Defeat of Italian Referendum Boosts the Dollar

The Dollar Index, the gauge of the greenback against a basket of rivals, was up 0.70% to 101.45 during Asian trading hours on Monday, recovering from Friday’s low of 91.30, which was attained after the index declined 0.30%.

The dollar retreated Friday after the U.S. reported mixed labor data. The rebound in the dollar is attributed to the outcome of the Italian referendum that has rattled the common currency euro. The referendum vote backed by Italy’s Prime Minister Matteo Renzi sought to overhaul the country’s legislature. Italian voters rejected the referendum proposal, leading Renzi to announce he will step down.

Euro loses ground but the impact limited

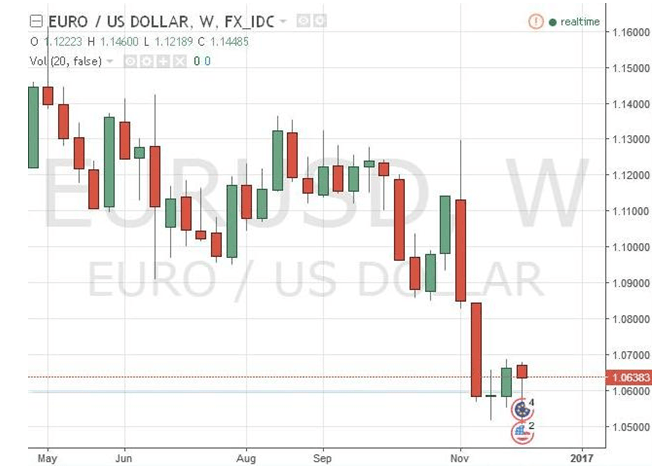

The EURUSD was down 1% to 1.0556 early Monday, while USDJPY was up 0.03% to 113.55. But, a surging dollar produces pain in emerging economies as dollar-priced assets become more expensive.

The defeat of Renzi’s referendum proposal is the latest event shaking up the Eurozone as the region struggles with a surging populist wave. Brexit referendum upset in June has sparked off a strong antiestablishment political wave in Europe. As for the Italian referendum, the decline of the common currency Euro appeared contained because of markets had largely expected the results. But, a rejection of a populist presidential candidate in Austria also seemed to back the euro, leading to the limited adverse impact from the Italian referendum.

Still, the resignation of Renzi following the defeat of his referendum complicates the picture for Italy’s struggling banking sector. The sector had hoped that Renzi would bring the economics needed to steer it back to steady health.

Dollar matching euro

Euro’s reaction to the Italian referendum outcome seems to give credence to the prediction of Societe Generale analysts that the dollar would hit parity with the euro in early 2017. The Eurozone has what looks like a complicated calendar in the coming years as several European Union member countries hold key elections. Germany, France, and the Netherlands have major elections in 2017, yet the countries are also seeing a rise in eurosceptic sentiments as they head to the polls.

The stunning Brexit outcome in June and the surprise election of Donald Trump as the 45th president of the U.S. early last month have inspired populist movements in Europe.

Boost to the dollar

The Italian referendum that rattled the euro has given a boost to the greenback, which suffered at the close of last week following mixed U.S. labor report. While the U.S. economy added 178,000 new jobs in November and unemployment rate declined to 4.6% to touch a multiyear low, the average wage declined. The average hourly wage dropped 0.1% in November compared to October levels. The year-over-year wage increase also slowed to 2.5% compared to 2.8% growth in October.

Strong wage growth helps drive consumer purchase and prices. While investors still expect the Federal Reserve to hike interest rates this month, the downbeat wage metric suggests future rate increases by the Fed might be slow. Higher interest rates drive up investor appetite for dollar-priced yield-bearing investments, leading to higher demand for the greenback.

The dollar retreated recently as the end-month draw in what analysts mainly attributed to portfolio rebalancing.

Comments (0 comment(s))