Best Forex trading tools to get your FX trading improved

Forex trading might sometimes get complicated, no matter if you are the amateur trader or the one who is doing it constantly day-by-day gaining experience. Trading currencies is an attention-demanding process that requires keeping the hand on the pulse every day. Thus, it might get hard to always make an analysis yourself. That’s where the best Forex trading tools come to help.

Okay, even though we’ve started on a hard note, the currency trading is not that tricky and is quite easy to understand. So are the FX tools, worthy to mention that those were initially created to help the ones out there who need assistance and certain guidance. Definitely not to make things even more complicated. Therefore, best Forex trading tools for beginners will be your friends throughout that never-ending path. Just take a deep breath, stick with us, and, hopefully, by the end of the article, you will become better in understanding the topic.

To understand the whole process easier, let us introduce you to Ben. He just moved to the new city and started to build his very first house. Now, what the one would need to create a stable and reliable base structure for the building? Right. Tools! That is exactly how the trading tools Forex are working, they are just the assets in hands of the ‘builders’ that allow simplifying the process. Moving on with Ben, he is not a professional builder, neither does he know what tools shall he use. Together with Ben, we will dig into the best Forex trading tools that will your, as well as Ben’s life a bit easier.

Let’s go straight to the point and discuss some of the tools that will definitely help you out on a daily basis. After all, that’s what you came here for, right?

Forex tools to use

Generally saying, there is a range of free Forex trading tools software that is accessible absolutely free of any charge and yet provides great assistance in trading. Notably, those are sometimes some of the best assets the traders might hold out there as well.

Economic News Calendars

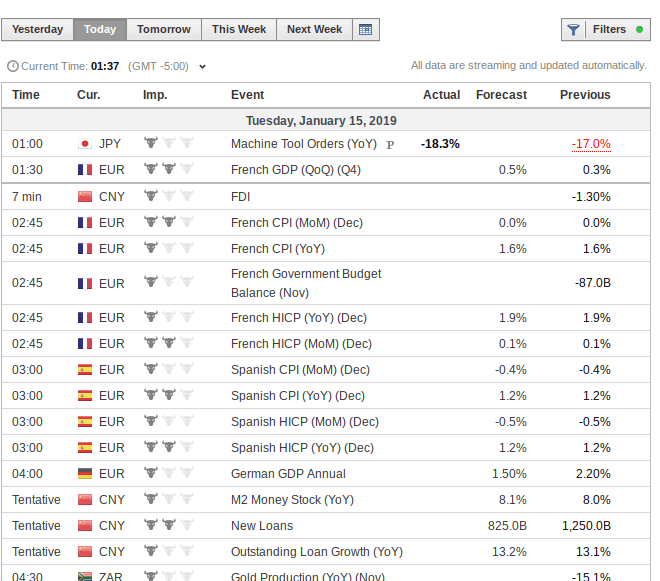

So, what does Ben need to do to find out what are the best tools for him to use while building a house? Well, he needs to check on the latest updates regarding the tools, check what his mate neighbors are saying. Therefore, that is just as important to check the recent news of the Forex market. As the currency rate is mostly dependent on the present economic conditions of the origin country. As the exchange rates are often based on market expectations, the economic news calendars might be one of the sources you can obtain all of the information you might need. Those will help in understanding how the correlation between the recent news and the exchange rates is created. Nowadays, there are dozens of apps, as well as news updates that are done by experts in that field in order to provide relevant and up-to-date information. Notably, some of those apps might not provide all of the updates online, but rather to offer to download the Excel spreadsheets with all of the information needed.

Usually, that shall be easy not only to find the future market expectations but to also check the previous market outcomes. The news portals are even uploading the monetary policymaker speeches and elections, the central bank policy statements, as well as the latest geopolitical events. All of those, are definitely one of the first things the beginner in trading needs to check on.

Usually, that shall be easy not only to find the future market expectations but to also check the previous market outcomes. The news portals are even uploading the monetary policymaker speeches and elections, the central bank policy statements, as well as the latest geopolitical events. All of those, are definitely one of the first things the beginner in trading needs to check on.

The things to put the attention to while checking the calendar, are the time when the news was updated, the currency that was affected as a result of the events, the values indicated. Moreover, it is quite easy, even for our builder-guy Ben, to come up with future forecasts by spending just a little bit of time analyzing the historical flow of economic releases.

