Libramarkets review: Should you trust it or should you avoid it?

One of the main tasks of any trader, whether they want to exchange Forex pairs, commodities, or stocks, is to find a credible brokerage that won’t betray their trust. The relationship between the two sides should be as strong and trustworthy as possible because if it’s not so, every trade will become risky and unstable.

Nowadays, it’s pretty easy to paint the company as a credible brokerage just by offering shallow spreads, big leverage ratios, and flashy websites. However, traders must be aware that if the broker has a flawed license and its trading platforms has some considerable holes, they should be very careful about doing business with it.

To make the selection process a bit easier, our team on Forex News Now has prepared a Libramarkets review where we examine all the major and minor details about this broker. So, let’s begin

First impressions

Libramarkets is a trading website that offers investment and trade facilitation services spanning an array of assets. The broker employs some seemingly impressive trading products and services, yet we cannot help but be skeptical about some details which we’ll discuss down below. In the Libramarkets reviews we found online, we saw that many tools offered by the broker such as risk management, personalized watch lists, powerful charts and other features for analyzing the trades are more of a facade than the real deal. There are many scam reports against this broker, that’s why it’s our responsibility to examine every little aspect as closely as we can.

So, is Libramarkets legit? What are their trading practices? What’s their newly emerging platform offering to the clients? Let’s go on and find out together.

What exactly does Libramarkets offer?

The broker describes itself as deeply committed to providing an excellent trading experience for its clients. Among the trading assets listed on its site are commodities, Forex trading tools, shares, and indices. Presumably, this is to allow the customer more freedom and choices in building their portfolio and also subsequently diversifying it.

The broker describes itself as deeply committed to providing an excellent trading experience for its clients. Among the trading assets listed on its site are commodities, Forex trading tools, shares, and indices. Presumably, this is to allow the customer more freedom and choices in building their portfolio and also subsequently diversifying it.

Alongside those assets, we see the leverage that goes as high as 1:500. It doesn’t matter whether we’re talking about Forex or indices, the leverage of such intensity is suspiciously high and very dangerous. Traders should be aware that when they use this feature, not only do they increase the prospective profits, but they also make losses even heftier and more damaging.

Therefore, every trader should use leverage very carefully. Yet Libramarkets certainly doesn’t regard this danger and goes full-on with its offering. This makes us suspect that there’s something that the broker wants to hide by flashing its 1:500 leverage. Maybe it’s the Libramarkets scam?

The Libramarkets platform review

Here’s our Libramarkets opinion based on the first impression of the website. First of all, we have to admit that the interface conveys the feeling that the broker has put a lot of effort to construct it. However, the same cannot be said about simplicity. The interface is full of high-definition images that take up the whole desk, yet it is a bit difficult to actually navigate the website.

As for the technical aspect, the website contains various financial tools and instruments that can guide you in the trading process, as well as in technical analysis. For instance, the broker offers its own charting mechanism which is super important for predicting future price movements. For this reason, we think that the website is a neutral part of this review: it has both positive and negative aspects to it.

However, when it comes to the trading platform, we cannot hide the fact that there are some worrying details about it. Instead of the commonly-used MT4/MT5 or cTrader, the Libramarkets WebTrader is the trading software we’ve got. And while the broker claims it’s as simplistic as any platform can get, we also have to mention that it is much more liable to the financial schemes than its mainstream counterparts. That’s because the broker is in charge of the program and can incorporate as many scams as it wants.

Can Libramarkets be trusted?

Traders invest their money into assets they deem profitable. Therefore, when risking your finances, the most important part is knowing that you can trust your provider to keep them safe. Admittedly, the Libramarkets website deploys the recent security protocols in order to protect the funds and the information their clients entrust them with. Above all, a trader must be able to rely on a broker in that regard. From the Libramarkets reviews that people have submitted and from our personal impressions of the website, the funds and data you give to them appear to be well protected from third-party interference.

Yet the financial platforms present on the website do not strike us the most secure or reliable. The broker only offers credit cards and bank wire transfer to its clients. It goes without saying that the above-mentioned means of payment have been around for ages and the hacker community has also gotten pretty accustomed to penetrating them. Besides, those platforms are very slow and take ages to complete.

