AvaOptions review – a great custom-made platform from AvaTrade

AvaOptions is modern trading software developed by AvaTrade. AvaTrade is a highly reputable multi-asset broker that offers various trading platforms to its clients. The broker offers MetaTrader 4 (MT4), and MetaTrader 5 (MT5) as main trading platforms. In addition, DupliTrade, and AvaSocial are also available.

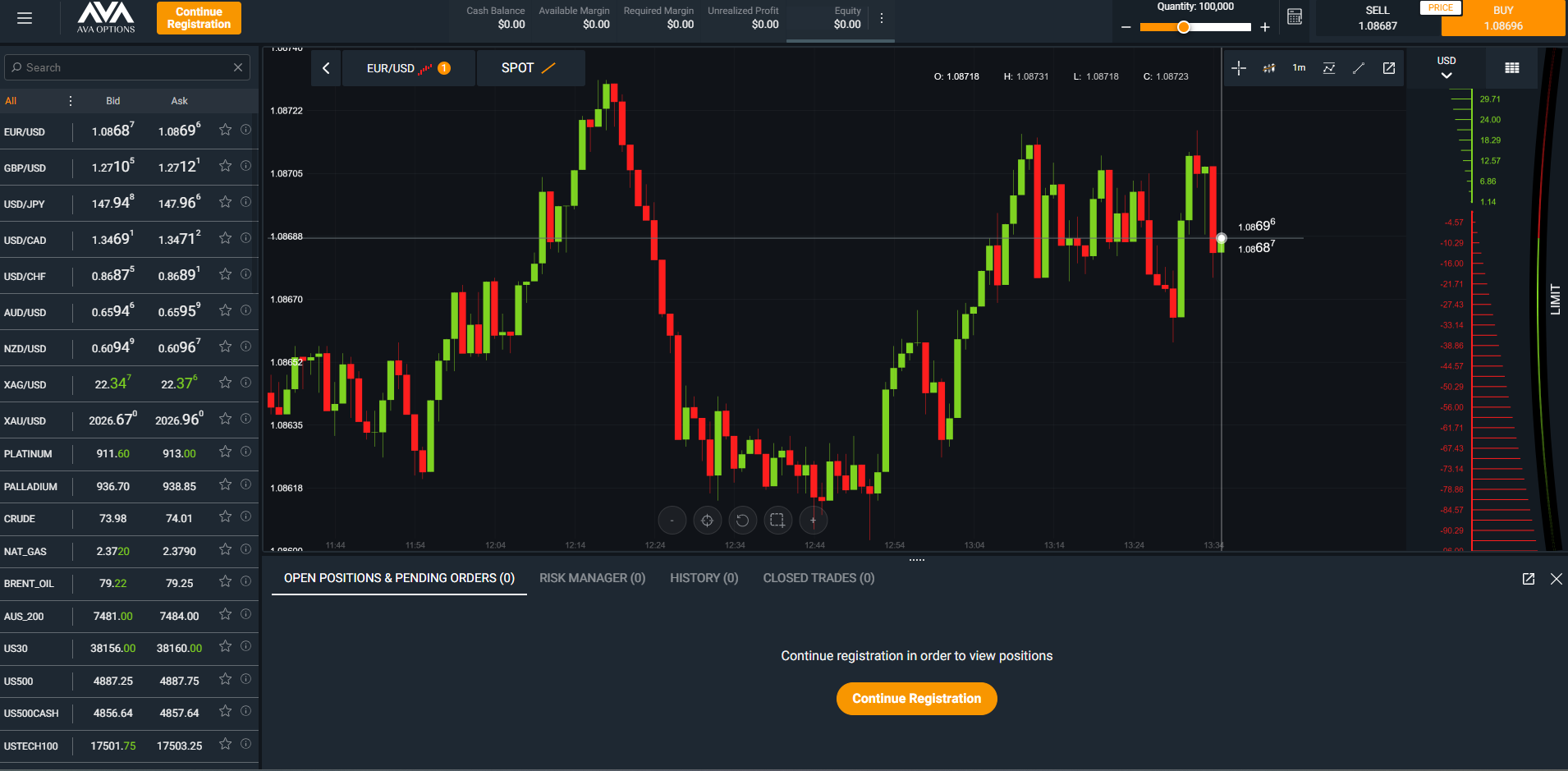

AvaOptions is a unique platform as it’s specially designed for trading options. The platform is web based, and it also supports mobile trading. There are 64 instruments available on the platform. Traders can access options on mostly currency pairs, a couple of hard commodities such as energies and precious metals, and indices. Before we learn more about the platform and its benefits, first let’s explain options trading in more detail.

How options trading works

Trading options enables traders to speculate on future asset prices. Trading options, involves buying and selling options contracts. The contracts give buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price called strike price. It’s important for the transaction to happen before or at the expiration date of the option. The options contracts are grouped into two main categories: call options and put options.

- Call options: buyers of call options expect the underlying asset price to rise, providing them an opportunity to buy the underlying asset at a lower price than its actual value on the market. Sellers of put options are obligated to sell the underlying assets if the buyer decides to exercise the option.

- Put options: buyers of put options think that the underlying asset price will fall, allowing them to sell the asset at a higher price than its market value. Sellers of put options are obligated to buy the underlying assets at the strike price when the buyer decides to exercise the option.