The economic calendar is the best free Forex trading tools for beginners. However, it is still used by advanced fundamental analysts as well. Those calendars are prepared by the Forex brokers usually and are published approximately two weeks prior to the releases.

Financial publications and newsletters

Now, when Ben heard from the neighbor that he saw a great tool advertisement in the newspaper sold in the nearest store, he rushes there to find something that might help him to decide which exact hummer to buy and whether it will last long for him to use at all. So are the financial newsletters, they are coming as an adjacent to the economic calendars. Notably, these might be reliable newspapers like the Wall Street Journal, Bloomberg, MarketWatch, Reuters, and the UK’s Financial Times. The newspapers are usually a bit more oriented towards the political situation of the country, any adverse geological events happening there, or even the country’s dependence on the production of strategic natural resources. They explain what is happening and what is already highlighted in the economic calendars a bit more detailed and broad. That is why those are among the factors of utmost importance when it comes to the currency exchange predictions.

Now, when Ben heard from the neighbor that he saw a great tool advertisement in the newspaper sold in the nearest store, he rushes there to find something that might help him to decide which exact hummer to buy and whether it will last long for him to use at all. So are the financial newsletters, they are coming as an adjacent to the economic calendars. Notably, these might be reliable newspapers like the Wall Street Journal, Bloomberg, MarketWatch, Reuters, and the UK’s Financial Times. The newspapers are usually a bit more oriented towards the political situation of the country, any adverse geological events happening there, or even the country’s dependence on the production of strategic natural resources. They explain what is happening and what is already highlighted in the economic calendars a bit more detailed and broad. That is why those are among the factors of utmost importance when it comes to the currency exchange predictions.

Together with that, more in-depth press conferences and policy statements releases are published there to highlight the country’s central bank and its monetary policymakers’ decisions. As those are the ones that decide the interest rates within the country. Which, in turn, affects the national currency value. That might actually be the best free Forex trading tools for beginners. Even though it is quite easy to open/download the newspaper and read it through, that makes a whole lot of difference. The financial newsletters are providing all of the updates on the recent events. This, in turn, will allow you to understand how exactly the currency rate of USD is changing because of the China-USA conflict.

Currency correlation tool

Now, what is going on with our friend Ben? He finally got to the store and found out that it is not enough just to choose the hammer, he now needs to find screws that will complement it. As we already know, there are many various currencies flowing around the foreign exchange market. Those are correlatable among each other. Presumably, what we don’t know yet is that there are certain currencies out there that are that have a more prominent correlation between each other. That is where the currency calculator come for help and for that particular reason it became one of the tools that professional traders use pretty much every single day.

Just to clear things out, the Euro and the Swiss Franc currencies are known to have a positive correlation. What exactly does that mean? Well, if, for instance, the value of the Euro will go up, the value of the Swiss Fran will go in an exact same direction. The USD/CHF, in turn, has an inverse correlation to the EUR/USD currency pair. That means that those two currency pairs will always move in the opposite directions.

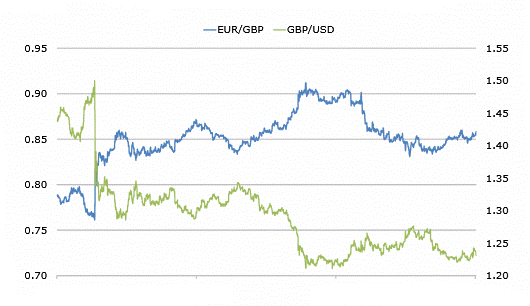

The currency correlations sometimes have a certain historical aspect to it. Thus, the EUR/USD and the GBP/USD are believed to be the strongest currency pairs out of all. However, after the recent political events, we are talking about the BREXIT, those two pairs became severely weaker.

The currency correlations sometimes have a certain historical aspect to it. Thus, the EUR/USD and the GBP/USD are believed to be the strongest currency pairs out of all. However, after the recent political events, we are talking about the BREXIT, those two pairs became severely weaker.

