What is Forex?

While you were browsing the internet, maybe watching some youtube videos or reading some blogs, you may have encountered an ad that was talking about Forex. The ad may have contained information about a single dad, or a regular guy with a regular job who started trading Forex and now owns a yacht and travels all over the world without having to worry about money. At some point, you got interested in what is Forex and started searching. Well luckily for you, you’re in the right place as we’re about to tell you the ins and outs of the FX market.

With this article, you’ll find out what Forex is that every ad is talking about, when it started and how you can actually utilize it if you decide to work with it. Essentially we’re going to use very simple language and not burden you with too many terms and abbreviations in order for you to get a really good understanding of Forex. So without further ado, let us begin.

A quick explanation of Forex

Forex is a smaller version for Foreign Exchange. You may have heard this term before as it is quite commonly used in news and different articles around the web. Essentially what it stands for is the exchange of different currencies around the world. Even more simply it is a global market that allows people to exchange one currency for another. For example, if you would exchange a USD for an EUR.

A better perspective of what Forex is

This is what you’re thinking right now, “Oh it’s so hard”, “It’s so complicated, I can’t do it” or “What are these guys talking about?”. Well, don’t worry we’re about it explain it as simply as we can. Chances are that you have already done Foreign Exchange, so there’s nothing to worry about. Think about it, have you ever been abroad for a vacation? Do you remember exchanging your currency for a local one? There you go, that’s your Forex experience.

Let’s tell a story to bring it more into the light.

Say hi to Steve, he doesn’t know what is Forex, he’s just a guy from New York and has decided that he has had enough of his office job and really wants to relax on a nice beach on the Mediterranean. So he decides to go to Sicily in Italy. He packs his bags, takes a flight to Palermo and once he arrives, he starts seeing this weird symbol €. As it happens, Italians don’t use $USD as their main currency and if Steve wants to be able to buy some stuff there, he needs to get € Euros, the local currency. After getting to the Exchange booth he finds out that his $1 will get him €2 (this is a hypothesis, this would never happen). So he exchanges $500 for Euros and ends up with €1000. Steve has now participated in the Forex market

What is Institutional Forex?

We haven’t really reached the part where we talk about the volume, but in the section, we need to mention it a little bit. You see, transactions in Forex are quite large, especially from the banks, sometimes it could amount to hundreds of millions, which is still a very small portion of the overall volume. This means that there are always constant exchanges going on between different country banks. Once again, chances are you’ve witnessed these types of exchanges take place. Have you ever read or heard news about a large export going out of your country towards another? There you go, that’s the beginning of a large exchange. Let’s tell another story.

Say, South Africa has just announced that they are running very low on Lumber. A Russian company contacts them and they make a deal with them, to sell $100 millions worth of Lumber. Here comes the hard part, because these two sides need to decide which currency to use. because imagine, when the Russian company receives the payments, it will be very hard for them to convert South African Rand into Russian Rubles, because there will be very few people who would want to buy the Rand. Therefore, the two sides need to decide a more demanded currency, for example, the USD. The reason why USD is a good choice is that everybody is ready to buy or sell it, therefore making the experience of actually getting locally useable money, very easy for the Russian company. If it still is hard to understand here’s a simpler version. Considering that you’re not from India when applying for a job, would you rather get paid in USD or in Indian rupees? USD right? because you can easily exchange it at a booth or a bank, which is always ready to buy it. Back to the topic. After the currency is decided two banks are contacted, the one in South Africa and one in Russia. Both parties tell them that they are about to make or receive a transaction so the bank prepares. So the company pays the South African bank in Rand, they convert it to USD, send it to the Russian bank, which then converts it to Rubles and the company is able to cash it out. There you go, you now know what institutional Forex is.

