TMGM Review – Efficient , but not so transparent

TMGM is a brokerage firm situated in Australia. Over the course of the years since its creation back in 2013, the site has received mixed reviews. We took it into our own hands to get all the information about the platform that one might not possess or didn’t pay much attention to it. The website appears to be qualified, as it possesses two unique licenses. These are ASIC and VFSC.

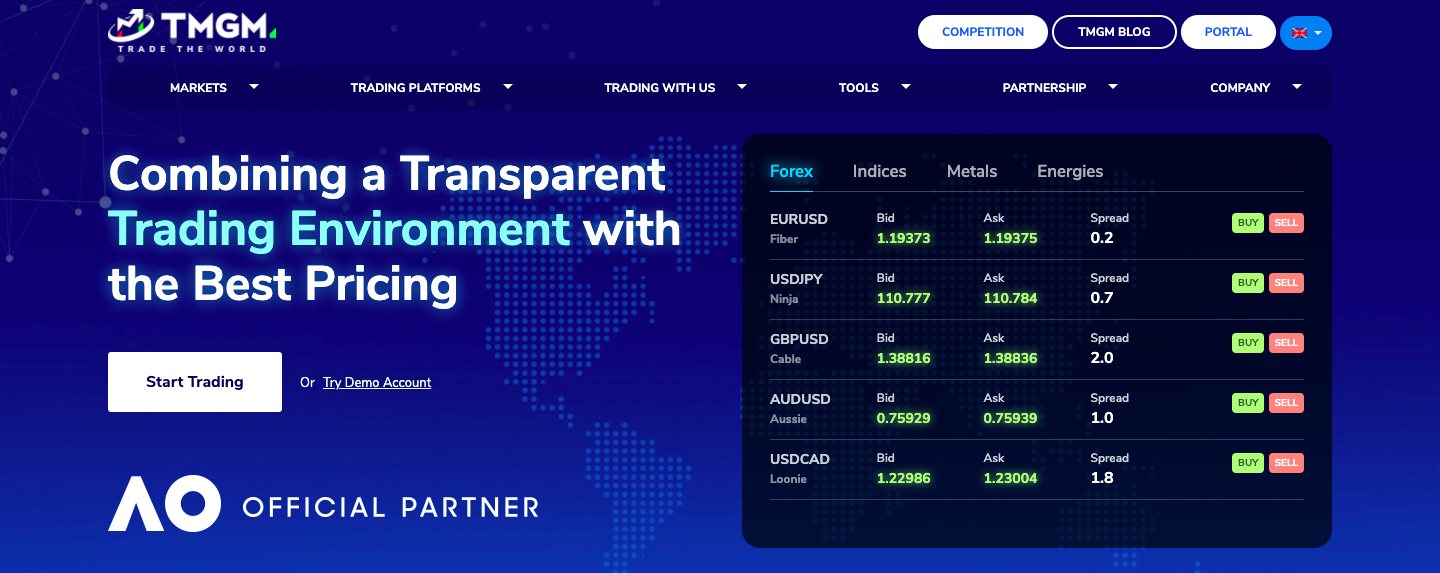

The site’s minimum deposit is $100. The maximum leverage ratio of 1:100 for the standard accounts spreads begins at 0.0 pips. On the TMGM website, there are over 15 thousand trading products available.