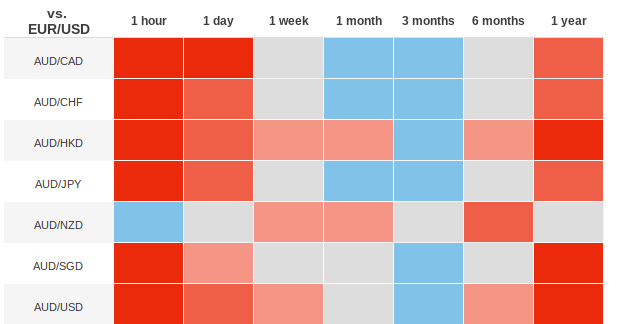

Notably, there are several Forex traders, brokers, and other platforms, like Mataf, that offer those correlation tables. Those are usually available completely free of any charge. The correlation rate might vary from -1.0 to +1.0. The -1.0 standing for a perfect inverse correlation, -1.0 for a perfect positive correlation, and 0.0 for no correlations whatsoever. The tables might be sometimes colored as well, the red-colored boxes, in that case, stand for a perfectly negative correlation and the blue ones for a perfect positive correlation between currencies. Thus, that shall be easy to navigate around the table even for the trading amateurs.

Generally saying, if Ben would buy a great and high-quality hammer and bad screws, will he even build a great and stable house? No, it will most probably fall apart pretty soon. The same is with the Forex trading, you should avoid trading with the highly positive, so as highly negative, correlated currencies. As the first will simply create more risk for your portfolio, and the second will just make the possibility for you to gain to nearly zero. That’s not what we want, do we? That is exactly why you need the correlation calculator. As it will help you to decide what currency pairs shall not be traded together.

Generally saying, if Ben would buy a great and high-quality hammer and bad screws, will he even build a great and stable house? No, it will most probably fall apart pretty soon. The same is with the Forex trading, you should avoid trading with the highly positive, so as highly negative, correlated currencies. As the first will simply create more risk for your portfolio, and the second will just make the possibility for you to gain to nearly zero. That’s not what we want, do we? That is exactly why you need the correlation calculator. As it will help you to decide what currency pairs shall not be traded together.

See those that are colored in red? Well, it might be not the best idea to trade the ones that are both highly positive (red). Neither it is good to trade the red-colored and blue-colored currencies together as well. Just try to go with the neutral ones or the ones with the lower correlation.

Pip calculator tool

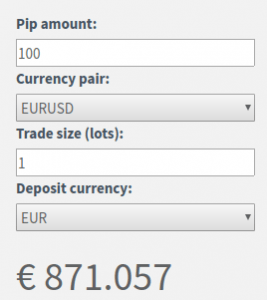

As the foreign currency trading concept is basically lying on the idea of exchanging different currencies, it might sometimes become a bit confusing. That might become even more complicated if the one is not familiar with what ‘pip’ is. The ‘pip’ itself stands for the Price Interest Point. It basically indicates the change in the currency pair exchange rate. It is quite tricky to understand still, we get it. Let’s then look at the certain example. The EUR/USD was traded for 1.1200 on Forex market, but over the time it became 1.1205. That means that pip was increase by 5 pips. So now to buy 100,000 euros you will need to pay US$112,005 instead of previous US$112,000.

As the foreign currency trading concept is basically lying on the idea of exchanging different currencies, it might sometimes become a bit confusing. That might become even more complicated if the one is not familiar with what ‘pip’ is. The ‘pip’ itself stands for the Price Interest Point. It basically indicates the change in the currency pair exchange rate. It is quite tricky to understand still, we get it. Let’s then look at the certain example. The EUR/USD was traded for 1.1200 on Forex market, but over the time it became 1.1205. That means that pip was increase by 5 pips. So now to buy 100,000 euros you will need to pay US$112,005 instead of previous US$112,000.

The pip calculators are truly one of the best forex trading tools for beginners. They allow the traders to calculate the pip value in just a second. The only thing the one should do is to indicate the position that shall include the size of the trade, the instrument or currency pair, the amount of currency traded, as well as the leverage and position size parameters. By using the pip calculator, the trader is able to be always informed about the amounts that positions are worth.

Time zone converting tool

As the currency trading is happening across the globe, the time difference might play a vital role as well. When the trader Jim is sleeping in Seattle, May in Bangkok, for instance, might be trying to sell Baht. Thus, it is important to keep track of the time in different parts of the planet.

There are several main centers of Forex trading, those are New York, Tokyo, London, and Sydney. However, all of those are located in within different time zones. Thus, it was decided that the Forex market will be opened at 5 pm New York time and closed by 5 pm New York time.

