Dollar Retreats To Gather Fresh Momentum?

The U.S. dollar pulled back against several foreign rivals on Tuesday, a development analysts attributed to typical portfolio rebalancing by investors at the end of the month. With that, EURUSD rose 0.3% and GBPUSD jumped 0.6%. The WSJ Dollar Index slid 0.1% to 91.37 after going up 0.5% earlier in the day. The index measures the strength of the greenback against a basket of 16 rivals.

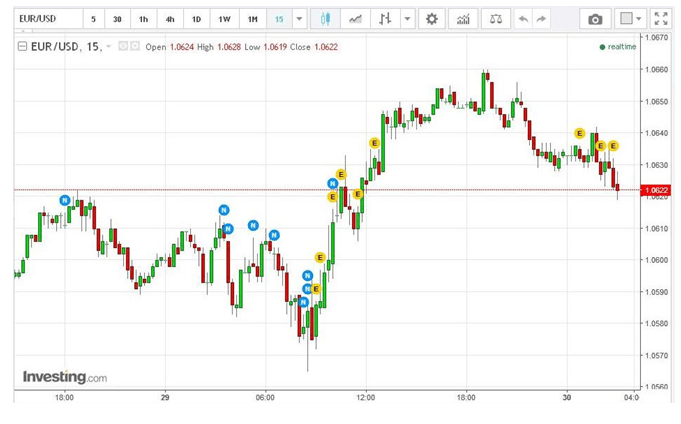

In Asian trading hours on Wednesday, the dollar could be seen recouping some of its Tuesday losses. USDJPY was up 0.3% to 112.690 after earlier dipping to a low of 112.060. EURUSD eased 0.25% to 1.0623, paring its overnight gain of 0.3%.

As such, the U.S. dollar index, which compares the strength of the greenback against a basket of six trade-weighted rivals, was seen up 0.21% to 101.15, down from its 14-year-high of 102.12 reached last Thursday, but still within a close call to the last week’s record high.

Besides the actions of traders adjusting their dollar portfolios as the month ends, uncertainty over OPEC members meeting is another factor analysts say is weighing in on the dollar. An unexpected outcome from the highly publicized OPEC meeting could cause volatility in the financial markets, rattling the dollar.

Powerful dollar rebound expected

However, analysts expect a powerful dollar rebound after the end-month portfolio rebalancing and the OPEC overhangs clear up. Among other factors, the greenback is expected to get a boost from strong U.S. economic data. U.S. payroll and manufacturing reports will be released this week and investors are expecting a growth.

The U.S. Commerce Department boosted hopes of strengthening economic growth after it released upwardly revised gross domestic product data for 3Q16 on Tuesday. The revised data show U.S. gross domestic product expanded 3.2% in 3Q16, up from the earlier reading of 2.9%.

Investors will be keeping their eyes on U.S. payroll and manufacturing data for confirmation that the Federal Reserve will hike borrowing rates at its December policy meeting. Several Fed officials have recently hinted that a case for December rate increase has strengthened. Higher U.S. rates benefits the dollar as it boosts the appeal of dollar-denominated yield-bearing investments.

Fiscal spending expansion

Investors are also buying the greenback in anticipation of increased U.S. government spending under the Trump administration. Expanded government spending on infrastructure projects, for instance, is expected to stimulate the economy further, supporting swifter future Fed rate increases.

Hopes that President-elect Donald Trump will expand the government’s fiscal budget are anchored on his campaign proposal to create more jobs in the U.S. Trump also hinted he will stand in the way of U.S. companies taking jobs overseas so that those jobs can remain in the country and boost domestic economic growth.

The President-elect’s proposal to allow companies like Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOGL) to repatriate their offshore profits at a reduced tax rate is also expected to further stimulate economic growth in the U.S., boosting the dollar in the process.

As such, the recent pullback in the dollar is seen largely as a temporary treat before the greenback resumes what could be a prolonged upward rally. The analysts at Societe Generale have also said they expect the dollar to hit parity with the euro in early 2017 amid fears of populist uprising in the Eurozone altering the region’s political landscape. Germany, France and other European Union members have nation elections early next year.

Comments (0 comment(s))