Forex segments and their comparisons

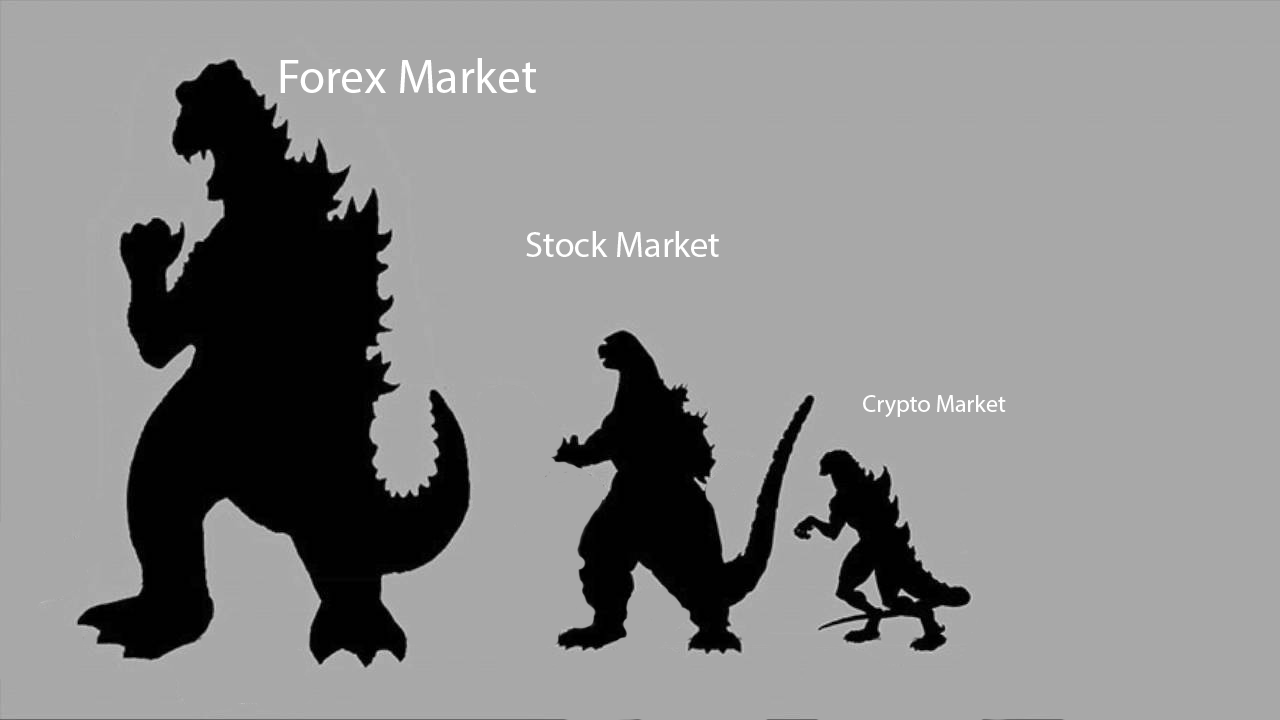

Now that we talked about institutional Forex, let’s break down the market size and tell what it’s about. Essentially, the Forex market is open for 24 hours, only closing on weekends. Therefore giving it the ability to always conduct transactions, massively increasing the volume. In numbers, the definition of Forex daily trading volume is about $7.2 trillion, if you want a better perspective that’s like 36 million Tesla Roadsters that cost $200,000 each. Institutional Forex is the one that contains all of the exchanges done by National Banks, smaller banks, Governments, and large companies. It is responsible for almost 94.5% of that $7.2 trillion, about $6.804 trillion or 34 million Tesla Roadsters.

If we compare that to Cryptocurrency market, we’ll be able to see a large difference. For example, the highest daily traded volume of cryptos was $201 billion, that’s like 3% of the Forex market, not even close. Comparing them to stock exchange daily trading volumes, we see more of a competition because of the accessibility and popularity of the stock exchange. The daily trading volume of Stocks in 20 exchanges around the world is $2.8 trillion or 14 million Tesla Roadsters, about 39% of the Forex market.

Retail FX explanation

Retail Forex is a small part of the Forex market. We’ve already explained Forex in its institutional stage, which covers 94.5% of all the trades, the remaining 5.5% is done by the retail traders, who are just normal people like you and me, speculating on the market with the help of news articles and expert opinions they see on TV. These are people who mostly conduct very small trades in the market, not affecting the currency prices at all. Retail FX traders can be regarded as passengers of the Forex Bus, who just come along the ride and react everytime the bus hits a hole or starts going uphill.

If you decide to start trading Forex you will be regarded as a retail Forex trader yourself, and you will need a middleman to make your trades for you. But how does that help you understand what is Forex? Well, it helps you understand the people you’ll be dealing with, the Forex Brokers. The broker is the one whose ad you saw and got you here in the first place most likely. They mostly focus on retail FX traders and offer them trading services, because, in Institutional Forex there is no need for middlemen, because of the volume.

Alright let’s now compare the two segments to each other, shall we? As already mentioned the Forex market, in general, has more than $7.2 trillion in daily trading volumes. We’ve also mentioned that 94.5% of those trades are made by institutional players like banks, financial institutions, and large corporations. But, how much do ordinary people like you and me trade on a daily basis? You’ll be quite shocked at the amount. So let me go back to my high school days and actually remember how the percentage formula works…….This is harder then I expected…….Ok, according to the calculator sitting next to me which I didn’t use, by the way, Retail Forex comes up to $324 billion, or in our calculations 1,62 million Tesla Roadsters. There aren’t even that many out there. Compared to individual stock exchanges and crypto daily trading volumes, even guys like you and me easily beat them in numbers.

