Will the Australian Dollar Start to Rally? AUD/USD Technical Analysis

The Australian dollar tries to rally to start the week, but the 200 day EMA just above is providing psychological resistance. Besides, the market looks a little bit overextended, and it gives occasion to think that the Aussie will continue to look down.

The Australian dollar showed a slight increase during the trading session on Monday, as the trade tensions between the United States and China only stepped up over the weekend, and that will clearly have a heavy impact on what is going to happen with the AUD next.

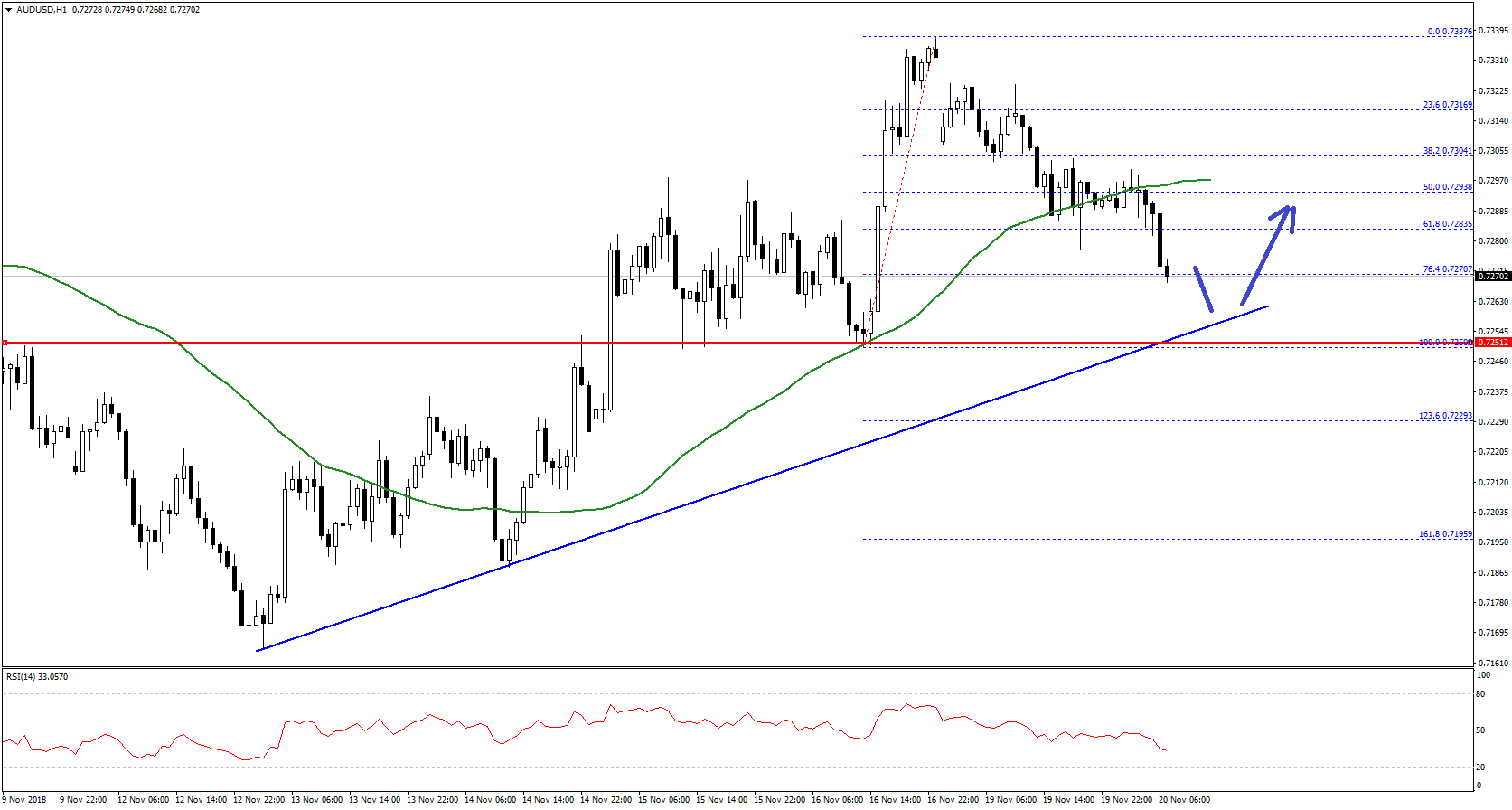

The Aussie dollar topped recently near the 0.7340 level and declined against the US Dollar. The AUD/USD traded below the 0.7300 support and the 50 hourly simple moving average.

The pair also declined below the 61.8% Fib retracement level of the last wave from the 0.7250 low to 0.7337 high. However, the pair is now approaching a strong support area near the 0.7250 swing low in the near term.

There is also a connecting bullish trend line in place with support at 0.7250 on the hourly chart of AUD/USD. Therefore, dips toward the 0.7250 level are likely to find a strong buying interest.

If buyers fail to protect the 0.7250 support, the pair could accelerate losses towards the 0.7200 level. On the upside, an initial resistance is at 0.7290, followed by the 0.7300 handle.

Comments (0 comment(s))