Eurotrader Review

When you come across a Forex broker that promises to bring you a fortune, you have to ask yourself: is this broker the real deal? Should I entrust it with my finances? How can I know whether its offers are real or not?

These are the questions that answering them would provide you with enough information to decide for yourselves. The importance of choosing the right broker cannot be overestimated: if you’re not careful enough, your money and financial security will be compromised. And we all know how devastating it can be.

With Eurotrader, these questions are still pressing and need to be addressed right away. Therefore, in this Eurotrader review, we’ll take a look at their trading conditions, as well as their regulatory materials and show you, whether you can trust this group or not!

Initial impressions – is Eurotrader legit?

We’ll start our review with an initial overview because, despite it doesn’t influence our final verdict, it’s important to know what impressions does the broker incite at a first sight. And what can we review the first other than the website? It’s the first feature that jumps to our eyes.

Eurotrader.com review

And an initial impression of the website is pretty decent. The interface looks streamlined; it is well-balanced and well-organized, there are various thematic tabs that take you to the different sections of the website. Overall, we think that the website interface is Eurotrader’s strong suit.

Another great thing about the broker is that it supports a wide variety of payment platforms. From the traditional methods like Visa, Mastercard, and bank wire, to the more unconventional ones like Bitcoin, the broker has it all. Now, there might be two different conclusions stemming from this: on the one hand, the broker might clearly be thinking about its customers’ convenience, while on the other, it might be looking for ways to increase the anonymity of the transactions. We’ll explain this more down below, while at the end of this review, we’ll know which conclusion is more feasible.

To be fair, there are several drawbacks to the website which are somewhat prevalent in various areas. For example, on several occasions, the visual effects and images look a bit too much. They give us the impression that the broker “overworked” on its website.

License, please?

As for the regulatory remarks, this is the most important aspect that almost always reveals the hidden flaws and imperfections. In the case of the Eurotrader Forex broker, this couldn’t be closer to the truth. Now, we’ll review this aspect in-detail down below but for now, let’s just say that while Eurotrader claims to be registered in the Republic of Marshall Islands, it doesn’t provide the licensing material and therefore, forces us to believe that it’s not actually restricted by any regulatory framework.

Promotions

And when it comes to the trading terms and conditions, this is the most double-faceted aspect that also incites two different conclusions. On the one hand, there’s this impressive 1:500 leverage ratio that promises to increase your profits 500 times, and the splits are also pretty decent: they start from 0.6 pips, indicating there’s not that wide of a difference between the currency (or other) pairs.

On the other hand, however, there’s a hefty commitment requirement. Eurotrader demands from its customers to transact no less than $250 at their first deposit. This is a very burdensome requirement and will easily scare the beginner traders away.

Should you trust the Eurotrader’s trading offers?

Since we’re talking about the Eurotrader promotions, let’s begin our in-depth review with this feature as well. We’ve mentioned above that the trading conditions are also very double-faceted and lead us to two very different conclusions. At the end of this chapter, we’ll review these conclusions and in the final chapter, hopefully, we’ll be able to decide, which one is more credible.

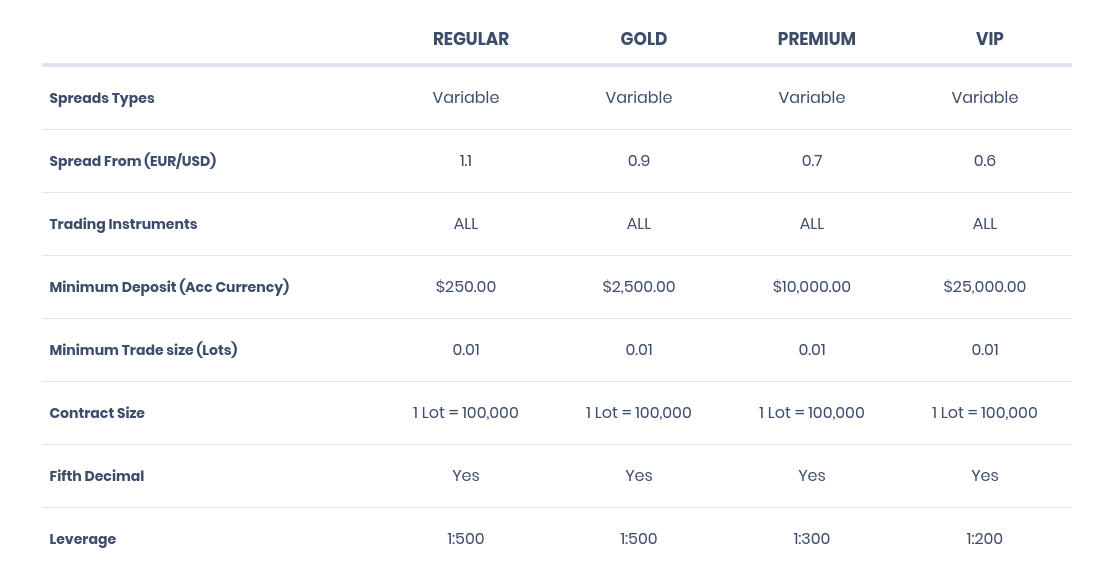

One thing that we didn’t mention in the initial review is that the broker offers four different trading accounts: Regular, Gold, Premium, and VIP. These accounts have their own perks and advantages, while such a diversity speaks highly of the broker: it indicates that Eurotrader wants to include as many traders from different experience backgrounds as possible.

