The Importance of a Forex Trading Plan

Forex trading online without a trading plan can be very much like sailing without a compass, or traveling without a map. You may be out on the water or on the road, but you don’t know where you are going.

Many successful traders using an online forex broker rely on a system or trading plan that when properly adhered to, maximizes their performance and allows them to avoid pitfalls such as overtrading and letting losses get out of control.

While most successful forex traders use different types of trading plans, most trading plans share similar characteristics. These can include when to initiate and exit trades or how to limit risk once a forex position has been taken.

What are the Advantages of a Trading Plan?

Basically, having a plan before you begin forex trading online or any other important endeavor is just common sense, especially when dealing with financial matters. Nevertheless, adhering to a set system or trading plan allows the trader to make decisions based on a previously determined set of parameters.

By keeping the decision making process to a set standard, the trader can avoid making decisions based on hunches, gut feelings or other emotions. Emotions and reacting emotionally to the irrationality of the forex market makes up one of the principal reasons many people lose money trading.

Another advantage of trading according to a set plan consists of the possibility of automating the trading plan. Depending on the parameters selected by the forex trader to signal when to initiate and exit a trade, many trading platforms — such as MetaTrader — allow the trader to input their parameters.

Once the parameters are met in the market, MetaTrader can be programmed to initiate and execute trades automatically. Many forex software developers have marketed their proven and tested trading plans as expert advisor software.

How to Develop Your Own Trading Plan

Certain elements, such as the size of positions relative to the size of the account and the criterion for getting in and out of the market make up key components to many trading plans. Furthermore, a trader would benefit enormously from just developing a plan, since they would have to research the market to find out what would work.

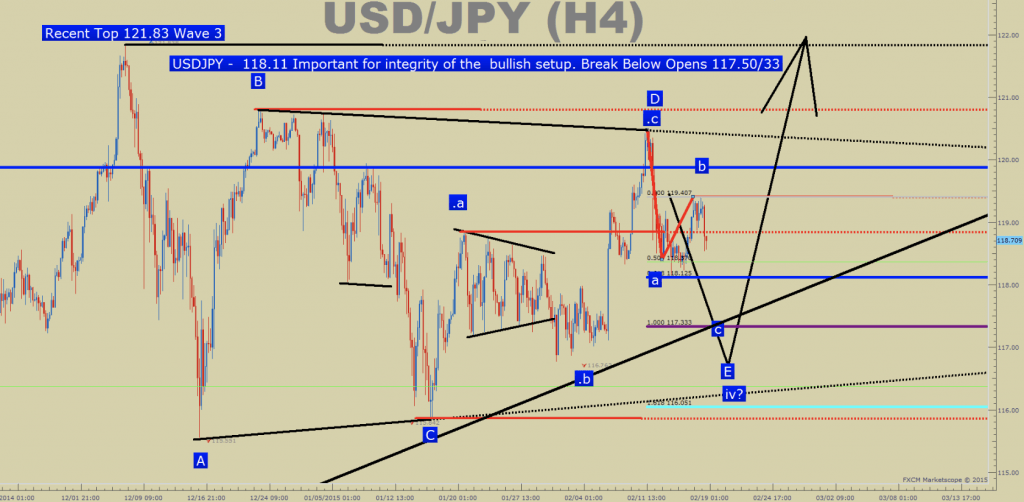

Other elements that many traders use involve technical analysis of rate charts. Trading platforms available from online forex brokers typically include excellent charting and other technical analysis software.

A trading plan would not be complete without a risk management component. Managing the amount of risk on each and every position, as well as strict guidelines for placing stop-loss orders immediately upon entering into a trade can keep a forex trader in business.

Using Someone Else’s Plan and Testing Trade Plans

Many successful forex traders trade with either someone else’s plan, or they have adopted many parameters used by other traders into their own trading plan. Also, many top forex brokers and independent developers offer trading signal services that can be used as a part of a trading plan.

Another way of obtaining an effective trading plan consists in using forex expert advisor software and applying or modifying their trading parameters to your own system. Using a variety of different trading robots to see which one performs best would also benefit the trader considerably.

Once you have either developed your own trading plan — or have decided to use someone else’s — you can often log into a trading platform like MetaTrader and back test your plan using historical data.

To test your trading plan in real time, many online forex brokers offer free demo accounts which can be traded with MetaTrader. Remember, testing your trading plan in a demo account before you begin risking money can save you a considerable amount of grief if your plan is not as successful as you had hoped.

Comments (0 comment(s))