It’s important to note that each option has its own expiration date, and once an option expires, it’s no longer valid. There are various options trading strategies that involve a combination of buying and selling call and put options to achieve various goals. Some investors use options for market speculations, while others use them for hedging and managing risks.

Key features of AvaOptions

AvaOptions web based platform is modern and user-friendly. The platform provides custom market watch features. The economic calendar and volatility curves are built-in to the platform that improves trade analysis. Traders are able to set entry and closing limits directly from the chart and get a clearer picture.

Indicators show how limit orders impact trade risk and profitability. Traders can place automatic entry limit or stop, and take profit (TP) and stop loss (SL) orders.

The platform enables traders to use any of the 13 options trading strategies including Spot, Calls, Puts, and combination of different options strategies from a clear menu. The Open Positions page shows each trade’s risk, with full sort and filter capabilities. Traders can see historic performance on the chart as well as potential price movements that are shown by Confidence Intervals. In addition, risk and reward charts (Profit/Loss chart) are constantly updated.

Required margin is calculated based on how risky your portfolio is. The platform uses a method named SPAN (Standardized Portfolio Analysis). The tool takes into account the volatility of an asset, as well as contract expiration date.

AvaOptions enables traders to have complete control over their trading portfolios to balance risk and reward, and align their market views. The platform enables traders to trade multiple accounts with a single ticket. AvaOptions offers an extensive range of sophisticated risk management tools, portfolio simulations, etc.

AvaOptions is an amazing options trading platform that provides traders not only live but also demo trading free of charge. The platform integrates useful tools, designed to guide and assist traders on their trading journey. In addition, the platform is simple to understand and use. AvaOptions has all the key options trading strategies built-in.

AvaOptions mobile trading app

The AvaOptions software is only available for web trading and mobile use. Mobile applications are highly convenient as they enable traders to access markets from anywhere in the world with a click of a button. However, mobile platforms come with an obvious drawback, smaller screen, which makes market analysis difficult. It’s important to note that AvaOptions mobile applications require iOS 11 or later versions for iPhone users. The AvaOptions app is free to download and install from the app store, and from the Google Play Store.

The platform supports 13 options trading strategies, including risk reversal, spot, call, call spread, call ratio, call spread, put ratio, put spread, put, straddle, straddle, butterfly, condo, and seagull option strategies. Liquidity is provided by multibank and streaming trades are available 24/5. Trade sizes vary from 10,000 to 10 million.

AvaTrade policies

AvaTrade has an inactivity fee on CFDs, and this rule also is true for options traders. The company charges an inactivity fee of 50 account currency (Euro, US Dollar, and British Pound Sterling depending on your account’s base currency). The inactivity fee is charged every month and is deducted from a live trading account after 3 consecutive months of non-trading period. In order to avoid inactivity fees, traders can withdraw all the funds from their account balance. The broker doesn’t charge accounts with less than 50 account currency on the balance.

Traders cannot open options trading accounts from certain parts of the world. The restricted countries are Belgium, Cuba, Iran, Syria, the United States of America, and New Zealand.

AvaOptions live and demo accounts

Trading Options can be difficult for many, as options involve complex trading strategies. The broker has done a lot to make options trading easier by offering a user-friendly platform, however, beginners still need to spend a substantial amount of time and energy on learning how to implement options trading strategies. Luckily, the broker provides traders with live and demo account types. The demo accounts are very similar to the live ones, with major differences that trading is simulated and there are no risks of losing money when trading demo. Demo trading is highly useful not only for novice traders, but also for more experienced traders. Beginners learn how to use trading platforms, develop and use trading strategies in a risk-free environment, while professionals use demo accounts to build and test their trading strategies.

FAQs on AvaOptions

Is AvaOptions a desktop trading platform?

AvaOptions is a web based trading platform that also supports mobile trading. Web trading terminals are convenient for traders as there’s no need to download a platform and no need to install it on your PC. In addition, traders can use web platforms to log in to their trading sessions from various computers using only their password and email address. However, web platforms have their own cons. Typically, desktop platforms are more reliable, and it’s faster to run desktop applications once they are installed.

Can I trade shares or cryptocurrencies on AvaOptions?

No, the AvaOptions only offers access to options trading. In case you wish to trade cryptos and shares, you can download MetaTrader 4 (MT4), and MetaTrader 5 (MT5) trading platforms. AvaTrade offers various asset classes through MetaTrader software. However, be noted that MT4 is a Forex trading software, while the MT5 gives traders access to a wider range of asset classes, including shares, bonds, and futures.

Is it difficult to use AvaOptions platform?

Not at all. AvaOptions offers modern, slick and user-friendly designs that makes trading intuitive. The platform is simple to use and traders don’t need special training. The simple design also increases reliability of the platform. However, it should be mentioned that many people find options trading difficult as there are many different trading strategies available.

What trading strategies can I use at AvaOptions?

AvaOptions offers a diverse range of trading strategies, including risk reversal, spot, call, call spread, call ratio, call spread, put ratio, put spread, put, straddle, straddle, butterfly, condo, and seagull option strategies. It’s important to note that trading options contracts are not risk-free, and traders should prepare accordingly.

Comments (0 comment(s))