Forex trading weekly outlook: EUR/USD intel for June 21-25

NEW YORK (Forex News Now) – The FNN team has prepared a guide to the economic events most likely to affect the euro against the dollar and make FX news during the coming week, June 21-25.

NEW YORK (Forex News Now) – The FNN team has prepared a guide to the economic events most likely to affect the euro against the dollar and make FX news during the coming week, June 21-25.

All times are given in GMT.

Monday:

10:30 A.M. – Trichet testifies (EUR): The European Central Bank president, Jean-Claude Trichet, is due to testify before the European Parliament in Brussels. FX traders will likely seek to discern clues to future monetary policy in his comments.

Tuesday:

4:00 A.M. – Current account (EUR): The ECB is due to publish this key data, which details the flow of goods, services, transfer payments and income in and out of the euro zone.

10:00 A.M. – Home resales (USD): The National Association of Realtors, a trade group, is due to publish this report on sales of previously owned U.S. homes; in fx trading, it is also known as “existing home sales.” This report will likely dominate European morning currency trading.

Wednesday:

2:00 A.M. – GfK German Consumer Climate (EUR): Gfk, the market research firm, is slated to publish the results of a survey, in the form of an index, of consumers on past and present economic conditions.

4:00 A.M. – Services purchasing managers’ index (EUR): Markit, the market research firm, is due to publish this gauge of activity in the euro zone services sector, which is also a leading indicator of economic health.

4:00 A.M. – Manufacturing purchasing managers’ index (EUR): Markit, the market research firm, is slated to release this gauge of activity in the euro zone manufacturing sector, which is also a leading indicator of economic health.

10:00 A.M. – New home sales (USD): The Census Bureau is due to publish this report on sales of newly constructed U.S. residences, an important signal of the strength of the housing market.

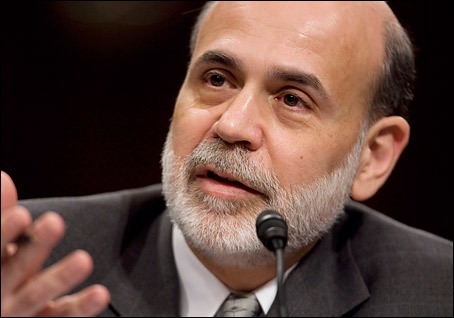

2:15 P.M. – Fed rate decision (USD): The U.S. Federal Reserve is due to reach a decision on whether to alter its benchmark interest rate, the Federal Funds Rate. The central bank’s Federal Open Market Committee will also publish a statement that will be read closely by analysts in the global forex market.

Thursday:

5:00 A.M. – Industrial new orders (EUR): Eurostat, the EU’s statistics arm, is scheduled to publish this data, which measures the value of new contracts for goods produced by the manufacturing sector.

8:30 A.M. – Core durable goods orders (USD): The Census Bureau is scheduled to value of orders placed with U.S. manufacturers for relatively long-lasting goods, excluding transportation.

12:30 P.M. – Unemployment claims (USD): The Department of Labor is due to release this report on the number of workers who filed new claims for jobless benefits;. The event will likely dominate European afternoon currency trading.

Friday:

8:30 A.M. – Gross Domestic Product (USD): The Bureau of Economic Analysis is slated to release its final quarterly estimate of U.S. GDP, the primary measure of the country’s overall economic output and a crucial signal for forex analysis.

Comments (0 comment(s))