There are several main centers of Forex trading, those are New York, Tokyo, London, and Sydney. However, all of those are located in within different time zones. Thus, it was decided that the Forex market will be opened at 5 pm New York time and closed by 5 pm New York time.

The time converter helps traders to navigate across different time zones. Sound quite a simple thing to do, but, however, the time converter is one of the Forex trading tools you cannot avoid to use. As time generally decides what is the activity and liquidity of the market at that exact moment. The trading activity, liquidity, as well as market volatility are the factors of utmost importance. And the tools for evaluating those will be provided below.

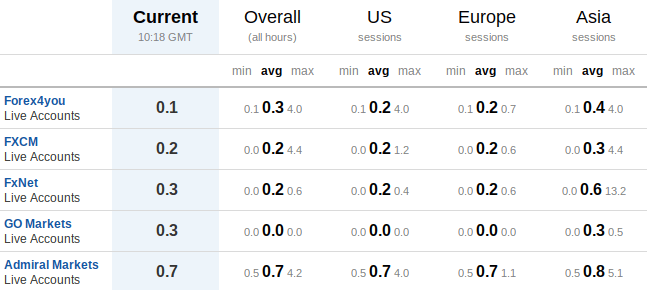

Broker’s spreads comparison tool

A dealing spread is another aspect the one may find interesting when trading the currency. When the trader is choosing the future Forex broker s/he wants to stick with, it is always important to look at the dealing spreads of the broker. That is important to understand what spreads are as those directly influence how the brokers that do not have a flat commission rate are making money. Thus, that is in your best interest to control how much profit you are getting after all.

Therefore, generally saying, a tight dealing spread is what will be more preferable for the trader. As with the tighter dealing spread, the broker is able to get in and out of the positions with the considerably less costly.

Therefore, generally saying, a tight dealing spread is what will be more preferable for the trader. As with the tighter dealing spread, the broker is able to get in and out of the positions with the considerably less costly.

Usually, the websites offering the tool allow the traders to filter the search by currency pair, session or time frame, they also may provide a competitive comparison of dealing spreads. However, many experts claim that this tool is becoming less important in the daily trading operations. As once the broker is chosen, it is quite hard and costly to switch to another one.

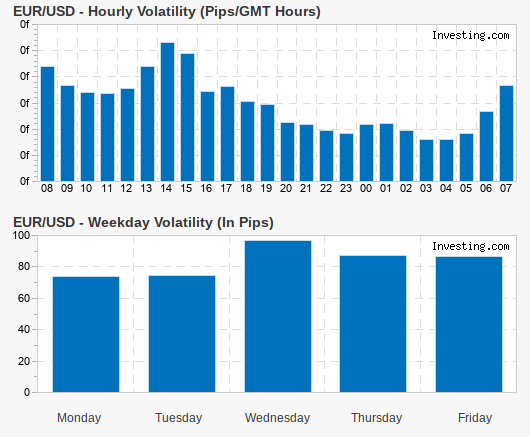

Forex volatility calculation tool

Okay, now Ben has decided what screws to go with, but he also needs to choose the ones that will last, right? Ben wants his house to become his ‘fortress’, therefore, he needs to invest in the high-quality tools for that. That is how the volatility might be perceived. It is actually one of the deciding factors when it comes to choosing what currencies to trade. That does also depend on the range of the currency trade. Thus, the currency pairs with the limited range, or limited volatility, are not the most preferable ones to trade. The greater is the percentage change of the currency value, the greater is the possible price change as well. Moreover, there are some currency pairs that are known for being highly volatile and preferable to trade.

The volatility calculators, in turn, might become one of the most valuable range trading forex tools for the one who wants to become a truly serious trader. That might be really hard for the person to evaluate and calculate the volatility ratio of the currency pair as that might require a historical value range evaluation, as well as some other factors that might be difficult to find sometimes.

The volatility calculators, in turn, might become one of the most valuable range trading forex tools for the one who wants to become a truly serious trader. That might be really hard for the person to evaluate and calculate the volatility ratio of the currency pair as that might require a historical value range evaluation, as well as some other factors that might be difficult to find sometimes.

