AM Broker Review

When you find a brokerage company which has recently been established, you inadvertently start looking for its hidden flaws. The AM Broker is no exception, and with its handful and divided reviews, we’re even more interested to find out what their actual website looks like and what their terms of service are. So, hang on and let’s find out whether the AM Broker scam is real or not.

AM Broker review – first impressions

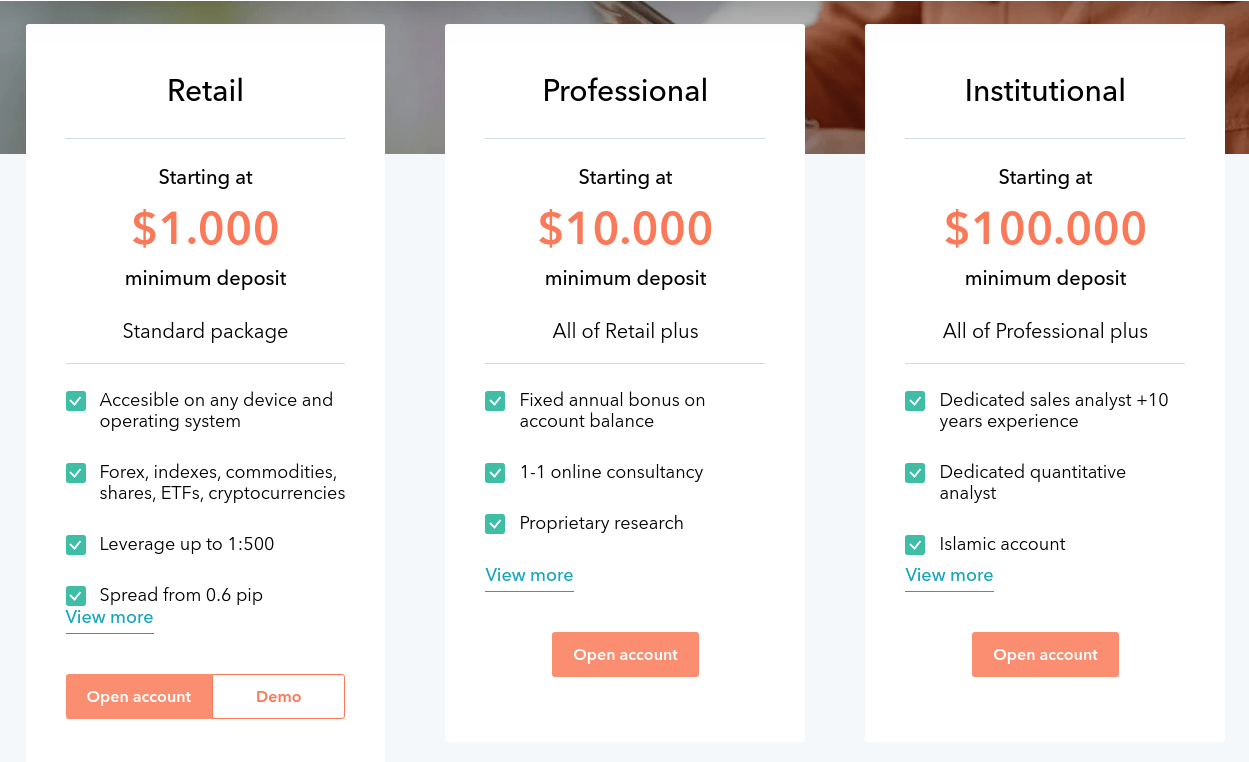

Just like any other broker reviews, we’re mostly interested in how AM Broker’s proposals stack up against the usual offers on the market. As we head over to “account types” department on their website, we’re greeted with a standard retail package which requires a minimum deposit of $1000; we’re going to talk about these and other numbers in detail a bit later, but for now let’s just say that $1000 for a minimum deposit is a BIG requirement from a new company.

