Contents

Ever since online retail Forex trading became popular in the late 20th century, no other trading platform has been as successful as MetaTrader 4. Therefore, it is not surprising that there are so many MT4 Forex brokers you can find online today to work with. Despite the common availability of the MetaTrader 4 platform itself, that does not directly translate to quality services from the brokers who offer it. Indeed, there are perhaps just as many fraudulent brokers providing MT4 as there are good ones. Therefore, in order to find the best MT4 broker, we have prepared this post so you can find the right match for you.

As already mentioned, there are very many FX brokers who offer retail Forex trading services through the MT4 platform. While this is welcome news to a trader who prefers to use this platform, it also makes the process of narrowing down the best candidate more difficult. This is what happens, according to psychologists, when a person is presented with too many options – analysis paralysis. Nevertheless, it is still possible to identify the best MT4 Forex broker among the crowd; you only need to know what you are looking for. However, before we even get to that, it is also important to look at MT4 itself – its history and why it is a good platform to use.

The MT4 platform was developed by the company MetaQuotes Software as the fourth generation Forex trading platform. The company itself, MetaQuotes, was established in Russia at the turn of the century to capitalize on the rapidly growing retail Forex market. Their first product in 2000 was called FX Charts, and it quickly gained popularity among traders because it performed better and did not require a lot of processing power compared to others at the time. Keep in mind that there were no powerful computers back in 2000, so traders appreciated immensely when a piece of software saved them the hassle. This was possible because they were using a different programming language, MQL (MetaQuotes Language) instead of the conventional C#.

Apart from the performance of the software, Metaquotes was also the first to introduce parallel trading of Forex pairs and CFDs. Other brokers back then could only offer one service at a time, so the MetaTrader 4 platform was a welcome change. Furthermore, it was now possible for traders to make use of automated robots. Prior to this, automated trading was the purview of huge investors and banks, but now MetaQuotes made it possible for anyone to do the same. Finally, MetaQuotes also brought mobile trading. There were no iPhones or Android phones back then, but there were Palm devices though.

Then the company continued to improve upon their technology until MT4 was finally launched in 2005. Just like FX Charts was a hit, MetaTrader 4 quickly beat the competition and most brokers began offering it. An MT4 annual license fee made it cheaper to acquire the MetaTrader 4 than other trading platforms, and that’s when it really took off. Keep in mind, this was also the time when new Forex brokers were starting to establish themselves and compete, so MT4 was a definite godsend to them. All companies were clamouring to be a MetaTrader 4 Forex broker.

Even now, more than a decade later, MT4 is still king in the online retail Forex market despite stiff competition from other companies. Even MetaQuotes’ own successor to MT4, MetaTrader 5, has not been able to wash off the MT4 allure. That is why the MetaTrader 4 brokers list is still so long. However, just what is the allure that makes MetaTrader 4 so irreplaceable after so many years? Let us find out.

The main reason why a company chooses to keep a product is simple – the people still want it. This explains why supermarkets still stock the same products and keep them on the shelves even if newer products are in the market. It is clear that retail traders really love using MetaTrader 4, therefore, just by looking at how many clients the top MT4 FX brokers have compared to those who don’t offer the platform. The question now remains, though, what features MT4 has that other platforms do not.

Just like how FX Charts had better performance in 2000 compared to the competition, so did MT4 at the time of its launch. To see how true this statement is, just read through the minimum system requirements for the MetaTrader software to work:

What makes MT4 so effective on a modern computer is that, due to the advances in technology, the platform can run very smoothly on a modern computer. As a result, overall performance is always smooth regardless of whatever computer you’re working with. Speaking as someone who still owns my 5-year old computer, this factor does not go unappreciated, and that is why I stick with my Forex broker MT4.

Furthermore, MetaQuotes have not just rested on their laurels all through, but have instead been making improvements to the software to make it even more efficient and responsive. Although it still uses the MQL4 programming language, there have been many bug fixes and modifications. Indeed, I can testify that the current version of MT4 is much more stable than the one I used back in 2010 when I was starting my trading career. As a trader, I appreciate this fact, as I’m sure others do too.

