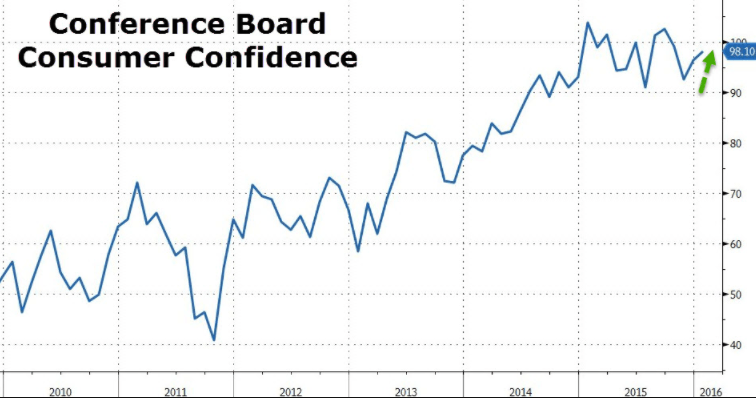

Conference Board Consumer Confidence Index

The U.S. Consumer Confidence Index (CCI) is an economic indicator that is used to evaluate the overall sentiment of consumers and the level of confidence they have in the economy. This is viewed as important because consumer spending is the main driver of the American economy; lower sentiment can be translated into a lower demand for products and services, which could point to a weaker economy.

The CCI is published on a monthly basis by The Conference Board. The Conference Board is an independent economic organization that specializes in economic research and analysis. The report itself is based off a survey of 5,000 households, and is composed by a series of surveys on consumers’ opinions on current and future conditions for the economy. There is a 40/60 split between the two in that 40% of the CCI’s number is based off of how consumers currently view the economy, and 60% is based off of how consumers expect the economy to perform in the future.

The index is an average that also takes into account future employment outlooks and the expectation for household income over the next six months.

Importance of Consumer Sentiment

Consumer sentiment is widely regarded as one of the key indicators in today’s economic climate for economic forecasting, trend analysis, and policy creation. The reason is because consumer spending is a major driver of economic activity across the globe. Consumers base their purchases off of expectations of the economy. If they believe the economy is strong and will continue to be strong, they will plan to make more purchases above essentials. If they view that the economy is weak or weakening, though, they will lose confidence in the economy, cut their spending, and increase their household savings.

The CCI capitalizes on this and is a useful indicator because it evaluates how Americans plan to spend and/or save. Economists then use this report to evaluate how the economy will respond to changes in consumer sentiment.

Impact on Forex Trading

The Consumer Confidence Index is a major mover in forex markets. Forex traders look forward to the monthly release of the CCI to gauge major movements in the index to determine how their trades will be affected.

Currencies are tied into the overall strength of an economy. The stronger an economy, the more value a currency will have (generally speaking). In an import-centric economy like the United States – an economy that relies heavily on consumer spending – consumer sentiment is critical. The higher the index, the more likely it is that the economy will grow – which means the dollar gains value. A significant rise in the index on a month-on-month basis can spur a trend of buying dollars, while a drop can spur a dollar sell-off.

The Federal Open Market Committee uses the CCI as one of the measuring sticks that play a role in raising or lowering interest rates. If the CCI is consistently high, the FOMC will be more likely to raise interest rates – which makes the dollar more attractive to investors and forex traders. Conversely, a poor CCI on a consistent basis makes the dollar less attractive if the FOMC keeps the interest rate stagnant or lowers it.

Comments (0 comment(s))