China may ban cryptocurrency trading through local exchanges

It is not looking good for cryptocurrencies as Chinese authorities are planning to ban cryptocurrency trading through local exchanges. China is among the top consumers of cryptocurrencies worldwide according to the daily traded volume. According to CryptoCompare, the Chinese market accounts for 17.5% of trading volume for bitcoin, which probably matches other cryptocurrencies too, yet it has substantially contributed towards the growth of Chinese economy according to InsideTrade predictions. Recently, there have been reports claiming that the Chinese authorities are planning to ban cryptocurrency trading completely, and the speculation has had a major impact on the value of most cryptocurrencies.

Why would China wish to ban cryptocurrency trading?

Since the start of the year, the People’s Bank of China (PBoC) has been making moves against cryptocurrency trading. In January, the institution required that local exchanges adhere to strict rules on money laundering and client verification. Besides, they required that the exchanges impose charges on all transactions. The addition of fees to cryptocurrency transactions was a setback, but not one that would slow the growth of cryptocurrencies.

Nevertheless, there was still speculation that the Chinese authorities were concerned by the rapid rise of cryptocurrency value. Apparently, the Chinese had been using bitcoin and other cryptocurrencies as a way to hedge against the devaluation of the yuan. These capital control measures were tightened even further in January, which probably caused the spike in bitcoin value at the start of the year.

According to analysts, the move in January to increase regulation instead of banning cryptocurrencies altogether was a wise move. Now, the PBoC may be interested in revisiting the move to ban cryptocurrencies, perhaps for the same reasons. China has once again imposed strict capital controls since July, and that may have promoted use of cryptocurrencies. Being anonymous, users can use these cryptocurrencies to move money out of China. It is then probably due to this fear that China intends to ban cryptocurrency trading completely this time.

Impact of speculation from China

The first report claiming that China was set to ban cryptocurrency trading came on the 9th of September came from Chinese publication, Caixin. In the report, Caixin claims that sources close to the PBoC were planning to ban cryptocurrency trading on all local exchanges. The action would follow the PBoC’s previous decision to ban all ICOs (Initial Coin Offerings). On the 4th of September, the PBoC had issued an order to all cryptocurrency exchanges to stop offering ICOs, as they are illegal.

So far this year, ICOs have raised almost $2 billion, and they are the most exciting venture in the cryptosphere this year. In the US, back in July, the Securities Exchange Commission (SEC) reported that ICOs be deemed as securities and be regulated as such. Recently, though, the SEC seems to be taking a more cautious approach by warning investors of the risks of ICO trading.

Meanwhile, the PBoC decided to completely ban ICOs, and that led to the drop in cryptocurrency value on the 4th. Bitcoin had just hit reached the all-time-high of $5,013 on the 1st day of September before retreating to around $4,900. Following the ban on ICOs, bitcoin value fell by $500 to $4,085 but quickly recovered above $4,500. However, the most affected cryptocurrency was Ethereum, since ICOs are usually structured based on the ether smart contracts.

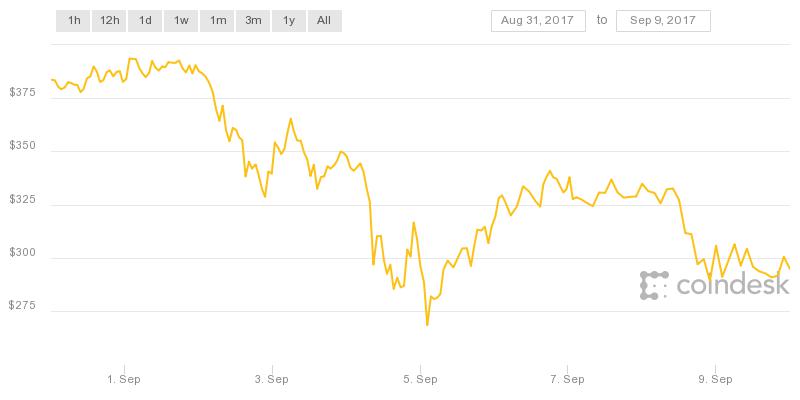

As a result, the price of ether fell by more than 20% from above $350 to $268 on the Coindesk exchange. Remember, the value of ether had risen by almost 4,000% in 2017, partly due to these ICOs and support from serious investors. Despite this setback, ether, too, recovered most of its market cap soon thereafter.

However, the latest blow from the PBoC may be disastrous for a market with such serious influence on the cryptocurrency market. Since the Caixin report, ether has lost 12% of its value, and is struggling to regain its value. Bitcoin and most other cryptocurrencies also lost more than 10% of their value, and are in the same boat with ether.

What happens next?

If you’re thinking of cashing out now, though, that may not be the best decision. So far, the reports about the ban on cryptocurrency trading is yet to be confirmed. Chinese exchanges OKCoin and Huobi both stated they have yet to receive any notice from the PBoC, so it may still be a while before it happens. Furthermore, these exchanges are already considering workarounds in case the PBoC does ban cryptocurrency trading.

Peer-to-peer trading would still not be illegal, and would probably work just as well. Despite the ban, ether and other cryptocurrencies would still regain their value and rally, probably to new highs. So, do not dump your ether, bitcoin or whatever your favourite cryptocurrency is, just yet, this is just another bump in the road.

Comments (0 comment(s))