EmiraX Markets Forex broker review — Everything you need to know

EmiraX Markets is the company’s trade name, website name, and the broker is also with the same name. It was launched in 2025 and offers two accounts with competitive trading conditions at a glance.

In this unbiased review below, we will assess Emirax Markets’ safety, licenses, accounts, spreads, leverage, profit withdrawals, support, and much more.

EmiraX Markets Overview of the website

The website is simple and modern in design, but it feels very laggy and slow. Probably it is overcrowded by unnecessary media, or the development was rushed. At any rate, the website is not snappy, and you have to wait for it to scroll down and navigate around, and this is the case even on a powerful machine and a good internet connection, which makes it important for the broker to improve its website.

Every important information and condition is provided in an easy-to-find top menu panel and is well-sorted, making it easy even for beginners to find exact details about the most important conditions, such as spreads, leverage, regulations, platforms, available markets, and so on. Additionally, there is no live chat plugin offered on the website, which is also a drawback.

Overall, the website of Emirax markets needs some serious refinements and improvements, especially with support options and its speed.

Emirax Markets Safety and Licenses Analysis

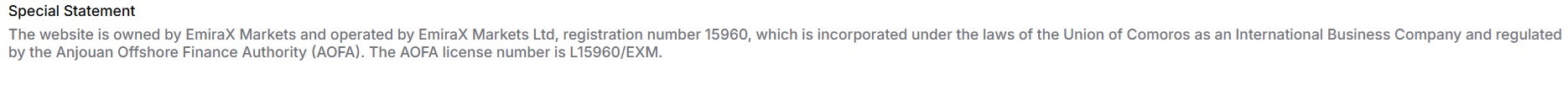

Emirax Markets is a newly launched broker that was established in 2025. While the broker is young, it has managed to acquire a license from an offshore jurisdiction. In exact words, the broker is overseen by the Anjouan Offshore Finance Authority (AOFA). The broker’s name is EmiraX Markets Ltd, and it is based in the Comoros. The broker states that client funds are held in segregated accounts with reputable financial institutions, which is among the most important client fund protection features. The broker also claims to offer negative balance protection, which is an important policy for beginner traders, especially because the broker offers very high leverage. Emirax Markets also implements anti-money laundering (AML) security features.

EmiraX Markets Accounts Reviewed

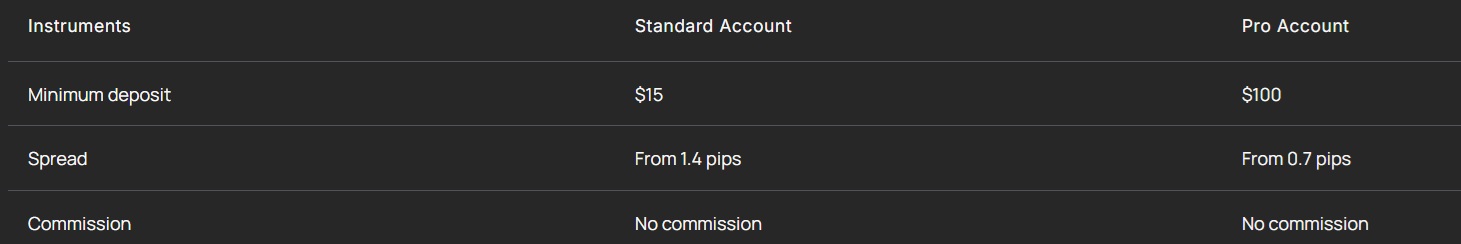

The broker has a simplistic approach to accounts; it offers only two trading account types. Both of them are STP accounts and differ in minimum deposit amount and spreads. These accounts are Standard and Pro account types. Let’s briefly review each of these accounts so we can evaluate how competitive the trading conditions truly are with Emirax brokers.

EmiraX Markets Standard Account

The standard account is an STP account with spreads but zero commissions, but spreads are on the expensive side:

- Minimum deposit – 15 USD

- Maximum leverage – Up to 1:1000

- Spreads – From 1.4 pips, floating

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

EmiraX Markets Pro Account

The pro account offers much better spreads, which are lower than most of the forex brokers in the sector, but the minimum deposit is higher:

- Minimum deposit – 100 USD

- Maximum leverage – 1:1000

- Spreads – From 0.7 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

Each account comes with a swap-free option, meaning the broker offers Islamic accounts, which are very competitive, especially on the pro account with super low spreads.

Deposit and withdrawal options at EmiraX Markets

The broker supports deposits and withdrawals in multiple currencies and a multitude of payment methods, such as local bank transfers, credit/debit cards, digital wallets, and USDT (TRC-20). Deposits are instantly processed, while withdrawals take 1-3 business days to complete, depending on the payment provider. The minimum deposit is just 15 USD, and withdrawals start from 20 USD, with a maximum of about 4,000 USD per transaction. The broker claims no fees on deposits and withdrawals, but payment providers might charge. Overall, the payment experience seems average, and withdrawals could be faster to make the experience more convenient.

EmiraX Markets Assets — What can you trade?

The broker offers access to multiple asset classes, such as forex pairs, metals, commodities, and cryptos. However, on the accounts page, it only lists Forex & metals, which is suspicious. Most of these assets are CFDs, which are very flexible for crypto trading as CFDs enable instant buy and sell orders, unlike blockchain networks, which usually require approval.

Trading platforms of EmiraX Markets

The broker provides access to the advanced MetaTrader 5 (MT5) trading platform, which is modern and very capable. MT5 supports custom indicators and Expert Advisors (EAs), and the broker does not seem to prohibit these tools, which is flexible. Mobile trading is possible via the MT5 mobile app, which is available on all mobile devices, including iOS and Android. The website is mobile-friendly and is much more responsive on mobile devices than on desktops.

Education at EmiraX Markets

As a young forex broker based offshore, Emirates Markets does not offer educational content. There are no webinars, video guides, or trading courses available, which is a drawback. The broker also lacks trading tools and market analysis tools, and there is no trading blog either. Lack of an economic calendar is also an issue.

EmiraX Markets Customer Support

The customer support experience is also limited at Emirax Markets as the broker only provides email support in an online form. There are no live chat or phone support options offered at the moment, which is a huge drawback. The broker is not multilingual as its services are provided only in English.

EmiraX Markets bonuses and promotions

EmiraX Markets does not offer bonuses or welcome incentives, which is a drawback. The lack of bonuses limits incentives for beginner traders to select this platform. There are no promotional events currently active at Emirax Markets either, which is also a drawback.

Is EmiraX Markets your broker? Final verdict

Emirax Markets is a newly launched offshore broker, licensed by the AOFA of Comoros, offering MT5 trading with high leverage of 1:1000, and a low 15 USD minimum deposit requirement. While trading conditions are mostly competitive, especially on the pro account, the broker has a slow website, lacks live chat support, has limited educational content, and does not offer bonuses, making it much less appealing for beginner traders.

FAQs on EmiraX Markets broker

Where is EmiraX Markets based?

EmiraX Markets Ltd is based in the Comoros Islands and regulated by the Anjouan Offshore Finance Authority (AOFA).

Can you withdraw from EmiraX Markets?

Yes, withdrawals are processed within 1-3 business days via several payment options like bank transfer, cards, wallets, or USDT.

Comments (0 comment(s))