GOFX Review — Full of red flags!

Gofx is an online Forex and CFDs broker regulated in Seychelles. It offers several account types and an MT4 advanced trading platform. Spreads start from 1 pip for all accounts, and there is very little difference between them. Let’s review Gofx and all its important features to define whether you can trust this broker.

A brief profile of GOFX broker

Gofx offers over 1200 trading instruments in diverse markets including Forex, cryptos, stocks, indices, and commodities. While the broker claims to have low spreads, when we checked on the assets page all account types offered the same spreads from 1 pip. This is very inconsistent and can mislead traders. While the broker mentions taking the award in 2021 we can not assume this is the date it was launched and there is no information on the website. Gofx offers no bonuses at this point.

GOFX Accounts Reviewed

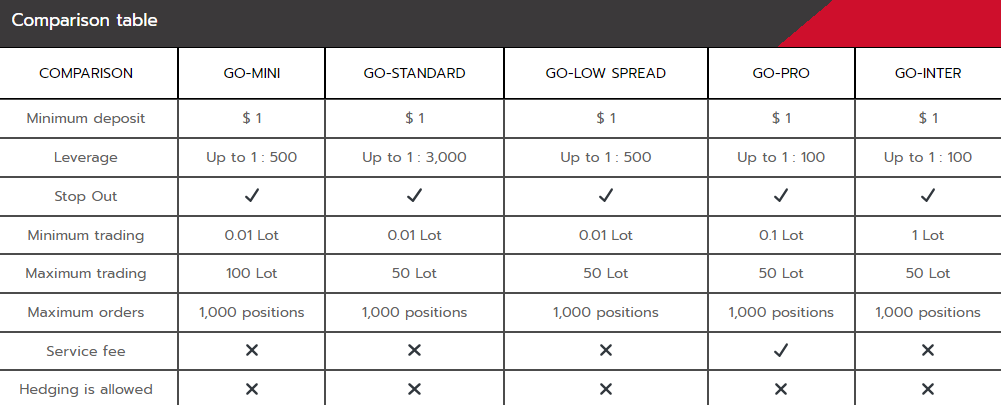

Gofx offers traders four different accounts Go Mini, Go Standard, Go Low Spread, Go Pro, and Go Inter. The broker has a commission-free feature for some trades and will start to charge daily fees and also fees for opening and closing each trading position, which is disadvantageous.

The standard specs for all four trading accounts are as follows:

- Minimum deposit — 1 USD

- Stop Out — Available

- Service fee — No, except for Go-pro accounts

- Hedging — not allowed

As we can see, hedging is not available for any of the accounts, which is very disadvantageous for traders who want to hedge their risks.

The funny thing is that the minimum spreads for all trading accounts are the same, despite the broker claiming low spread accounts starting from the lowest spreads. So, unless you are searching for higher leverage, there is no difference in which account you select. The broker has a lot of work to do, as it makes little to no sense why it would offer so many accounts with the same specs unless it wants to mislead traders.

GO MINI

The Go Mini account is targeted at new traders who are transitioning from demo to live and promises them low risks and high profits, which is a bit exaggerated. The mini account from Gofx has similar specs as other accounts and in general, there is little to no difference between each trading account. The only difference lies in the maximum leverage and minimum lot size, which are 1:500 and 0.01 lots for the mini account. The maximum lot sizing allowed is 100 lots in total for all open positions combined.

GO STANDARD

The Go standards account is for general trading and offers almost the same specs as other accounts except the leverage is 1:3000, and the minimum lot size starts from 0.01 lots. This account makes it easier to blow up an entire account in a few unlucky trades.

GO LOW Spread

The Go Low Spread account also comes with similar specs as others and its leverage is 1:500 and the minimum lot size is also from 0.01 lots. So, we can not see any difference between low spreads and other accounts, as the spreads are the same.