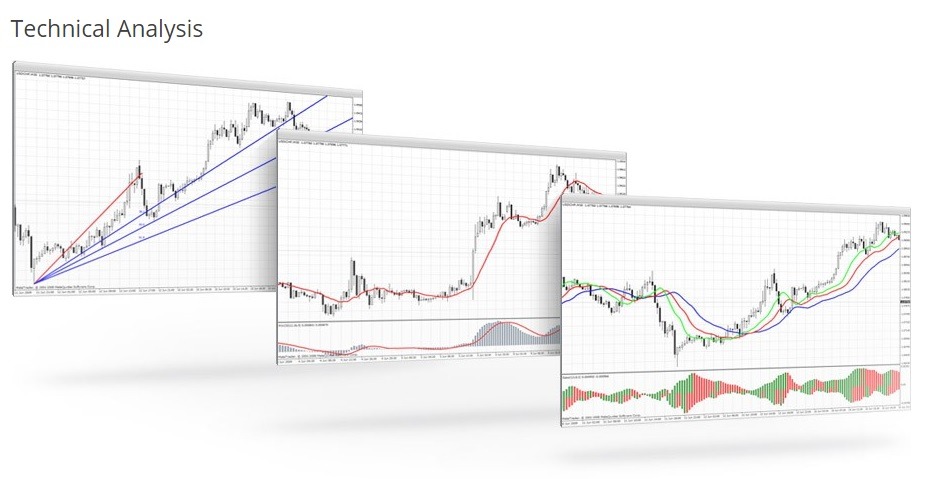

As a trader, you are going to make use of technical indicators, trading, robots and signals. MT4 provides all these features right out of the box without requiring additional software or products. All the most common and popular technical indicators come pre-installed with the software to ensure all your technical analysis needs are met. These tools are very essential to every trader, and therefore they make MT4 ever more popular. Besides, there are many methods of execution beyond just the market orders through pending orders. As any trader knows, these are important tools when trading the Forex markets as they give you flexibility whenever you can’t manually place the orders.

I could speculate that most Forex traders today first got a taste of the Forex markets using MT4 through MT4 brokers demo account. This is not just because it is popular, but the overall design makes it easy to understand and use even if it’s your first time. Just after installation, the Forex charts are easy to read and even look familiar, which is crucial when trading the FX markets. The last thing you want to experience is not being able to understand what you are looking at. The commands are easy to locate, understand and apply, an essential factor when you want to make trades quickly in volatile markets. What’s more, it is also possible to change the theme to suit your preference, making the platform just right for you.

Being a global market, the FX markets bring together traders from around the world. We can also agree that no one can succeed on their own, and the MetaTrader 4 community makes this happen. Due to the large number of traders relying on MT4, a large community has developed around it with members helping each other to make profitable trades, share custom technical indicators and even trading signals. In fact, it is this factor that has kept MT4 firmly on the top spot.

Finally, MT4 is also available on mobile devices. Whether you’re using an iPhone, iPad, Android device or tablet, you don’t have to stop trading. Anyone who travels a lot knows this all too well, and MetaTrader 4 makes it possible to keep track of your trades even on the go. How about this… imagine you’re in a foreign country and step into an internet café. Well, MT4 is also available on web browsers so you can securely log in on any computer and carry on trading.

The first thing I encourage traders to look out for is the MetaTrader 4 broker with most instruments. Remember how MT4 grew in popularity partly because of the inclusion of more trading instruments? Well, why would you want to settle for less? Competition in this area has been very good for the traders as brokers try to outdo each other. Therefore, it is not unlikely to find a broker offering more than 50 currency pairs, CFDs on stocks, commodities, and indices then top it off with cryptocurrencies. All these present trading opportunities for everyone in terms of hedging against risk and diversifying your portfolio. An MT4 with stocks is clearly better than the one which only allows for Forex trading. Therefore, this is the first thing you should look out for.

$100

CySEC, CBI, ASIC, FSCA, FSA, BVI FSC, ADGM

1:400

2006

MT4, MT5, WebTrader, AvaTradeGo

5$

CySEC, FCA

30$, 50%+20%

1:888

2009

MT4, WebTrader

$10

IFSC

1:2000

2009

MT4, MT5, R WebTrader, R MobileTrader, R Trader

$10

FCA, CySEC, FSA, FSCA

1:Unlimited

2008

MT4, MT5, WebTerminal

$10

CySEC

N/A

1:30

2013

WebTrader

10 USD

N/A

Affiliate Program

1:500

2019

MT4/WebTrader

250$

FCA, NFA

N/A

1:200

1999

MT4

0.01 BTC

N/A

N/A

1:1000

2018

Web trader, Android, and iOS apps

1 USD

ASIC, FCA

10 USD

1:500

2005

MT4, MT5, WebTrader

250 USD

FSCA

N/A

1:200

2012

MT4, WebTrader, Copykat

15

CySEC

30%

1:500

2015

MT4

250 EUR

FSA, Seychelles

None

1:200

Unknown

Custom

Next, you should find out more about the Forex broker themselves. Where are they located? Do they have a license from the local financial regulator? And what do their clients have to say about them? These are questions you have to ask of your potential MT4 FX broker. The first two are somewhat connected since the company will most likely be regulated in the area they are headquartered.

Now you have to ask yourself if the regulation in that area is effective and trustworthy. MetaTrader 4 brokers UK, for example, would be more trusted than those in Cyprus. It is important to know which areas have the best regulation. As for the third question, the strong community of traders we spoke about earlier is going to be your best resource. On various online forums, traders talk about their past experiences with various brokers, and it is thus easy to spot the bad egg and avoid them.

With all these steps done and measures are taken, you should now have a good idea which broker you are going to go within the end. All in all, there is no one size fits all broker, and you may have to kiss a few frogs before you find the perfect match. With this tips, though, I expect that you will avoid at least the ugliest frogs in the pond.

Get the most recent news at your inbox

Stay up to date with the financial markets everywhere you go. We won’t spam you.