Opus

Opus is a company offering compliance and risk management tools to businesses across various industries including banking, life sciences, gas & oil, manufacturing and technology. The company operates in 195 countries in 47 languages and unites more than 2 million users. The solutions offered by Opus aim to automate the risk management processes in a company and thus make them more effective. These solutions encompass issues like money laundering, GDPR compliance, information security, bribery, corruption and more. Based on these solutions the company is offering products that help businesses with Know Your Customer compliance and third-party management. The KYC products include Alacra Compliance Enterprise, Alacra Compliance Professional and Alacra Surveillance. Each solution is discussed in more detail below.

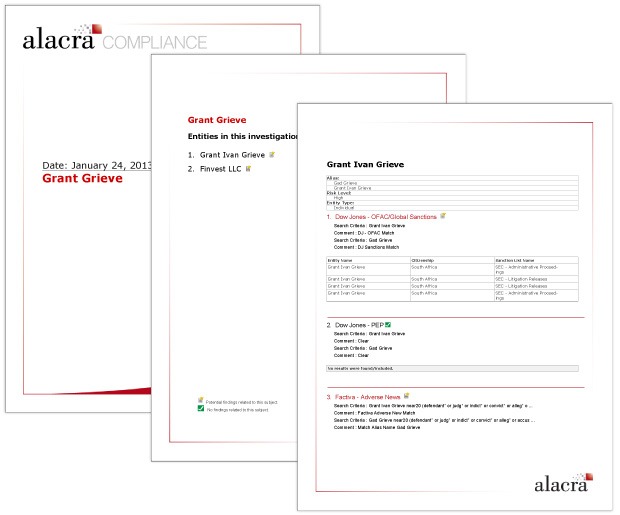

KYC solutions offered by Opus enable businesses to screen and continuously monitor customers

One of the largest issues for businesses with the Know Your Customer regulations is the time it takes to conduct the due diligence necessary to meet the requirements. As a result, companies’ profitability and effectiveness might be compromised. Alacra Compliance Enterprise offers solutions to this problem by streamlining the customer identification process as well as credit investigation and due diligence. With automated processes, the risk of having manual errors is minimized as well. Alacra Compliance Professional offers similar benefits but with no hardware or software configurations needed. Thus, it is deployed much faster. “Alacra Compliance Professional provides a simple, effective Know Your Customer (KYC) workflow with ongoing monitoring. This SaaS solution can be purchased and deployed rapidly without IT assistance or detailed configuration decisions; greatly accelerating time-to-value,” – describes the company.

Alacra Surveillance is the third KYC product offered by Opus. This is a module that can be used with both versions of Alacra Compliance. This solution monitors the changes in customers’ characteristics that might affect their riskiness in terms of money laundering and terrorism financing issues. This reduces the company’s exposure to regulatory risks as it will be continuously aware of its customers’ riskiness and will be able to take the necessary measures if the need arises. “Should an event occur, you will be notified automatically so you can re-evaluate the entity and take appropriate action,” – says the company.