High Inflation in Emerging Nations Vs. Low Inflation in OECD Countries

NEW YORK (ForexNewsNow) – With the exception of Brazil and China, emerging markets (and oil exporters) around the world have been hesitant to take strong measures to curb inflation, as these countries often prioritize growth over inflation. In contrast, OECD countries ,which are often characterized by high unemployment rates and the stabilization or even decline of commodity prices, are showing extremely low inflation, despite multiple government efforts to inject large amounts of new capital in the market in order to stimulate the economy and overcome the current Debt Crisis.

What are the consequences of this imbalance in the global economy? How does the rising inflation in emerging countries and the low inflation in OECD countries impact the global economic system?

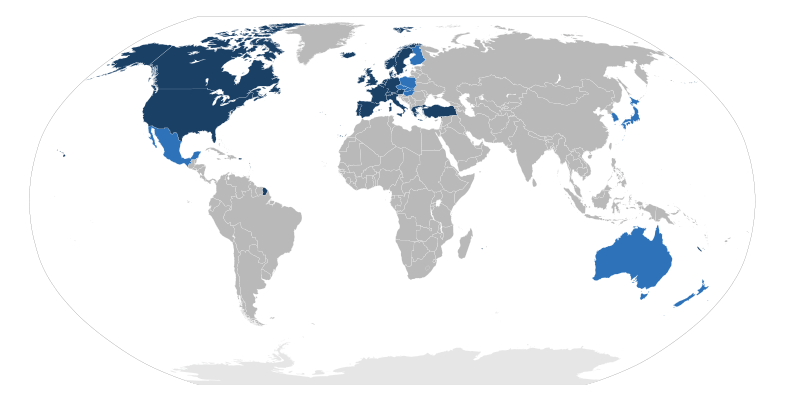

FNN – OECD Members (founders in dark blue)

As we will see, the consequences of this phenomenon, which we can call “Inverted Inflation”, differs whether we consider the short term or the long term. Consider the following points:

- The exchange rates of emerging countries are rising in the short-term since their interest rates are higher than OECD countries. But in the long term these rates should depreciate in order to compensate for inflation, as we already clearly saw in Argentina.

- In the short term the trade deficits of OECD countries will increase compared to those of emerging markets, because of the growing prices of imports from emerging countries. While the production of OECD countries and emerging countries are not substitutable, in the long term the possible loss of competitiveness of emerging countries may lead to a relocation of production to OECD countries and at the same time reduce their trade deficits.

- Emerging countries growth is boosted in the short term by maintaining an expansionary monetary policy despite inflation (hence the strong credit growth), but in the long term it will be slowed down by the loss of competitiveness.

- Short-term growth in OECD countries will be slowed down by the deterioration of terms of trade vis-à-vis emerging countries and higher rates of debt due to higher import prices. However, in the long term, OECD countries should experience growth driven by production relocation due to the loss of competitiveness of emerging economies.

According to Natixis, the collective choice among emerging countries not to take a strong stance against inflation is favorable in the short term for these economies, as long as their monetary policy remains expansionary, their terms of trade improve and they continue to have trade surpluses. But in the medium to long term, there is an opportunity for OECD countries to expand and take advantage of the market conditions, especially as the competitiveness gap between OECD countries and emerging markets continues to shrink.

For more exclusive Online Forex News, follow us on Twitter or join us on Facebook.

Comments (0 comment(s))