MFM Securities Review – Should One Be Cautious?

MFM securities is a forex broker with years of experience. The firm was created in 2011 and ever since has been actively providing its services to a wide range of consumers.

Our dedicated team of financial experts has done extensive research on this broker. One can find information about all the general aspects of the company, while conducting research on the site we have also taken in mind the expert traders’ authentic MFM securities reviews.

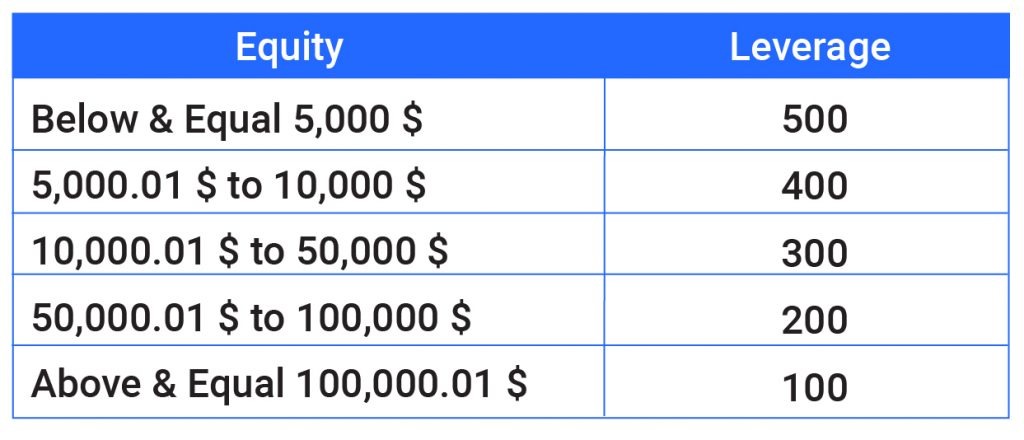

Based on research and analysis of MFM securities broker we have concluded the following intel. The maximum available leverage ratio on the site is 1:500. The minimum deposit requirement that one has to meet is $15. The site has variable spreads which can go as low as 0.0 pips depending on the trading instrument.

MFM securities offer MetaTrader4 and Metatrader5 alongside the ClearPro trading platform. in this regard, there is somewhat diversity which is always nice to have when it comes to trading software.

As for the customer support of the site, it’s mediocre at best. One can either send a mail to the MFM securities Forex broker customer support team, call them or use the live chat option which is very insufficient and is a useless widget as the response rate of this widget is very bad it takes more than 13 minutes to get a decent response and even then the given answer is very vague and abstract.

all in one place this means you no longer have to spend hours searching for information about this broker our team of financial experts has worked tirelessly to analyze every aspect of the MFM securities and we will provide you a review based on brutal honesty.

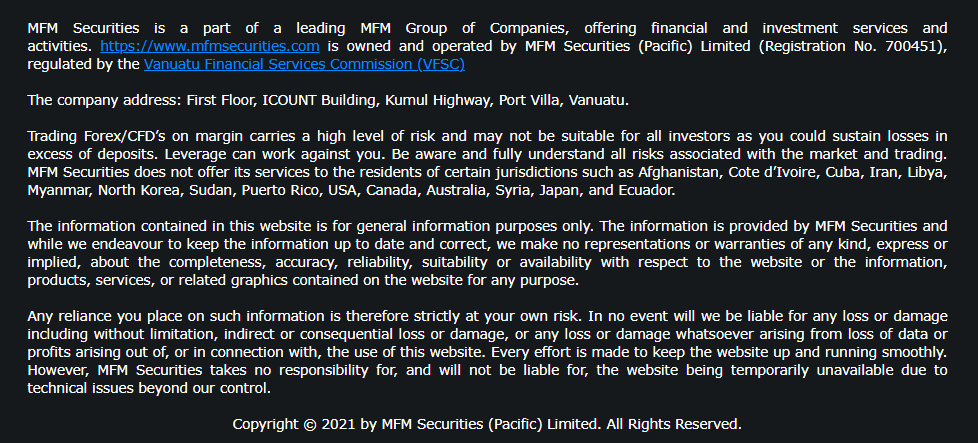

License and regulations – Is MFM Securities legit?

MFM Securities seems to only have one qualification from the Vanuatu Financial Services Commission. Technically this broker firm is regulated, however, they do imply that they offer their services and products to the international market. This raises a few questions. For a company like MFM Securities FX brokerage to do so, they ought to have at least two different licenses one local qualification and the other for the international ventures. This brokerage firm is very discreet about its VFSC license however there is no mention of any other international regulatory body, which they are lacking to have.

