A comprehensive OspreyFX review to understand the broker’s features

Osprey FX Forex broker is an Electronic Communication Network (ECN) broker. The brokerage has established recently, as there is no information about the broker, and there are no reviews or opinions about it. OspreyFX is registered at Saint Vincent and the Grenadines but as all of the other companies, it should have an office somewhere else. However, the broker does not display this kind of information. While most of the brokerages have full information about itself, where do they operate or where are they authorized on the front page of their website, OspreyFX has indicated none of them.

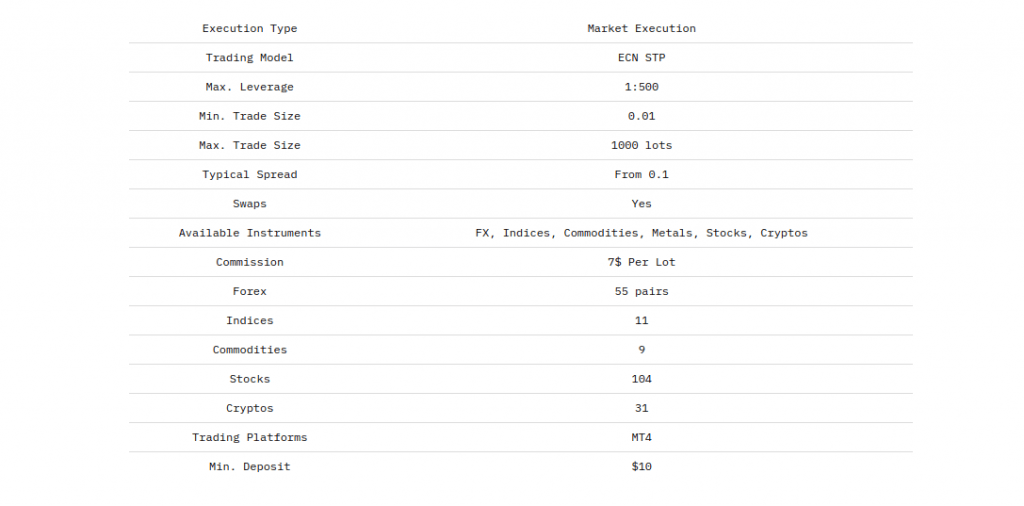

However, we investigated the broker and learned all about it while making the OspreyFX review. The brokerage offers trading several asset classes – Forex, cryptocurrencies, CFDs on commodities and stocks. The minimum deposit with the broker is 10 USD. There is only one type of account available, the leverage is from 1:1 to 1:500 but also varies based on the trading assets. Let’s discuss the broker’s services in details and start with the regulatory side of the broker.

Is OspreyFX legit?

OspreyFX is a trading name of Osprey Ltd. It is not stated when the brokerage was established but it seems to be just created. All of the content that is uploaded on the website dates back to March 2019 earliest. So is OspreyFX regulated? Looking into it, the broker is registered at Saint Vincent and the Grenadines and is not regulated by the local FSA. In the FAQ section, the broker states that it is not regulated since getting the license takes some time. Getting licensed from the FSASVG is not difficult at all as the regulator does not have a high standard or strict requirements. This supports the thought that the brokerage was established recently. As it is a new brokerage that is not regulated many might consider Osprey FX scam to be real. Even if the broker gets a license, it will be from the FSASVG, which is not the best regulatory bodies in terms of investors protection. In fact, many scam brokers are registered and authorized in Saint Vincent and the Grenadines simply because it is so easy.

The broker does not offer its services to the following countries: Burma, Cuba, Congo, Democratic Republic of Congo, Iraq, Iran, Japan, Lebanon, Libya, Malta, North Korea, Somalia, Sudan, Syria, Vietnam, and Zimbabwe. It means that the broker is going to offer its services to the residents of the European Union, the US and other countries where the broker does not have a right to provide with financial services. This points out the fact that OspreyFX fraud is really a case.

What does the broker offer

The broker offers trading several assets including over 55 currencies, 30 cryptocurrencies, CFDs on commodities, indices and stocks. There is a page that is designed to show what OspreyFX spreads look like with OsperyFX but unfortunately, this page is not working at the time of making this Ospreyfx.com review. The broker offers leverage of 1:500 but leverage depends on the trading assets. For Forex the leverage is 1:500, for indices 1:200, for cryptocurrencies 1:100, and for stocks 1:20. This leverage is significantly high from what the broker is allowed in the EU member countries. The brokers are restricted to offer leverage more than 1:30 for currency pairs, the leverage cap for cryptos are 1:2. Hence, the broker is not only providing unauthorized services to the EU residents but violates some of the most important regulations of the ESMA.

