, and unclear negative balance protection lower its reliability. While not a scam, the broker is still very risky, so traders should approach it carefully.

FAQs on Radex Markets broker

Where is Radex Markets based?

Radex Markets is registered in Seychelles under the FSA license.

Can you withdraw from Radex Markets?

Withdrawals are possible, but the broker does not disclose payment methods, fees, or processing times, which are red flags.

Comments (0 comment(s))