Upbeat US Economic Data Put Pressure on Gold

Gold continued to lose steam on Thursday as bullish market sentiments drove investors away from safe-haven assets. A stronger dollar has also meant that gold is more expensive for traders holding foreign currencies.

Prices of gold futures for February delivery declined 0.2% to $1,130.70 a troy ounce on Thursday. Gold had earlier in the day tested a high of $1,135.50.

Appetite for gold has diminished as investors turn to yield assets.

Source: WSJ

The gold drawdown can be linked to the upbeat economic reports coming out of the U.S. The Commerce Department released revised gross domestic products estimates that showed the U.S. economy expanded 3.5% in 3Q16, the strongest quarterly growth in two years. The revised GDP growth estimate jumped from the initial estimate of 3.2% and also came above the consensus estimate that called for a revision to 3.3%.

Additionally, U.S. durable goods orders fell 4.6% in November, less than 5% drop that economists expected. Durable goods orders would have been much stronger in the month had it not been for a tepid demand for civilian aircrafts.

Gold prices tend to rise when investors are pessimistic of economic outlook, but those conditions have been rare since the U.S. presidential elections. Markets have grown more optimistic about economic prospects, partly because of the positive economic data being reported and partly because of hopes that the Trump administration will foster economic prosperity.

The President-elect Donald Trump is asking U.S. companies to keep jobs in the country and encouraging them to invest domestically in more growth. He is also wooing foreign companies to invest in the U.S. and his calls seem to be bearing fruits as SoftBank, the Japanese company that owns U.S. wireless carrier Sprint (S), has pledged to invest $50 billion in the country. SoftBank’s investment will come from a $100 billion investment fund called SoftBank Vision Fund that the company is putting together. The investment of $50 billion is expected to yield more than 50,000 jobs in the U.S.

Besides SoftBank, Apple’s manufacturing partner, Foxconn, is also planning to expand its U.S. operations with speculations that it could bring some iPhone production work back in the country. Foxconn expansion is further expected to add new jobs.

Trump has also proposed a plan to enable U.S. companies to repatriate their offshore profits at a lower tax rate of only 10% instead of the usual 35% or 40%. More than $2 trillion in corporate profits are stashed oversees by U.S. companies that are trying to avoid the heavy tax on their repatriated cash. If the cash is brought back in the country, it could go into expanding operations, hiring more people and increasing employee wages. Higher consumer incomes bode well for the economy because people are able to buy more, leading to more corporate sales and profits.

With these expectations of economic prosperity, investors are reducing their exposure to gold, which pays its holders nothing except that they profit from price appreciation. Investors are pulling their money from gold investment and putting them in bonds and stocks. Bonds have been attractive because of the soaring yields. Bond yields and prices have an inverse relationship.

The recent move by the Federal Reserve to lift interest rates is also weighing on gold. Higher interest rates lift the dollar as investors seeking yield assets in the U.S. buy the greenback, but a stronger dollar makes gold more expensive for foreign traders.

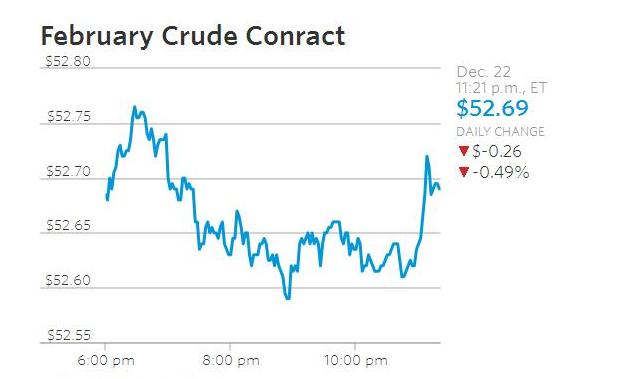

Crude prices jump on bullish sentiments

Crude prices have recovered from record lows since OPEC reached a deal to freeze output.

Source: WSJ

In the energy sector, crude prices rose Thursday, helped by bullish market sentiments. Crude oil for February delivery jumped 0.9% to $52.95 a barrel. Crude prices have recovered from historic lows since OPEC members and some nonmembers of the cartel agreed to cap their output.

Comments (0 comment(s))