Wealthfront

Wealthfront is a robo-advisory company offering automated investment services to its customers. It was established in 2008 and since then has managed to attract many investors. Currently, the company manages over $10 billion worth of assets. This is especially impressive considering that Wealthfront started out 2013 with only $97 million under management. That year the company showed a massive growth of 450%. Wealthfront leverages modern technology in order to make the investing process more efficient and reduce risks and fees.

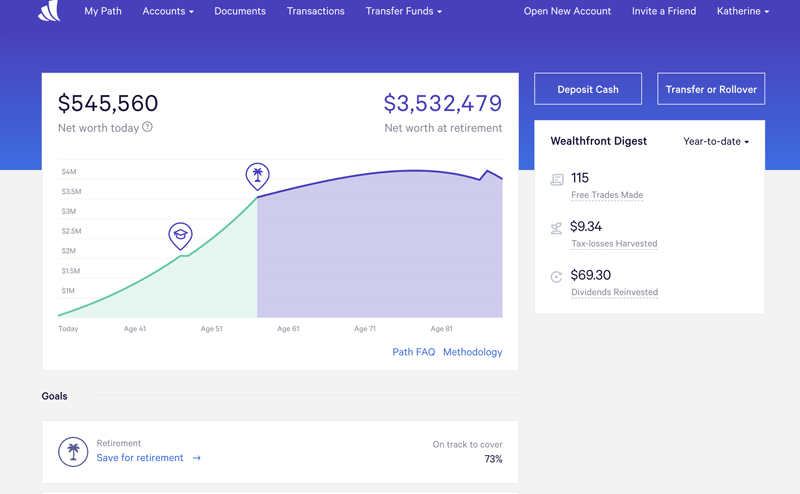

“Wealthfront will develop a plan around your personal goals and invest your money to help achieve them,” – says the company. Focusing on a tailored experience is especially important with robo-advisors as the automated services usually tend to offer uniform trading strategies to their customers. Wealthfront manages to create specific strategies for people with different needs. Some of the things that can be facilitated by the company include investment of savings, planning for a home, planning for retirement, planning for college and more.

Wealthfront employes modern technology to improve its services

Investment of savings is great for those customers who might need to withdraw the funds at any moment. “An investment account is ideal for your long-term financial needs, where your savings can benefit from higher returns. Investing can mean more risk, but your portfolio is built to fit your risk comfort zone to minimize potential losses,” – says the company. Such accounts can be individual, joint and trust accounts. There are some trading strategies employed by the company that make its products successful. These include Tax-Loss Harvesting, which reduces tax bills and thus leaves more capital for investments. The company also uses Smart Beta, which weights securities in the US stock index to make more efficient investment decisions.

Wealthfront offers services to those who are planning to purchase a home as well. “Based on your finances, Path recommends a home budget that still keeps your other goals on track,” – says the company. The software uses personal data in order to tailor the strategies to a specific user. The application uses customer’s location, net worth, debt-to-income ratio and credit score in order to estimate the mortgage that specific customer can obtain. Those who are looking to invest for retirement have several account options as well including Traditional IRA, Roth IRA, SEP IRA and 401(k) Rollover.