LexaTrade Forex broker review — Everything you need to know

LexaTrade is an unlicensed offshore Forex and CFDs broker, offering multiple trading accounts and access to a multitude of different asset classes. However, we have detected several red flags with this broker.

In this review of LexaTrade, we will assess its safety, accounts, leverage, profit withdrawals, trading costs, support, and much more.

LexaTrade Overview of the website

The website of LexaTrade is simplistic but responsive and modern. Users can quickly navigate around and find all the details needed to understand what the broker has to offer. Information is given in various tabs, and traders can access it from the website’s top menu. The website is also mobile-friendly, which is crucial. The live chat is directly built into the website, which enables quick customer support service.

Overall, the website is satisfactory and provides all details about trading services.

LexaTrade Safety Overview

LexaTrade is the website name and trading name of Swissone Group Ltd, which is registered in several offshore jurisdictions. The broker is not regulated by the local authorities in offshore countries it is registered. It is only registered in Saint Vincent and the Grenadines and the Marshall Islands.

This is a major red flag for the safety of clients, and there is no guarantee the broker follows strict ethical procedures. As an unregulated broker, there is no confirmation that the broker keeps trader funds in segregated bank accounts, which is also a major security risk.

There are no details on whether the broker offers a negative balance protection policy, which prevents traders from losing more than their initial investment.

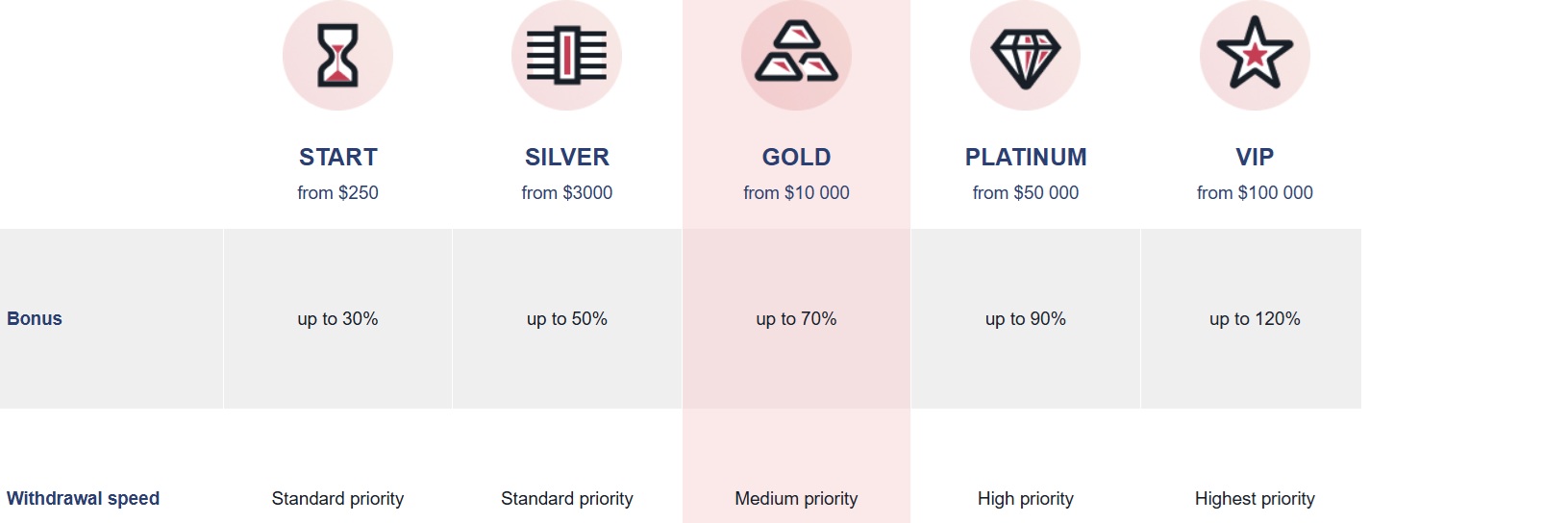

LexaTrade Accounts Reviewed

LexaTrade offers five different types of trading accounts, including Start, Silver, Gold, Platinum, and VIP. Generally, when brokers offer too many accounts, it becomes difficult to select the most suitable one. Let’s briefly overview the main features of each of these accounts to see what the broker has to offer.

