Collective2 Automated Trading Systems Review

It has always been difficult to spot the right automated trading system that can give you good returns on your investment. Usually, there is no way to compare different systems and identify which ones are real and which ones aren’t. Collective2.com addresses these problems by allowing you to track the performance of over 18,000 trading systems. You can then select any of these systems to execute trades automatically in your brokerage account with any automated trading forex broker.

How Does Collective2 Work?

Collective2 takes you from trading system identification to auto trading in five simple steps.

1. Find the Right Trading System

Collective2 offers a System Finder which allows you to filter down to the best forex trading systems for you by using a simple point and click interface. You can filter out trading systems based on the instruments they trade in, the trade frequency of the systems and the payment requirement of the systems.

Trading systems on Collective2 can trade in various instruments like forex, stocks, futures and options. You can either look for systems that trade in any of these instruments or just in the instrument of your choice.

You can also filter out the best forex systems based on the trading frequency you prefer. The trading systems on Collective2 are classified as long term trading systems, short term trading systems and swing trading systems.

Collective2 also provides another way, known as The Grid, to filter out trading systems based on various parameters. The grid allows you to set parameters like the age of the trading system, number of trades, average duration of the trades, profit factor, annual compounded return, performance in the last 30 or 60 days, trading instrument, maximum drawdown or the profit or loss per unit.

The Grid has an intuitive interface and can help you narrow down to the best forex systems of your preference within a matter of minutes. So if you are interested only in trading systems that are over 150 days old, have a maximum drawdown of less than 20% and have an annual compounded return of over 25%, all you have to do is enter these figures and voila, you’ll have the list of trading systems that satisfy this criteria.

2. Evaluate the Trading System

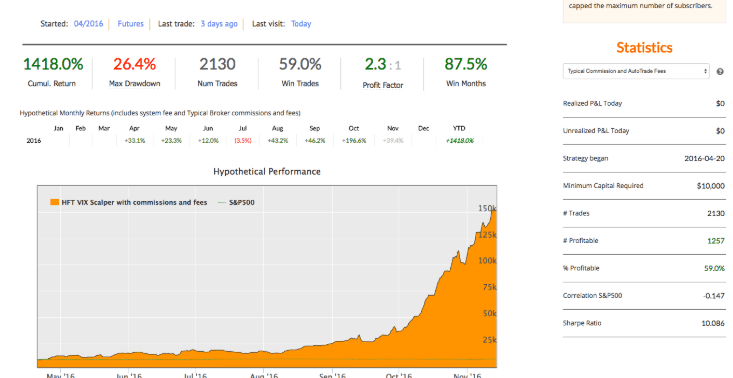

Once you have identified the trading system you are interested in, you can click on it to check out the details. You can zoom into the charts to examine details graphically or you can check the monthly performance of the trading system ever since it has been active.

You can perform due diligence on the historical records and check each trade if you need to. Once you are done with your evaluation, you can read what other people using the system have to say about it. As important as your evaluation is, the forex trading systems reviewed by real users will give you additional insight into the actual performance of the system.

A lot of the detail pages of the trading systems have data and performance records of real money accounts which the system creators are trading on. These aren’t hypothetical trades or trades with a demo account but real trades executed by the traders’ brokers.

3. Subscribe to the Trading System

Once you are sure that you like a particular trading system and want to trade according to it, you can subscribe to the system. This subscription will cost a small monthly fee which lets you set your trading account to trade as per the trading system you have selected.

The fee varies across trading systems and will depend on the system creator. In some cases, you might be able to try out a trading system for a limited time on a free trial without spending any money. As with the pricing, the prerogative to offer a free trial lies with the system creator.

4. Switch AutoTrade On

Collectove2 offers compatibility with the largest number of automated trading forex brokers. After you have subscribed to a particular trading system, you can switch AutoTrading on in your account. You can then set the limits to the trade sizes that you are comfortable with.

It is usually a good idea to start with small trades and increase the trade size gradually as your confidence in the trading system grows. Once you have completed these settings, you will see new trades being placed in your trading account as and when the trading system recommends a trade.

5. Sit Back & Watch

Once everything is set up and your account has started trading automatically according to the trading system you selected, you can either sit back, watch the trades passively or you can intervene in case you feel the need to.

Automated trading with Collective2 lets you stay in control of your account at all times. This means that you have access to real time profit and loss reports along with trade statuses. Depending on the market conditions, if you feel the need to close a trade for any reason, you have the ability to do that.

Who Creates the Systems & How Are They Compensated?

The trading systems offered on Collective2 have been developed by traders and system developers and can be either automated or manual. Collective2 offers system developers a lot of flexibility and options to share their systems with other people and be compensated for that.

The system developers can choose to charge subscribers a monthly, quarterly or annual fee for using their system. Optionally, system developers can charge on a “pay per trade” or a “pay per profitable period” basis. Collective2 also offers the ability to generate discount coupons and special offers along with the ability to broadcast private emails to subscribers.

An additional benefit that Collective2 provides is that system developers don’t have to share any information about their system with the subscribers. In case the developers are using an automated trading system, they don’t have to share any expert advisor. This goes a long way in preventing piracy and protecting the intellectual property of the system developer.

Pros and Cons of Collective2

Pros

1. Research Tools To Evaluate Trading Systems

Collective2 offers a lot of tools to let you compare multiple trading systems and filter them to identify the best one for you.

2. Transparent Trading

You can check the history of trades for any particular system. This includes systems which use a demo trading account and systems which use real trading accounts.

3. Simple To Set Up

It doesn’t take more than a few minutes to set the system up and start auto trading.

4. Past Customers’ Insights

You can interact with past subscribers for any trading system to check their experience and gain additional insights.

5. Simple to Subscribe and Unsubscribe

It is easy to subscribe to any system you like and unsubscribe from any system you don’t like. You won’t have to jump through hoops to get this done.

6. Systems Available For Multiple Instruments

You can find trading systems on Collective2 that trade many instruments including forex, stocks, futures and options.

7. Protects Intellectual Property & Prevents Piracy

Collective2 helps system developers share their system with other people and receive compensation for it without having to worry about piracy or theft of intellectual property.

Cons

1. Not Compatible With All Brokers

While Collective2 is compatible with a lot of brokers, it still isn’t compatible with all of them. This means that if you don’t hold a trading account with one of the compatible brokers, you might have to open a new one.

2. Limited Choice Of Stock Exchanges Outside The US

Outside the US, Collective2 support four stock exchanges including the London Stock Exchange, the Australian Stock Exchange, the Toronto Stock Exchange and the Deutsche Börse. It is currently not possible to trade on other international stock exchanges outside the US.

Comments (0 comment(s))