For instance, when you want to withdraw your money from the account, you first have to make an application that can usually last several days. It would’ve been so much better if the broker offered cryptocurrencies or PayPal; these platforms are far more convenient and secure than those we’ve mentioned earlier.

So, can Libramarkets be trusted? We’re not so sure.

Very suspicious stop out level

Another very suspicious detail that we came across in the Trading Conditions panel is the fact that the broker has set the Stop Out Level to 0%. Here’s what stop out means: when traders use leverage to increase their position sizes, they create margin accounts. These accounts require traders to have a certain amount of cash on their account that the broker will take once they open a leveraged position. It’s like a service cost for the leverage.

The whole account is called the available equity, whereas the funds taken by the broker – used margin. These two indicators are very important because they show traders how much funds they have for maintaining their positions and for opening new ones. To do that, they divide available equity by used margin to get the margin level.

If the margin level goes below 100%, this means that the trader has fewer funds on their account than what the broker has taken from them. This time, the broker initiates a margin call and asks them to deposit more money or close some positions. And if they don’t do so and the losses continue to occur, the margin level will go even lower.

At that point, the broker will start the stop out level where the positions are closed automatically. This happens in order to save traders from the negative account balance – the position where traders have to pay for the losses. The majority of brokers set the stop out level at 50%, yet Libramarkets has it on 0%.

The only thing that this means is that it doesn’t really care about its clients’ account balance. If the losses are larger than the whole account balance, the broker will remove all the responsibilities and leave the traders in this situation. That’s why we also think that Libramarkets fraud can actually be real!

Education and investment advice

As we’ve pointed out earlier, the broker offers various tools and features like charts and technical analysis that are very useful for the price predictions. If there are any positive Libramarkets opinions on the internet, they’re certainly based on the fact that the company employs some of the finest analysts working in the industry. The customers of the broker have access to layered professional analysis, both technical and fundamental from these people. The broker also offers customers a detailed analysis of the movements and the state of the market. What’s happening at the moment and furthermore, what’s to be expected in the future.

The experts also provide educational webinars to the clients. This is done in order to help you gain solid footing as an independent investor. Libramarkets isn’t aimed at constantly guiding your hand with your money in it. It seems that they still want to help you gain a fundamental understanding of the market you operate in. This is done in order to benefit both the broker and its clients. An educated investor is better suited to take full advantage of the multitudes of services and tools Libramarkets is offering. Therefore, providing this education gains the company loyal users who will be able to make the most of their trading potential. They’re also the ones who spread the word of mouth to others willing to go down the same path.

This practice increases the Libramarkets rating. Yet definitely not to the extent where other flaws are totally forgotten.

Libramarkets client support

A website as multifunctional as Libramarkets can’t function efficiently without an enthusiastic and highly responsive customer support department. The professional analysts the broker employs may be a great addition to the platform, yet if the service department is lagging behind, the clients can get into trouble where there’s no helping.

Unfortunately, we couldn’t find the proof of the broker’s claim that its customer service works smoothly and flawlessly. Sure, maybe people employed in that department are also professionals of their job, however, the execution of their job definitely doesn’t strike us as a display of professionalism. Out of two ways of communicating with the broker – email and phone call – none worked properly. When we reached out to the broker via either of those methods, it took the broker ages to respond. A properly-functioning customer service department definitely doesn’t look like that!