MFM Securities Review – Trading Features

A Brokerage firm is only as good as its trading features. This term encompasses multiple aspects of the company like the trading tools, minimum requirements, and promotions. In this section of our review, we will be discussing these aspects in detail to provide our readers with clear information about the firm.

Leverages

The maximum amount of available leverage on the site is 1:500. An interesting fact about the company that one ought to know is the fact that the leverage is dynamic. So what does that even mean?

According to our MFM Securities review much like regular leverage, it is a risk management tool aimed at reducing the hazards associated with trading activity. The distinction arises in the fact that margin requirements are defined per instrument and adjust automatically if the equity in the customer account rises or falls. All of the firm’s account types have dynamic leverage.

Spreads

MFM Securities offers a variable spread on its trading instruments. The information alluding to this only mentions the fact that the spreads go as low as 0.0 pips. This is a very vague notion. After our thorough research, we have concluded that the site is actively making its written content about the spreads confusing. After making a demo account we have noticed that the promised starting spread of 1.8 pip is actually 2.3. This is evidence of fraudulent behavior. MFM Securities scam might be a possibility.

Account Types

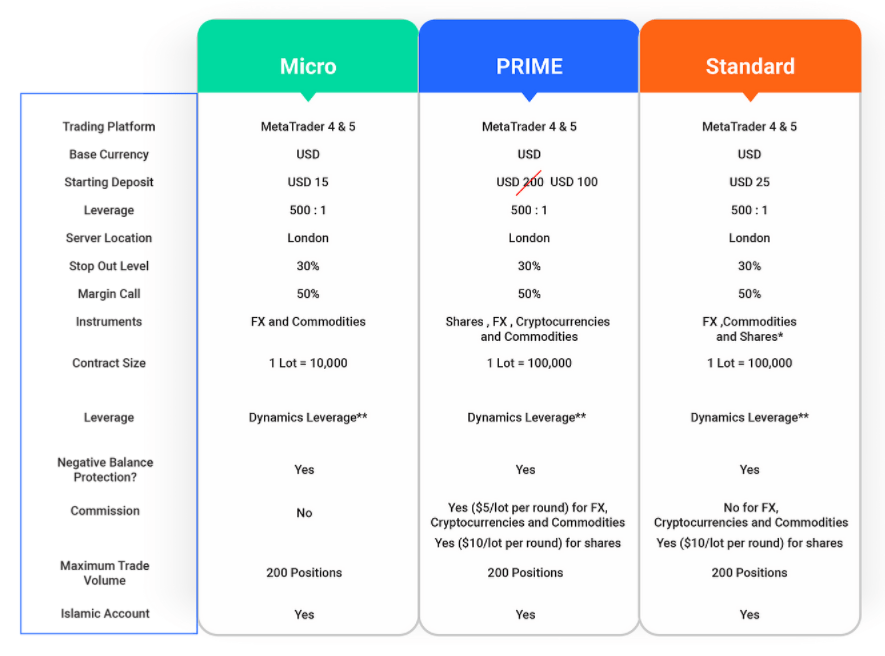

The categorization of the account types on the site is very messy. The firm offers its services to three distinctive categories of traders. This is why one can find three titles in the account section of the site. These are VIP offerings alongside individual and corporate accounts.

By the looks of the way the written content is made for the website, one can find additional account categories in each already mentioned title. These are Micro, Prime, and Standard account types. It’s important to emphasize the fact that the features of each upper-mentioned account type are identical in every possible way for the individual and corporate account which makes absolutely no sense.

All of the accounts use MT4 and MT5 as trading platforms. One can not use the ClearPro platform for any of these MFM securities Forex broker accounts. The base currency for trades is USD and London is the location of the firm’s servers. The stop-out level is identical for all three accounts and is 30% while we can say the same about the margin call which is 50%. The maximum trade volume for all of the accounts is 200 positions. Additionally, negative balance protection is in place for all the accounts alongside Islamic accounts.

The following are the few distinctions we could find between these three account types. A clear difference is the available trading instruments each type of account user can start trading with. Micro users can only use FX and commodities for their trades, Prime users can use them as well, and also additionally they are granted access to other asset types such as cryptocurrencies and Shares. The standard account users can only trade with FX, Shares, and commodities.

According to our MFM Securities review the contract size of the Micro account, 1 lot equals 10,000. Whereas for the Prime and standard account types, 1 lot equals 100,000.

The Micro account doesn’t have any commissions whereas other account types do have it for particular aspects. The Prime account has a $5 lot per round commission for FX, commodities, and cryptocurrencies and a $10 lot per round commission for Shares. The Standard account only has a $10 lot per round commission for Shares.

As for the VIP offering on the site, there’s not much information offered about it. The written content about this topic is very vague and the only specific intel one can get about it is the fact that the minimum requirement to open this type of account is $1,000,000. Most of the available information about it on the site is all promises and no specifics.