LexaTrade Start Account

The Start account has the smallest minimum deposit requirement, but it is still high. Here are its main specs:

- Minimum deposit – 250 USD

- Maximum leverage – 1:200

- Spreads from – 1.6 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

- Bonus – Up to 30%

LexaTrade Silver Account

The silver account has higher minimum deposit requirements, but the broker is not clear about the exact spreads. Here are its features:

- Minimum deposit – 3,000 USD

- Maximum leverage – 1:200

- Spreads from – 1.6 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

- Bonus – Up to 50%

Financial analysis service is provided for free.

LexaTrade Gold Account

The gold account has an even higher minimum deposit requirement, and the bonus is also higher. Here are its specs:

- Minimum deposit – 10,000 USD

- Maximum leverage – 1:200

- Spreads from – Unknown

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

- Bonus – Up to 70%

LexaTrade Platinum Account

A Platinum account has an even higher bonus and minimum deposit requirement, but spreads are unclear. Here are its specs:

- Minimum deposit – 50,000 USD

- Maximum leverage – 1:200

- Spreads from – Unknown

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

- Bonus – Up to 90%

LexaTrade VIP Account

VIP accounts offer the highest bonus but require the highest minimum deposit to operate. Here are its specs:

- Minimum deposit – 100,000 USD

- Maximum leverage – 1:200

- Spreads from – 1.6 pips

- Commissions – 0 USD

- Minimum lot size – 0.01 lots

- Bonus – Up to 120%

Deposit and withdrawal options at LexaTrade

When it comes to deposits and withdrawals, the broker accepts multiple funding methods. Traders can use Visa, MasterCard, several wire transfers, Skrill, and several other e-wallets. However, the broker is not specific about its fees for funding and withdrawals, and processing times are not disclosed either. Higher-tier accounts offer faster withdrawal priority, but exact times are unclear, which is a serious red flag.

LexaTrade Assets — What can you trade?

Trading asset diversity is strong at LexaTrade as it offers access to stocks, Forex pairs, indices, commodities, and crypto pairs. The leverage is conservative at 1:200, but spreads are expensive. The availability of both crypto pairs and stocks is an advantage, but traders won’t be able to deploy scalping strategies because of high trading costs.

Trading platforms of LexaTrade

The trading platform category is another one where the broker falls short in providing reliable service. There are no major platforms offered like MT4 or MT5. Instead, the broker only offers its own custom trading app, which is a web-based platform and lacks the advanced features required for proper trading analysis and execution speeds.

Education at LexaTrade

LexaTrade lacks educational resources, as no learning materials are available. The lack of webinars and trading courses makes the broker unsuitable for beginners. However, there are plenty of market analysis tools available, including economic calendars, news events, and market insights. There is a dedicated section on the website to access all these features.

LexaTrade Customer Support

Customer support at LexaTrade is provided via live chat and email channels. There is no phone support option available, which is a serious red flag. While live chat is the fastest way to contact the broker, phone support has its place when it comes to internet issues and other difficulties. The website is mobile-friendly, but the broker is not multilingual, which is also a noticeable drawback of LexaTrade.

LexaTrade bonuses and promotions

When it comes to bonuses and promotions, LexaTrade offers up to a 120% deposit bonus. However, it depends on the trading account. For the beginner account types bonus is lower. Here is the list of accounts and the corresponding maximum bonus:

- Start – Up to 30%

- Silver – 50%

- Gold – 70%

- Platinum – 90%

- VIP – Up to 120%

There is only one promotional event, which is just a refer-a-friend program.

Is LexaTrade your broker? Final verdict

LexaTrade is an unregulated offshore broker with high minimum deposit requirements, unclear fees and spreads on most accounts, and a weak trading platform experience. While it offers multiple trading asset classes and a large bonus, the lack of regulations, transparency, and essential protection policies makes it a high-risk choice for traders.

FAQs on LexaTrade broker

Where is LexaTrade based?

LexaTrade is registered in Saint Vincent and the Grenadines and the Marshall Islands, both offshore jurisdictions.

Can you withdraw from LexaTrade?

Withdrawals are possible via cards, wire transfers, and e-wallets, but fees, conditions, and processing times are unclear, which is a serious red flag.

Comments (0 comment(s))