Giraffe Markets Forex broker review — Everything you need to know

Giraffemarkets.com is owned and operated by Giraffe Markets Ltd, which is a brokerage company offering securities trading services globally. It is based in Saint Lucia, which is an offshore jurisdiction.

In this full and unbiased review of Giraffe Markets’ features, we will analyze the broker’s critical aspects, including safety, accounts, spreads, leverage, security policies, profit withdrawals, support, and more.

Giraffe Markets Overview of the website

The website of Giraffe Markets is extremely convenient as it is responsive and provides all the necessary details about the broker’s services. All information is well-ordered, making it easy to navigate and user-friendly. Traders can instantly find all the important information regarding crucial details such as spreads, accounts, platforms, markets, and so on. This is critical and makes the website look and feel professional, which is critical in online financial trading.

The website also incorporates a built-in plugin for a live chat, which is flexible, enabling quick access to support in case something goes wrong.

Giraffe Markets’ regulations and policies

Although the website looks amazing and practical, the broker has a fatal flaw. It is unregulated, meaning it is not overseen by any authority. This is a major red flag because unregulated brokers are often scams, with very rare exceptions. As an unregulated broker, we can not confirm that Giraffe Markets keeps client funds in segregated bank accounts, which is also a serious security issue.

The broker does not offer a negative balance protection policy, which prevents traders from losing more than their initial investment; in other words, traders won’t go into the negative as the balance is reset to zero.

Giraffe Markets Accounts Reviewed

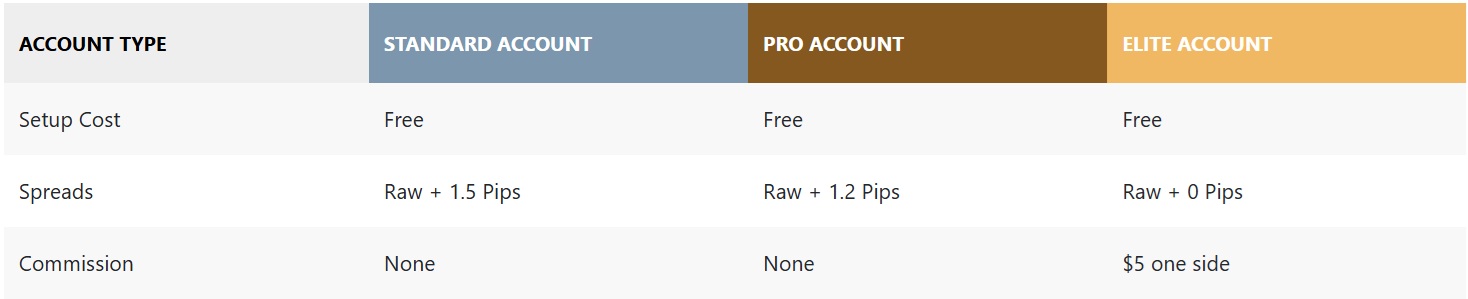

Giraffe Markets offers three different account types: standard, pro, and elite. Each of these accounts comes with its unique pros and cons, and we are going to analyze their offerings in great detail below. This is to define whether the broker is competitive when it comes to trading conditions.

Giraffe Markets Standard Account

The standard account is an entry-level account with the following conditions:

- Minimum deposit – 100 USD

- Maximum leverage – 1:500

- Spreads – From 1.5 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

Giraffe Markets Pro Account

The pro account has even lower spreads, but leverage is lower, and the minimum deposit requirement is higher:

- Minimum deposit – 1,000 USD

- Maximum leverage – 1:400

- Spreads – From 1.2 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

Giraffe Markets Elite Account

The elite trading account offers ECN trading experience at zero spreads, but the minimum deposit requirement is even higher here:

- Minimum deposit – 2,500 USD

- Maximum leverage – 1:300

- Spreads – 0.0 pips

- Commissions – 5 USD per lot per side

- Minimum lot size – 0.01 lots

As we can see, the broker offers flexible conditions and diverse accounts, but spreads are truly expensive, and minimum deposit requirements are extreme. This is because many alternatives offer better conditions at lower deposits and are more reliable and regulated.

Deposit and withdrawal options at Giraffe Markets

Deposits and withdrawals are crucial in forex trading. Giraffe Markets accepts several types of payments for both deposits and withdrawals: wire transfers, bank cards, and e-wallets. From bank cards, the broker allows both Visa and MasterCard payments, but it does not provide details about accepted e-wallet options, which is a drawback. The broker also lacks details about processing times for profit withdrawals, which is a red flag. There are no fees charged for either deposits or withdrawals, which is flexible.

Assets — What can you trade?

Traders can access FX pairs, cryptos, stocks, commodities, and indices on Giraffe Markets platforms, which are diverse and enable multi-asset traders to speculate on their preferred markets. This is also good for diversification. However, the spreads are not competitive, and traders need significant capital to access better conditions.

Trading platforms of Giraffe Markets

Trading platforms at Giraffe Markets are limited to MetaTrader 5. MT5 is an advanced trading platform, and it is enough to speculate on all the available instruments. It allows traders to use custom indicators and Expert Advisors, and the broker does not prohibit them from using these tools. Mobile trading is available via the MT5 mobile trading app, which is accessible on both iOS and Android app stores.

Education at Giraffe Markets

Education is crucial for beginner traders. Giraffe Markets does not offer educational content. There are no webinars, trading courses, blogs, or video guides available, which is a serious drawback of this broker. From market analysis tools, the broker only provides an economic calendar, which is useful but not enough. There is also market news, which covers important market news and developments.

Giraffe Markets Customer Support

Customer support experience at Giraffe Markets is provided using live chat, email, and phone options. The broker also discloses its address, which is a very positive sign for its reliability. The live chat is a plugin, built directly into the website, offering the fastest access to support personnel.

Both the website and support are only available in the English language, which is also a downside.

Giraffe Markets bonuses and promotions

The broker offers several promotional events. Traders can win up to 10,000 USD on a 30-day challenge. There are other trading challenges, and traders can also use copy trading services. There are no other promotions offered, like trading bonuses or welcome bonuses, which is a minor drawback. The lack of deposit bonuses makes the broker unattractive for many beginner traders.

Is Giraffe Markets your broker? Final verdict

Giraffe Markets offers an MT5 advanced trading platform, multiple account types, and a clean website with built-in live chat support. However, it is unregulated, lacks key protection policies like negative balance protection, and charges high spreads with very high minimum deposit requirements. These inefficiencies make the broker a highly risky choice for both beginners and seasoned traders, and we advise our readers to exercise extra caution with an unregulated broker such as Giraffe Markets.

FAQs on Giraffe Markets broker

Where is Giraffe Markets based?

Giraffe Markets is an offshore Forex broker that is based in Saint Lucia, which is an offshore jurisdiction known for less stringent rules.

Can you withdraw from Giraffe Markets?

Yes, but withdrawal policies lack transparency as the broker fails to provide exact details, which is suspicious.

Comments (0 comment(s))