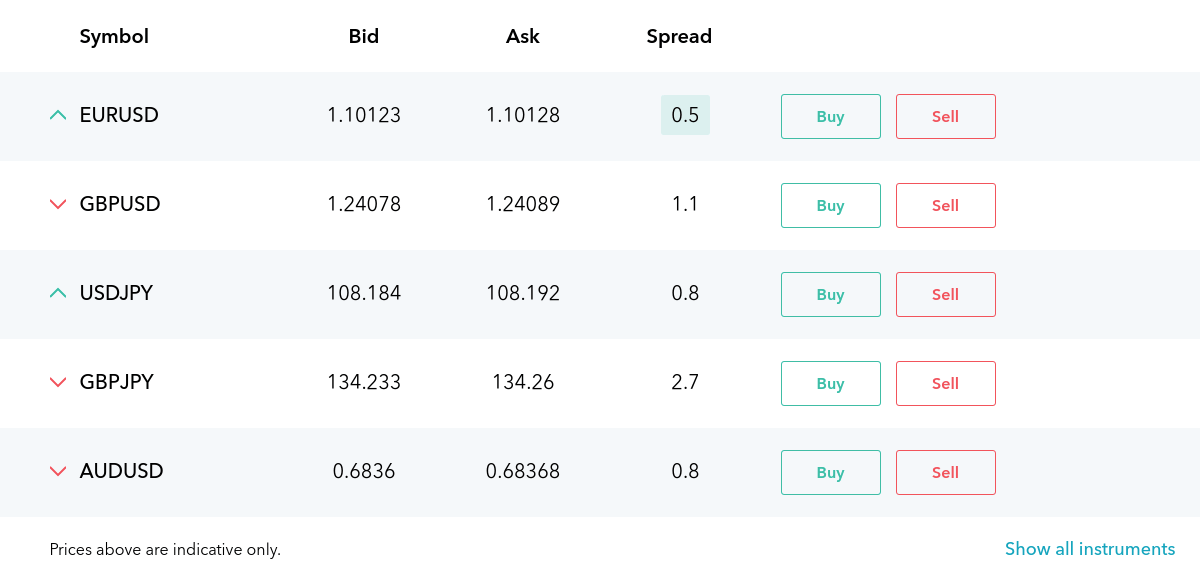

Right under this number we see, that the maximum leverage goes up to 1:500, which is an impressive rate, but more about that later. Another important indicator is spreads, which varies from 0.6 to 0.9; again, this is quite a good number and we’ll make it clear why.

As for the regulation, at the bottom of their first page, they say that the company has been registered and regulated by the Financial Services Authority of Saint Vincent and the Grenadines, which should have been enough to remove any AM Broker fraud suspicions, but that’s not necessarily the case; interestingly enough, right after that line they mention that they don’t provide service to the citizens of Japan, the US, Canada, the EU, and New Zealand, which speaks for itself. And finally – software support, which is quite diverse and modern: they offer their services through Metatrader 5, Web Trading, and iOS/Android apps.

Now let’s head over to their website and see how it looks.