The broker offers a staggering 1:500 leverage ratio. This means that every time you make a deposit, it’ll get multiplied by 500 which also increases your trading volumes, as well as extracted profits. And judging from the fact that the market average of this indicator is somewhere around 1:250, Eurotrader is clearly pushing its limits. However, it’s not overly obvious whether it’s a good thing or not.

Now, let’s talk about spreads. Despite we said that the minimum spread is 0.6 pips, which is a fairly decent indicator, we also have to add that it’s only applicable to the most expensive, VIP account. If you can afford to deposit no less than $25,000 in your trading account, then we don’t really think that the 0.6 pips will have a significant difference in your funds.

As the account price decreases, so do the splits: the Regular accounts can only use the minimum of 1.1 pips in spreads. This, in turn, enforces our Eurotrader scam suspicions that we’ve had since the first chapter. As we go ahead with our review, we suspect it’s only going to get worse.

Traders want to minimize risks

The somewhat impressive trading conditions are quickly overshadowed by a hefty minimum deposit requirement. The broker demands from its customers to deposit a minimum of $250. Now, when it comes to the beginner traders – who will be most definitely choosing the Regular account – they want to minimize the trading risks as much as possible. And when the broker asks you to spend no less than $250 in trading, you’re not really minimizing the risks.

We said earlier that there are two counteracting conclusions to the broker’s offers, so here they are: the first conclusion is that the broker offers impressive trading conditions such as high leverages and decent spreads to let its customers produce as much profit as they can.

However, with such a high deposit requirement, we’re led to suspect that the second conclusion is more feasible: that Eurotrader wants to reap as much money from its customers as possible. And when it comes to giving back anything in return, it goes only so much with its flashy leverage ratio.

Does regulation material alleviate Eurotrader fraud concerns?

As we’ve mentioned above, there are a lot of grey areas with Eurotrader’s regulatory remarks. The broker claims to be registered and headquartered in the Republic of Marshall Islands, however, it doesn’t include its licensing material anywhere on the website.

Therefore, we’re led to believe that there’s no actual license whatsoever. The broker merely mentions its registration place to somehow cover this fact. But it is not difficult to find out the truth that Eurotrader fraud is a real possibility.

While it’s obvious why a company would want freedom from any legal restriction, it’s still important to explain, why would anyone avoid the legal responsibilities.

You see, when companies like Eurotrader fake or cover their regulatory materials, they do so in order to avoid taxation and punishment for illicit activities. And even if Eurotrader was regulated by the Marshall Island’s financial institution, it still wouldn’t make a difference: the Marshall Islands is a small distant island with no political or economic influence whatsoever. The country doesn’t have the resources to control the broker who operates all over the world.

As it turns out, the Marshall Islands is a perfect place for such fraudulent companies like Eurotrader – they avoid taxes and strict financial standards.

What does the website look like?

Perhaps the most positive area which speaks highly of Eurotrader is its website. We’ve already said that the interface looks pretty decent with its easy-to-discern information and well-separated sections. In fact, there are 8 different tabs that take you to the Home page, Account types, Spreads, Platforms, etc.

Such a detailed separation makes it easy to find any detail about the broker without too much fuss. And this is definitely an advantage for Eurotrader.

Another aspect where the broker shines is its payment platforms. There are both traditional methods such as Visa/Mastercard cards and bank wire transfer, as well as the new platforms like Bitcoin. Of course, Bitcoin is the most impressive offer here. With its security and instant transactions, this blockchain-based currency is truly revolutionizing the way we manage our finances.

However, even in this area, there are some concerns. On the one hand, if Eurotrader was legit and credible, Bitcoin would definitely be beneficial for both the broker and its customers. However, since our Eurotrader opinion is not that positive, we suspect that the broker uses the anonymity provided by Bitcoin to cover the tracks and therefore, its fraudulent activities.

Besides, we’ve also noted that there are some areas like the very first page where the visual effects are too overpowering, making the interface look a bit amateurish.

And even though Eurotrader also has some other advantages such as MetaTrader 4, which is a simplistic trading platform that makes it easy for many traders to do Forex trading, these shortcomings are far more superior than the advantages.

Final Eurotrader rating

The internet is full of Forex brokers. Some of them are legit, while the majority of them are only there to manipulate the customers into their schemes and reap as much money as they can. While it’s not easy to say for sure that the Eurotrader FX brokerage is a scam, there are many grey areas in its terms and conditions.

Some of Eurotrader’s trading promotions are really impressive such as the leverage rate of 1:500 and the spreads at 0.6 pips. However, the broker also has a hefty requirement of $250 which easily overshadows those advantages.

As for the website, for the most part, it looks overly professional and well-balanced. And while there are some imperfections and flaws, it’s not a decisive factor that influences our final decision.

What is influential is the broker’s licensing materials – or, to be perfectly clear, no licensing materials at all. The broker claims to be registered in the Republic of Marshall Islands but there’s no trace of a legit license. And even if there was any issued by the Marshall government, it still wouldn’t make a difference considering how incapable the country is to regulate a financial entity.

In conclusion, the negative aspects are more prominent and vivid; they easily overshadow the broker’s advantages and make our suspicions even stronger. Therefore, we give Eurotrader 2 out of 5 and wouldn’t recommend anyone to use their services.

Comments (0 comment(s))