Advantages of the FX market

It may still be hard for you to wrap your head around, why people actually go for the FX market instead of others. Therefore we will list a couple of reasons so that you get a better perspective of what are the advantages of the Forex market.

What is Forex Liquidity?

One of the primary reasons why people are attracted to Forex is the liquidity. Liquidity is something that describes how easy it is to buy or sell a specific item. Let’s compare commodities to Forex. For example, if you have an apple, you have higher liquidity because there would be a lot of people who would want to buy an apple. However, if you have a nuclear missile, it would have less liquidity, because there aren’t too many places or people you can sell that to. What liquidity is in Forex is that there will always be someone willing to buy or sell currencies. That is why there are currently several major currencies you’ve definitely heard of, like the United States Dollar, the Euro, the British Pound and etc.

These currencies have a lot higher liquidity because there are always a lot of people willing to buy or sell them. Even when the price of a currency is going down, it is still a lot easier to sell it. Because imagine, the prices of currencies change all day every day, which means that even if the price is going down, there’s a high chance that it will rise soon enough. Therefore there are people willing to buy it during price dropping times in order to sell it later on when it increases. If we look at stocks, it’s way harder to sell one when the price is going down. Because the price of the stock is always dependant on the company’s success, which takes a lot more time, therefore there are very few people willing to buy one when prices are dropping, making it very hard to sell and leaving you with losses you can’t avoid.

The accessibility

As we have already mentioned, the Forex market is open all day, every weekday. Because there could be transactions made in different time zones, for example from the US in the EU, the market always stays awake and functioning. Which means that you will have no problem accessing it on your own time. For example, if you have a job, it would be hard for you to use if it closes at the same time you finish work won’t it?

This 24/5 accessibility is thanks to its decentralization, which is the key player in the Forex definition that we already talked about. Furthermore, you get to trade other countries’ currencies without any problem, when it would be quite hard to do so in stocks. The reason is of course that the stock market is centralized, meaning that every country has its own. Example time. If you work and live in New Zealand, you’ll find it very hard to access the US stock market to trade US company stocks. The reason is that, by the time that you’re awake in the morning, the American working hours will have finished and therefore the market will have closed, giving you a very small window of accessibility, and limiting your choice of stocks to either local, Japanese, Australian or European at most.

Disadvantages of the Forex market

What is Forex risk?

If we want to give an accurate explanation of Forex, we need to say that its a lot riskier than stocks. The volatility or the frequency at which prices change is very high. Meaning that there is never a guarantee that you will make a profit. It nearly always 50/50. However, with stocks, it’s a safer investment, but a longer one as well. For example, there are large companies in the world, who never really suffer losses that affect their stock price. Therefore, they always have a steady increase, making them a lot more safe and less volatile. Besides, you can always go with an international company, whose failure in a specific country may not mean much. But in terms of Forex, if a specific country is facing issues than you can be sure that their currency will suffer.

History of Forex

Essentially Forex can be traced way back to the ancient times. however, we don’t want to confuse you with ancient coins called wabadabasomethings. Alternatively, we will focus on more important events that took place throughout the last 150 years.

The golden standard

Before actual currencies, most of the international payments were made in either gold or silver. It used to be quite effective, but at some point, people found out that there were way too many factors that could affect the prices. For example, the supply and demand would become chaotic once an individual country found there they had a gold deposit in one of their mountains. Therefore their gold supply would dramatically increase out of nowhere.

Because of this, the gold standard was created. According to it, governments would guarantee that no matter what, your currency would always be convertible into a specific amount of gold. Basically making currencies backed by gold. Because the economy suddenly became pegged to gold, governments found themselves scrambling in order to meet the demands of currency exchanges taking place in their country. Before this nobody really had an idea of what the Foreign exchange market is but, eventually, everything stabilized and all the major countries pegged a given amount of currency to an ounce of gold. As time went on international business started to speed up. Therefore some countries found themselves with less gold reserves than they expected, effectively increasing the price of an ounce, because of this exchange rates came to be which were dependant on the difference in price of an ounce of gold between two countries.

Unfortunately, as in any other scenario, wars started to meddle with the largest economies, eventually bringing them to their knees in World War 1. The volume of money printed at that time outweighed the gold supply and therefore ultimately increased its price, which in turn depreciated the local currency. After the war, things stabilized again for a bit but finally changed to a different system after the devastation of World War 2.