What the website looks like

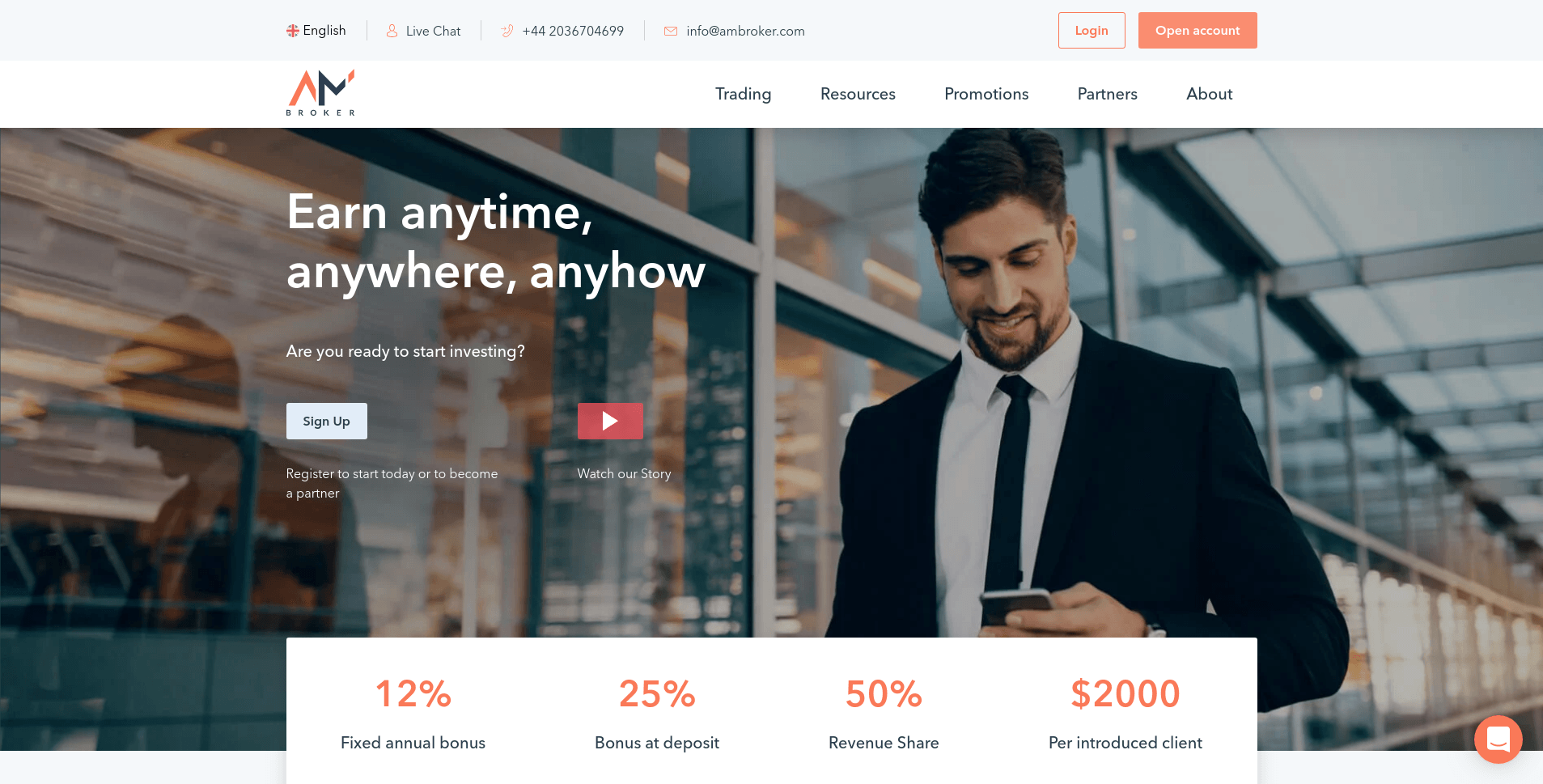

Before you start gushing about AM Broker’s modern and simplistic website, you have to know that it doesn’t take much IT knowledge to create a pretty sophisticated website. There are platforms such as Wix, or Squarespace, who offer their pre-existing templates to let you easily create a website of your liking. So, with that in mind, let’s carry on.

First thing you notice about the website is its simplistic look and design, but is AM Broker legit because of that? Not necessarily. There are 5 tabs at the top-right corner of the first page, that lets you get the information about trading, resources, promotions, partners, and about the AM Broker itself. A bit downwards you can see their basic offers and propositions (12% annual bonus, 25% deposit bonus, etc.), which, again, gives you a better sense of what they have to offer. They also have a market prices window on the first page, which contains not only Forex indicators but also indices, commodities, shares, ETFs, and cryptocurrencies.

Another important indicator of a decent website is the About Us page. When you get to that page, at first glance it seems alright: there’s a short video and not too long story of what the idea behind creating this company was and what their goals are. But when you start reading, one thing that flashes most is how dramatic and radical they portray the trading environment and their role in it.

What they basically say is that before them there was this capitalist darkness in the field, where the companies were focused on exploiting their customers and sucking as much profit as they could; That’s why they were determined to make trading field more “democratized” and available for a wider array of customers with reasonable terms of service. If you haven’t already guessed what kind of a self-description that is, let us help: it’s bragging! And the one thing braggers usually do poorly is their job.

Can AM Broker be trusted with the authorities?

As we’ve already mentioned in the basic AM Broker review that the company has been registered by the Financial Services Authority of Saint Vincent and the Grenadines.

If you don’t already know, these distant and isolated islands are what’s called “safe havens” for those businesses, which are inclined to hide their profits from their governments or providing services that are otherwise illegal in their respective countries. Being regulated by one of the smallest countries in the world from one of the poorest regions in the world basically means no regulation whatsoever, which gives the AM Broker scam a much wider sphere of action.

Another interesting fact about AM Broker is that they don’t provide their service to the citizens of Japan, the US, Canada, the EU, and New Zealand. This is not surprising given that the developed countries have much tougher regulations and actually care about their citizens, that’s why they don’t let the unknown and suspicious companies scam their people.

Numbers in detail

Now let’s get a closer look at the actual numbers. We already know that the minimum deposit requirement is $1000, which is way higher than the average number out in the trading field, which is somewhere around $200-250. But as we have already noted, suspicious companies such as the AM Broker have their fraudulent schemes of obtaining revenues, which itself contains high risks.

Adding to that the fact that they generally provide their service to the developing countries, it becomes obvious that the high risks require high prices and demands. That’s why they require you to make a minimum deposit of $1000 so that they can justify their activities.

Maximum leverage also heavily depends on the high-risk factor, which couldn’t be more obvious in this case. The AM Broker offers you max leverage of 1:500, which is an impressive number – but not surprising. You see, to make you interested in their products and make you discard all the suspicious information about them they need to offer you something in return, which in this case is high leverage rates.

If you’re bold enough (or, we’d say careless enough) to use their service, you’ll theoretically yield more profits out of your deposits. Here we can also mention lower spreads (0.6-0.9), which gives you an opportunity to purchase or sell your currency in pretty much the same amounts. These lower rates also depend on high risks and, as you already know, you can never trust someone who’s using offshore areas for their activities.

As for the AM Broker withdrawal, the company only offers money withdrawals via Visa or MasterCard, which is not impressive. In fact, it’s a disadvantage, given that it takes almost a whole week to withdraw money using these platforms, unlike PayPal or other online systems, which offer instant operations.

Conclusion – is AM Broker legit?

After everything we’ve said about AM Broker, we can only add one thing: IF you value stability and trustworthiness, then don’t trade with them. They’re a company that’s based on a false claim of FSA regulation but it doesn’t mean anything in effect. They’re using “safe havens” to do their job, which in itself is not something you should be looking for in a trustworthy company. Some numbers might also be impressive and tempting but you should keep in mind that these kinds of enterprises need to balance their risks with high profits and leverages.

Yes, there are several AM Broker opinions that give a 4- or 5-star ratings to the company, but after close inspection, we can see that they might as well be false and misleading.

So, there’s our review of the AM Broker. We hope you make a wise decision while trading.

Comments (0 comment(s))