OspreyFX account types

Traders who want to start trading with Osprey FX does not have a big choice when it comes to the account types, that decreases the OspreyFX rating significantly. Traders should have the ability to choose the account that corresponds to their needs. Osprey FX account – ECN account is has a market execution. The minimum trade size, as the broker claims, is 0.01, maximum – 1000 lots. the typical spread is indicated to be 0.1 pips. As usual, brokers claim to have low spreads on the description of the account and the reality is often different. The commission for per lot traded is 7 USD.

OspreyFX minimum deposit and withdrawal

The minimum deposit with Ospreyfx Forex broker is 10 USD but it also depends on the way you fund your account. The payment methods are very limited, one can fund the account via Credit/Debit card, Wire transfer or with Bitcoin. There is no deposit fee if you are using a Debit/credit card or Bitcoin. However, the minimum deposit for those using Wire transfer is 100 USD and 25 USD is a fee for depositing the funds. This is quite a high fee and it is not clear why does the broker have it, considering that none of the good international brokerage’s charge money for wire transfers.

As for the OspreyFX withdrawal, the broker states there are no fee’s charged. However, there is 25 USD fee again for Wire transfer, for some payment methods fee might be up to 20 USD plus the broker comments that there might be additional fees based on other payment methods but does not provide any more information about it. The withdrawal processing time is very long too. The broker states that withdrawal is processed on the same or following day, but after it is processed it takes another 3-6 business days. Hence, if you submit withdrawal on Friday, it will be processed on Monday and you will have to wait until Monday or Tuesday, meaning you will only be able to get the money after 11 days. This is a lot of time for the broker that markets itself as a lighting fast ECN broker!

Osprey FX scam

Sadly, not many traders check the risk disclosure and terms & conditions when they want to choose the broker. It is understandable, no one likes to read pages and pages of legal documents but it is absolutely necessary when making this important decision. These documents contain information that might be crucial for you. Osprey FX scam can be found exactly in the risk disclosure document. Osprey FX is an Electronic Communication Network broker and it is essential for the platform to work without any problem that might result in the damage of the customer’s finances. In these cases, the broker puts all of the risks on the trader and avoids all the related responsibilities. For example the broker states the following:

- If there will be any failure of information, communication, electronic or other systems, the customer shall be responsible for the risks of financial loses caused by these failures.

- If due to the system failure trader’s orders will not be executed according to the customer’s instructions, or will not be executed at all and the trader loses money due to this, the company does not accept any liability on it.

- The customer is responsible for the risks of the financial losses that might be caused by the company’s hardware or software failure, misuse or malfunction. A poor internet connection from the company’s side, for interruptions of transmission blackouts, hacker attacks, and an overload of connection.

As you can see, the broker holds the trader responsible for every imaginable technical problem that might be occurred from the broker’s side itself. Apart from it, the broker warns that the customer should acknowledge that at the times of excessive deal flow the customers might find it difficult to contact the broker for any assistance.

Can OspreyFX be trusted?

Our final opinion, based on this Osprey FX review is not something the broker would like to see. OspreyFX is an unregulated brokerage that offers unauthorized financial services to the residents of the countries, where the broker is not allowed to operate. Even if the broker will manage to get a license, it will be from the Financial Services Authority of Saint Vincent and the Grenadines, which is known as scam brokers regulators. Even if it was not so, an offshore regulated brokerage cannot be held responsible for any financial loses, simply because there is no possibility for other regulators to take any measures against the broker.

Sometimes, traders close their eyes on regulations if the broker offers a good service. At this point, OspreyFX is a disappointment as well. There is no choice of an account type, the broker charges commissions and does not provide full information about it. The withdrawal process is very long, and since there are several OspreyFX scam indicators it is not guaranteed that someone will actually be able to withdraw any money. In addition to that, the broker hands over all of the responsibilities to the customers when it comes to the technical problems. Overall, the broker does not look very promising and it will be better for all the mindful traders out there to avoid the broker.

Comments (0 comment(s))