Minimum Deposit

The lowest minimum deposit on the MFM Securities FX brokerage site is $15. However minimum deposits are different for each account type.

- The Micro account has the requirement of $15 as a minimum deposit.

- The minimum depositing amount for the Prime account type used to be $200, but as of now they have a sale on it and the minimum depositing amount is $100.

- The Standard account has the requirement of $25 as a minimum deposit.

Bonuses and other promotions

There are many promotional initiatives available on the MFM securities website. Indeed they do offer bonuses and also provide their consumers with contests and a loyalty program.

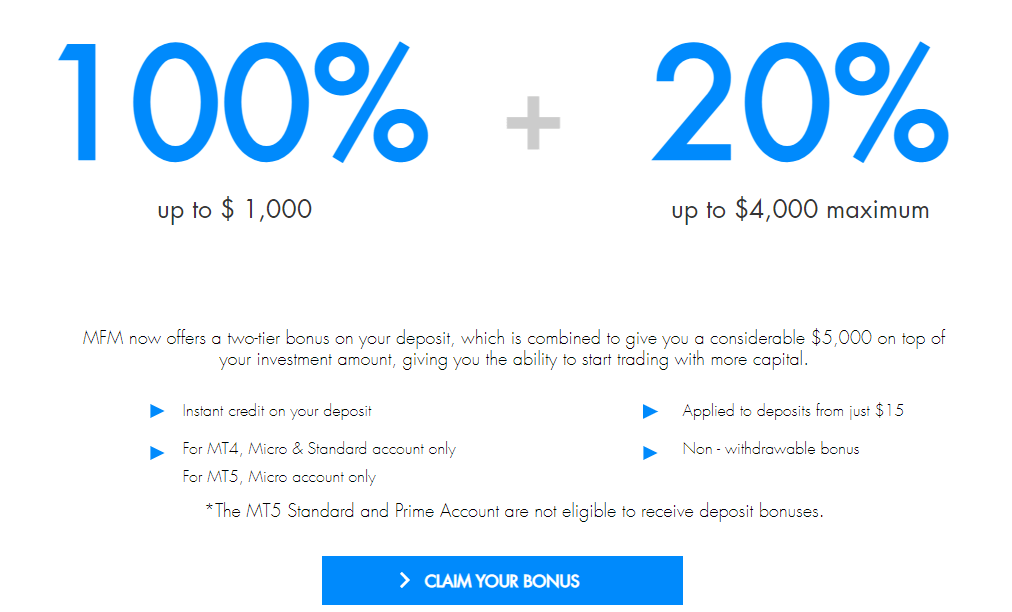

Firstly let’s discuss the MFM Securities bonuses. are they any good? what type of bonuses do they have? it is a two-tier deposit bonus that can go up to $5,000, depending on your depositing amount. To be more specific they have a 100% first-time deposit bonus and a 20% reoccurring bonus. The MFM Securities bonus will be automatically credited to one’s account. $1000 is the maximum amount of money one can get from the initial depositing bonus. For the reoccurring bonus, this amount is $4,000. The bonus amounts can not be withdrawn. These bonuses are available until November and only Micro account users can reap its benefits.

The contest is a reoccurring promotional initiative on the site. As of now, there are three different contests available on the MFM Securities website which are the Golden Raya contest, Gung Ho V5 demo contest, and the 10th-anniversary special contest where one can win many prizes.

The loyalty program is a new edition to the promotions section of the site. As of now, this page is under construction but the firm is actively promoting the fact that it is coming soon.

MFM Securities Review – Our Final Thoughts

All in all, we think that MFM Securities is not as transparent as they want you to think. One should be very cautious while doing any type of business with this firm because the site’s advertised features and promotional offers are subpar and do not correspond to industry standards when compared to other brokers.

They seem to have an attractive minimum deposit requirement and a good leverage ratio. however, the faults of the broker far outweigh the positive aspects of the MFM Securities forex broker.

one does get a bonus but it can be only used for trading one can not withdraw it when one pleases. additionally, the promotional offers are not for any trader, Only users with a Micro account can take advantage of the two available deposit bonuses. This is not inclusive on the behalf of the firm.

The MFM securities Forex broker site offers its services to multiple jurisdictions without an international license they only have a VFSC qualification. Which is basically the easiest license to get, one basically can buy it.

MFM securities scam is definitely a most like possibility as the platform has a very unusual approach to its consumers regarding marketing tactics.

We do not recommend that our readers visit the site because it is not worth their time or effort. A live chat widget is available on the site at the bottom right corner. We can certainly claim that it is definitely a bot after finishing the study and using it personally and that even if you do obtain a response, it will take far too long.

Comments (0 comment(s))