Is Dollar Drawdown A Cause For Alarm?

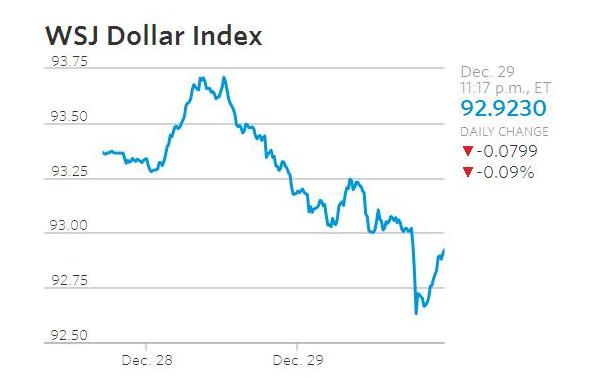

The dollar index, which gauges the strength of the US currency against six trade partners, retreated 0.3% to 102.93 Thursday, erasing some of its recent gains. The WSJ Dollar Index, which measures the greenback against a basket of 16 rivals, also eased 0.5% to 93.06 Thursday, only a day after the index closed at its highest level last seen in June 2002. But is it time to press the panic button or this is only a normal correction of a currency that has tested 14-year peak multiple times in the recent days?

The dollar has surged on hopes of economic prosperity in the U.S.

Source: WSJ

Analysts see risk of dollar reversing gains if Trump administration fails to secure Congress backing for expanded infrastructure budget.

Source: Tradingview.

The recent dollar drawdown appears to be a correction. End-month and end-year portfolio rebalancing seem to have combined to put pressure on the greenback. Investors typically adjust their holdings heading into a new month. As for December, monthly and yearly portfolio rebalancing happen in this month because of hedging and tax reasons. That could explain the pressure on the dollar.

Dollar set to end 2016 on a positive note

The dollar is on track to finish 2016 on a high note. The greenback could register a gain of at least 3% this year.

Meanwhile, analysts are forecasting that the dollar will reach parity with euro in early 2017 and that the greenback will continue gaining ground against yen.

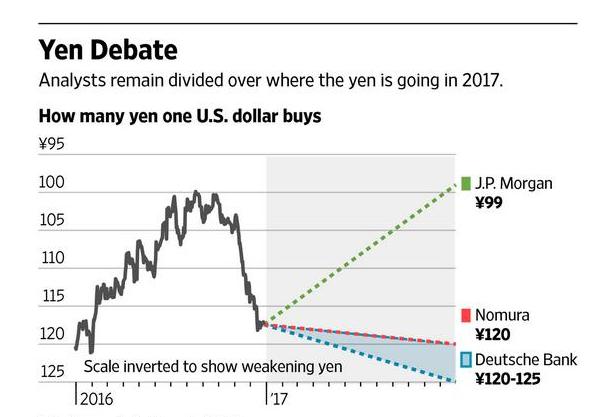

The yen has dropped 10% against the dollar since the U.S. election in November and analysts predict an even tougher period of the yen in 2017. The analysts at Deutsche Bank say the yen could end 2017 in the range of ¥120 to ¥125 against the dollar as Japan struggles with a sluggish economy.

The dollar is further forecast to hit parity with euro in early 2017.

Pressure on yen could persist in 2017 if the Japanese economic growth remains problematic.

Source: WSJ.

2016 supportive events for the dollar

Multiple events have bolstered the dollar in 2016. The surprise outcome of the Brexit referendum in the U.K. was one of the events that put pressure on the sterling pound and the common currency euro but supported the dollar. Investors worried about a prolonged period of economic uncertainty in the Eurozone following the Brexit vote pulled their investment from the region and put them in U.S. assets. That set off a strong demand for the dollar.

The greenback has also been on a tear since November following the surprise election of Donald Trump as the 45th president of the U.S.

Investors are betting on Trump administration coming up with policies supportive of economic growth. Those hopes are anchored on Trump’s proposal on the campaign trail. His proposals included a tax cut and expanded fiscal budget.

Among other reasons, Trump’s tax cuts will be aimed at encouraging U.S. companies to repatriate their cash held in offshore accounts and invest it in the country. U.S. multinationals including Apple (AAPL), General Electric (GE), Cisco Systems (CSCO) and Microsoft Corporation (MSFT) are hoarding more than $2 trillion in profits in their overseas accounts.

Hopes that Trump could be friendlier to business than the outgoing Obama administration has led to a strong demand for U.S. assets, driving up the dollar.

Recent dollar gains can also be linked to a move by the U.S. Federal Reserve to hike the benchmark interest rates. The central bank also promised that it plans to raise rate at least three more times in 2017. However, the dollar gains could unwind if Trump administration fails to persuade Congress to approve an expanded budget for infrastructure.

Comments (0 comment(s))