Bretton Woods

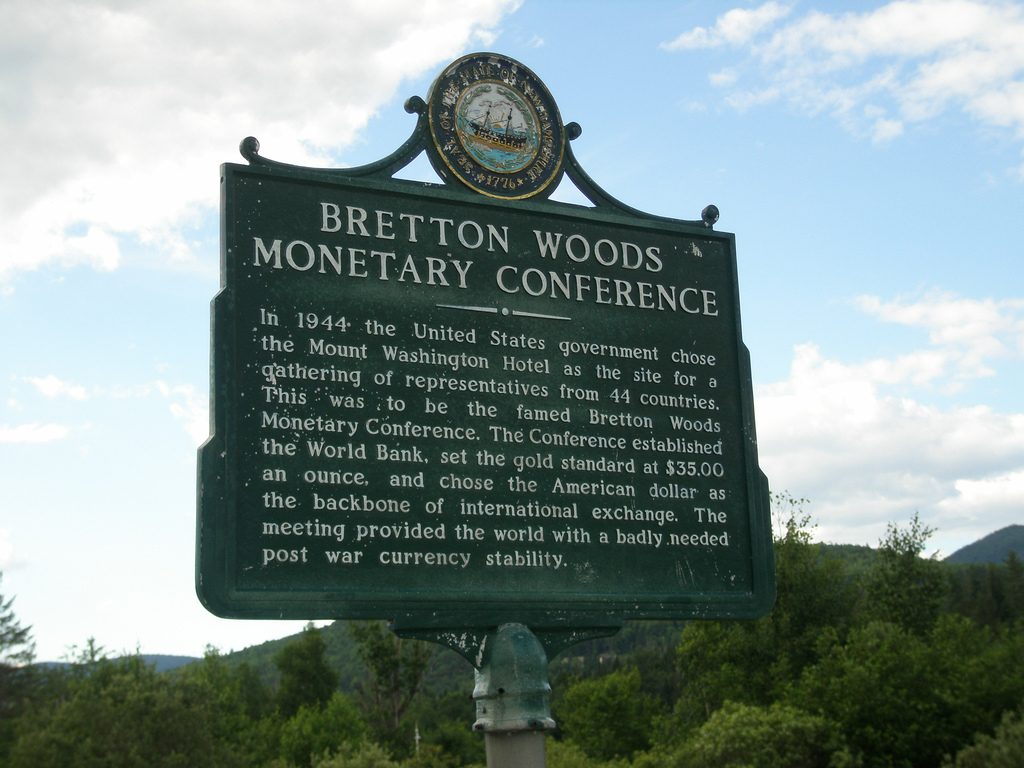

The Bretton Woods Agreement has no less important than the golden standard. In 1944 governments from 44 different countries gathered in Bretton Woods, New Hampshire to officially improve the world’s economic situation. The outcome of the meeting was the setting of the exchange rate, of the USD against gold, ultimately pegging all the other currencies to it.

The Bretton Woods Accord came into full functionality in 1958, when currencies around the world became convertible. This happened when countries started to settle international balances with USD dollars. Ultimately, this kept the price of gold fixed to $35 per ounce. However, keeping it that way fell on the shoulders of the US, which was experiencing an economic surplus, therefore making it pretty much impossible.

Soon enough, the Americans couldn’t see profitability or any reason to continue the agreement anymore, as the world economy was becoming a lot more vibrant. Therefore between 1968 and 1973, the agreement was dissolved by President Richard Nixon. After this countries started to freely choose their exchange rates, besides the price of gold. Finally, the ultimate decision was made to make their currencies float on the market, letting it decide what currency held what value.

Institutional and Retail Forex

After currencies were let to float around the market. Something needed to be done when the time came for international business. Because the market was inaccessible from home, the market was exclusively institutional, which meant that ordinary traders could not utilize it. It remained this way for some time, about 2 decades before the computer geniuses came up with the Internet and made Forex what it is today. As with any other technology in the 90s, it started booming and the banks noticed it. Ultimately, the decision was made to offer trading accounts to the general public in order to increase profits.

Conclusion

In conclusion, I think we’ve answered the question of what Forex is by describing it as a vibrant market filled with opportunities. It has come a long way and has embedded itself as a viable option for people looking for a way to make a quick buck. It is something that you will definitely encounter in your life if you decide to go abroad or just purchase something online, there’s no avoiding it. Which would definitely explain the ridiculous volume. We may still not know, what kind of changes it may go through, but at this point, it is in the best shape it has ever been.

Comments (0 comment(s))