A good calculator, however, would analyze the past historical exchange rate information and calculate the expected volatility rate based on the data obtained. It will also present those predictions within various time frames, that are usually a 1-week, 1-month, 3-month, or 1-year period. By just looking at the analysis prepared by the volatility calculator, the one might receive a clear vision of whether the price, or volatility, of the particular currency, is high or low in comparison with the former rates.

What is the practical benefit of analyzing currency volatility, you would ask? Well, it’s simple. Firstly, it saves you loads of time that could have been spent on creating the Excel spreadsheets. Secondly, by looking at that indicator, you may simply understand if it is worth to trade that currency. As when the volatility rate of the currency is estimated to be high, there is a higher possibility of even better trading opportunities to appear.

The volatility calculator might become the most useful free Forex trading tools software in case it is used correctly. As the volatility values obtained might be interpreted differently by traders who are seeking different goals. Thus, the traders that don’t want to rush and just want their capital to slowly but surely grow, they would look for the currencies with the low volatility levels. But the ones who are seeking for the higher prices and, thus, higher profits, would look for the currencies with the high volatility levels.

Forex platforms as the best Forex trading tools

Just like the building tools catalog, there are several trading platforms, or software, created to help traders with the Forex trading analysis, as well as the execution of trades. Those are usually free of charge and require the creation of the trader account. The platforms allow trading stocks, bonds, futures, etc.

The great thing for the beginners is that the majority of those platforms allow users to create a demo account and test out the trading process first. There are so many platforms out there to choose from now, so you shall definitely take your time and investigate each of them. However, below you may find some useful information about one of those platforms, MetaTrader 4.

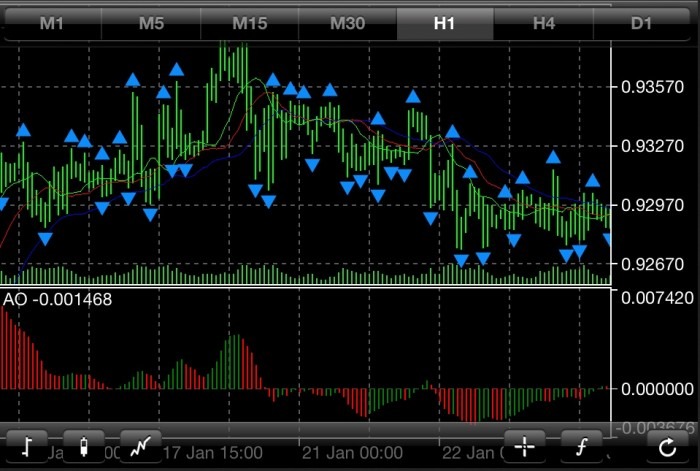

MetaTrader 4 platform as a separate tool

When it comes to the MT4 platform, there is truly no other competitors standing on its way. And you shall definitely check that and get deeper into its functions as that will undeniably open up so many opportunities and prospects for you in terms of currency trading.

That is kind of a free Forex trading tools software. The developers made sure to include as many assets and tools there as possible. That is why, it is now one of the widely-used platforms for serious traders to use, so it shall become for you as well! MetaTrader 4 includes various tools and technical assets that allow completing the full technical analysis of the currency performance. The currencies are directly paired in the platform and are spread depending on their current rate.

MetaTrader 4 includes various tools and technical assets that allow completing the full technical analysis of the currency performance. The currencies are directly paired in the platform and are spread depending on their current rate.

While creating a platform, developers were considering all of the possible features to include as they wanted to attract as many online brokers as possible. So they did. Nowadays, there are dozens of brokers operating on the MT4 platform. With the automated trading function, as well as the ‘expert advisor’ option, MT4 allows traders to employ their own parameters while trading the currencies. There is also a possibility of establishing the demo account and see how the trading strategies are working in real life.

So, all in all, that is truly a Forex tool to download. As it is available for free on the official MetaTrader 4 platform website.

A bonus tip

As a small bonus for you guys, we really advise keeping your own trading journal. Like a real one, doesn’t matter if that would be a digital or written one. Buy try to record every trade made by you and analyze it from time to time. That way you will be able to track your mistakes and just analyze your trading habits. But that is important to record the trades as detailed as possible, so don’t forget to indicate a time of the trade, size of the trade, size of the trade made, and final results of the trade as well. That, together with the tools provided above will definitely help you out on your way to success!

Comments (0 comment(s))