Libramarkets account types review

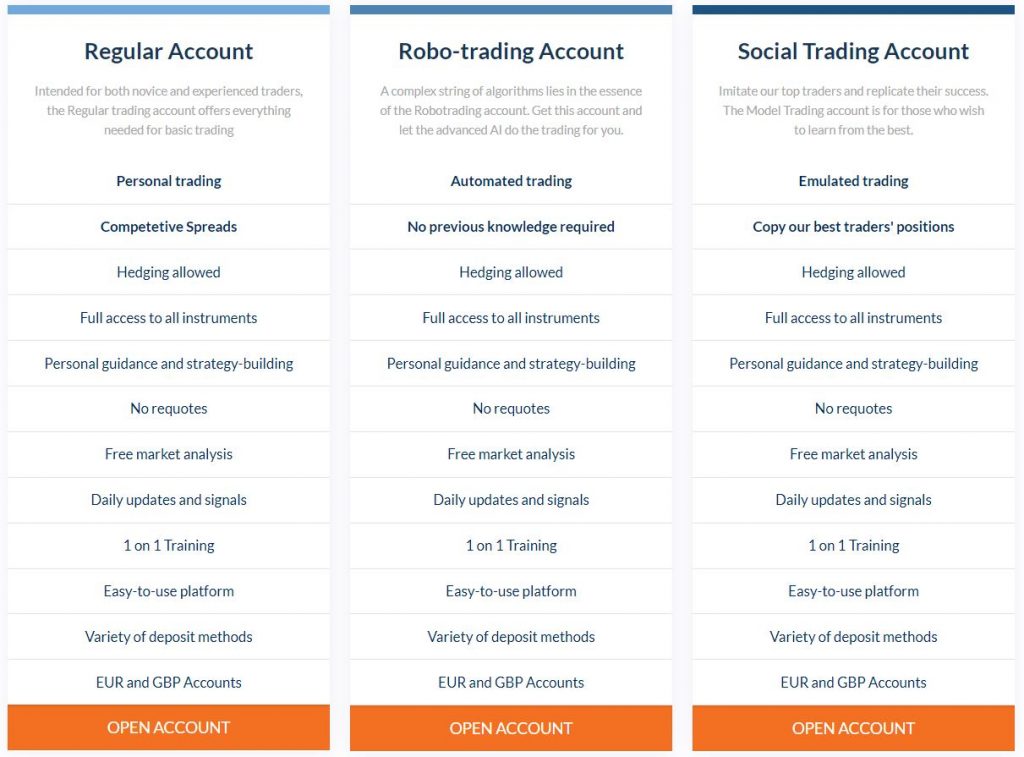

Then there’s the account separation. As the broker claims, in order to provide their users with a high degree of comfort, Libramarkets have devised three distinct account types for them. This is the standard amount of accounts usually available with investment brokers. In addition to that, a custom account creation feature is also available. If you contact the company and reach an agreement with it, they’ll provide you with a specialized account designed specifically with you in mind.

However, behind such dreamy claims, there are some unwanted realities that the broker wanted to mask out. For instance, while it claims that the accounts are very different from one another – a statement to justify high costs for more elite accounts – these are, in fact, more similar than different.

For example, the base account still provides users with an array of services aimed to make your trading flow smoothly. For example, hedging is allowed for all three accounts, as well as no requotes, free market analysis, and even 1 on 1 trading. We wonder, what is it apart from those auto-trading or copy-trading features that should entice traders to spend more money on Robo-trading or Social trading accounts? Sure, these features are useful for many traders, but they’re certainly not worth spending extra buck!

The final verdict of our Libramarkets review

In short, are Libramarkets scam allegations based on factual evidence? The company is a newcomer to the brokerage industry. And newcomers on the market are often treated with skepticism until they can prove otherwise. We were also skeptical from the get-go and we remain to be so still.

Despite the fact that Libramarkets provides seemingly great trading conditions on most of its securities, like 1:500 leverage, zero spreads, etc, we still need to consider the fact that they do not have a regulatory license to fully legitimize their business model. Therefore, the possibility of a scam is pretty high.

The fact that the company is catering to EU citizens and is able to offer the leverage it is offering right now is a bit more than suspicious. Besides, its website looks a bit overcooked with its unnecessary visual effects and unprofessional education section.

And when it comes to the accounts, all three of them are more similar than different from one another. So, it seems like the broker wants to sell unnecessary features to the clients for a higher price.

Therefore, we can’t necessarily recommend a broker that still has this many question marks regarding their business ethics. The safest route for everybody would be to simply avoid the company completely.

Comments (0 comment(s))