GO PRO

The same tendency is true for the Go Pro account, except it charges service fees and offers maximum leverage of 1:100 and lot size from 0.1 lots. It is interesting why the pro account actually offers worse trading conditions than accounts for retail traders. Highly suspicious and another red flag. This account is ECN and is aimed at signal providers as well. While the website mentions spreads from 0.2 pips and 7 USD round turn commission, the page for assets shows completely different spreads from 1 pip. So, take this information about low spreads with a grain of salt.

GO INTER

The Go Inter account which is an international investment account comes with 1:100 leverage and lot size from 1 lot. How can you be an investor by trading makes very little sense, as investment and trading are two different approaches, and any broker should differentiate between these terms. This account offers stocks for trading in addition to other assets, but we could not find out if these stocks are just CFDs or real stocks.

GOFX Deposits and Withdrawals

There is literally no information or FAQ section to give users clear information regarding deposits and withdrawals, which is never a good thing for a financial broker. We assume the broker accepts bank cards and wire transfers and charges fees for both deposits and withdrawals. There is no other reason not to give a clear explanation about funding methods and fees. Gofx claims it has high-quality withdrawal processing but never mentions exact processing times, and we assume this could be longer than 1-2 business days. Traders are advised to exercise extra caution when dealing with brokers who are shy of showing clear information about deposits and withdrawals.

GOFX platforms and tools

Gofx provides access to MetaTrader 4 (MT4) which is an advanced trading platform. It supports automated trading and is available for desktop and mobile, including iOS and Android. The broker does not offer any technical tools for its MT4, but the platform is advanced enough.

GOFX additional features

Gofx offers no additional features, there are no bonuses or any other motivators for traders. The broker has a somewhat simple website, which is good, but it fails to offer FAQs or anything useful.

GOFX education and training courses

There are no educational resources offered by Gofx, only a few tools and market research materials. These tools include an economic calendar and a technical view. The Technical View service is an economic news service that requires registration. The news is then sent to the email of traders.

GOFX Support review

Gofx offers several support options, but there is a catch. Unless you click on register an account which transfers you to the new page which is in Thai, you can not access live chat or any other support options. This is incredibly concerning and inconvenient, to say the least. The website is available in three languages, but the support seems to be only in Thai, which is another downside. However, when you click on the live chat, it is not working, and only social media pages can be accessed raising another serious red flag. The website seems incomplete, and we do not recommend using Gofx as your primary financial broker.

Is GOFX regulated?

Gofx is overseen by the Financial Services Authority (FSA) in Seychelles. Regulations are key for offering reliable services. However, the FSA is not very strict and leaves room for brokers to be flexible. This is good for brokers but not for traders who should always rely on strictly overseen brokers.

Is GOFX a scam?

While Gofx might not be a scam broker, it severely lacks many essential features. The website is simple but lacks FAQs or any educational materials. There is no information regarding deposits and withdrawals, and several inconsistencies were found. The spreads are supposedly from 0.2 pips on pro accounts but when checking the page for trading assets all accounts have the same 1 pip spreads. Either the broker got its accounts updated and has not reflected it on other pages, or the spreads are high. The broker also claims to start charging trading commissions after some time of trading, meaning even with 1 pip spreads, traders might have to pay commissions which is super disadvantageous. We advise our readers to exercise extreme caution when dealing with Gofx as there were numerous red flags during our review.

Conclusion

Gofx presents itself as a Forex and CFDs broker that is regulated by the FSA of Seychelles. It offers a wide range of trading instruments and access to MT4. Despite regulations and low minimum deposit requirements, several aspects of Gofx’s offerings raise red flags. Gofx lacks transparency regarding foundation year, the uniform spreads across different account types despite claims of low spreads, and the absence of bonus incentives are notable drawbacks. All accounts are super similar with very few differences in leverages and lot sizes, making it misleading and confusing.

In the end, we advise our readers to exercise caution when dealing with Gofx because of inconsistencies and red flags we have detected.

Comments (0 comment(s))