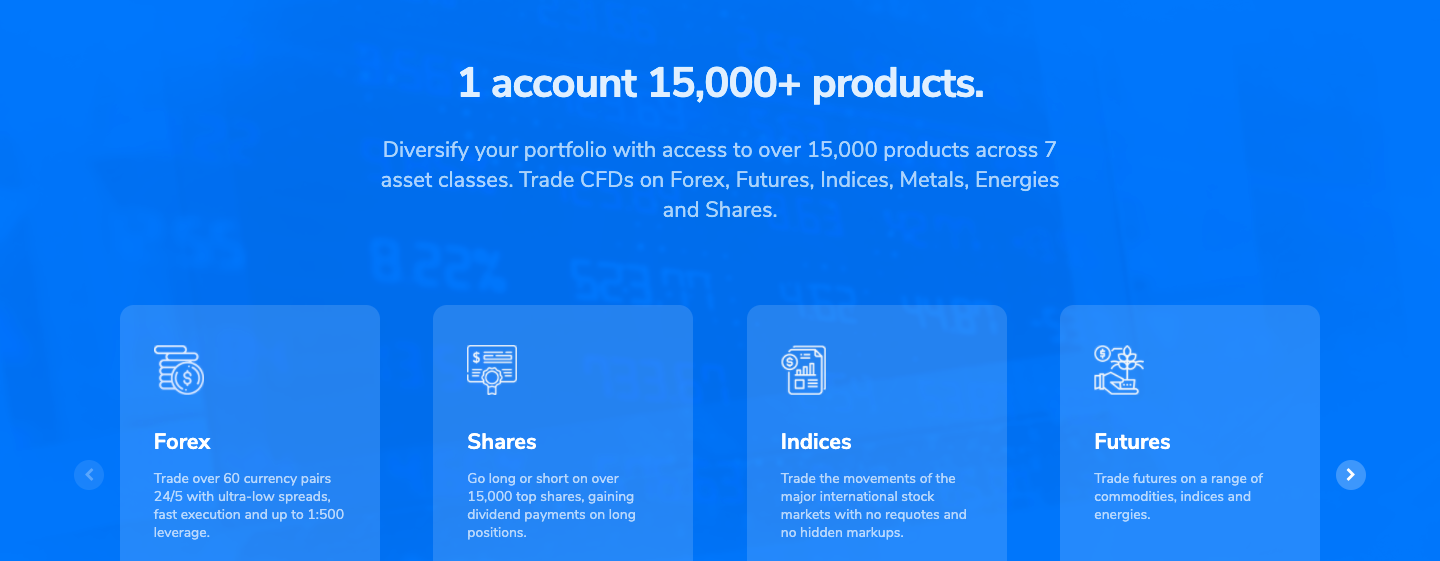

TMGM is a broker that allows users to trade on more than 15,000 financial instruments across seven asset classes, including forex, metals, energies, cryptocurrencies, commodities, indices, and shares. Users from the US, Australia, and around the world can trade directly from the Metatrader 4 and Metatrader 5 trading platforms, as well as the IRS trading platform for desktop, web, and mobile.

License and Security – Is TMGM Legit?

Australian Securities and Investments Commission is one of the regulatory bodies that monitor the action of the brokerage firm. This is no surprise as we have already disclosed the origins of the company. The firm is Australian-based and therefore firstly needs to have a local license to even have a smog of functionality.

additionally, we have seen that the firm offers its services and products to the international markets. to do so, they need to have a secondary license. This is the sole reason why the company also is being monitored and regulated by the Vanuatu Financial Services Commission.

TMGM Review – Trading Features

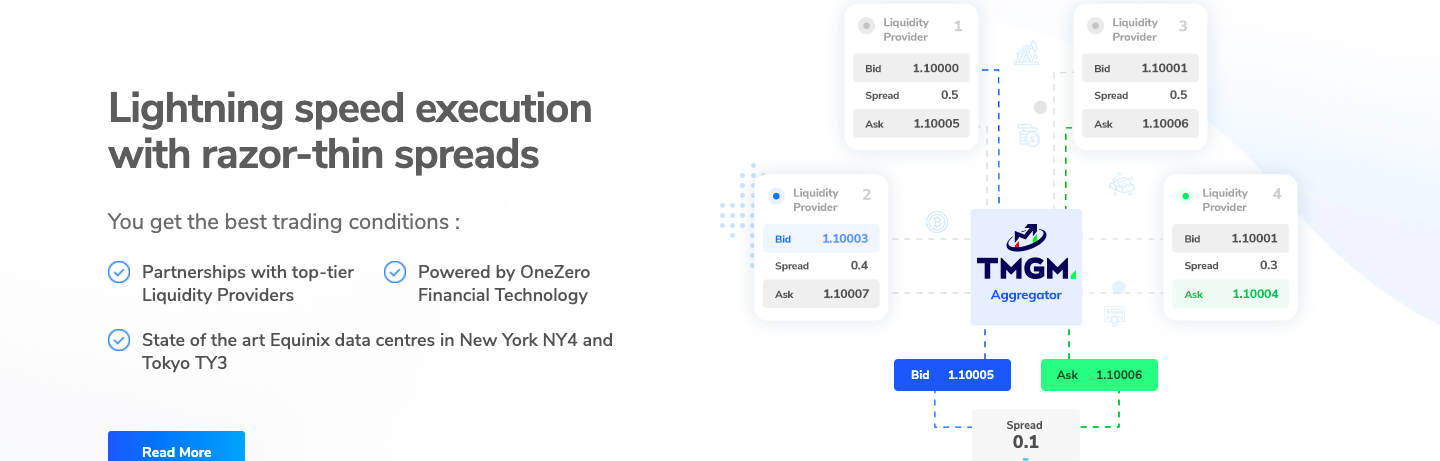

There are numerous features that are important to ant brokerage firms this includes many things like the leverage ratio, spreads and the offerings of each available account not type which there are plenty on the site. TMGM offers debatable trade from two main types of trading accounts called the edge and classic account, both of which require only a $100 minimum deposit. As shown here, the edge account offers raw spreads from zero pips with commissions of seven dollars per round turn, while the classic account offers commission-free trading from spreads as low as one pip.

Account Types

The broker also offers Islamic swap-free accounts, and as we can see, the broker also offers maximum leverage of up to 500 to one, but this may vary according to the regulatory jurisdiction. On its trading accounts page, the broker includes a really interesting account feature comparison table, which you can see here. Users of both training accounts can trade on the Metatrader4 and Metatrader5 trading platforms, and it includes additional information such as available base currencies such as US dollars, Euro, British Pound, Aussie, and Kiwi, as well as fee-free deposits and withdrawals.

Edge and Classic Accounts

The minimum deposit amount for both of the account types is a hundred dollars and the minimum lot size is 0.01. There are no commission fees when depositing on these account types and they also come with a free professional advisor. Hedging and scalping are also permitted on both the Edge and Classic accounts. For both accounts, the stop-out thresholds are 40 percent. There are 46 currency pairs, six commodities, and ten indices available for these accounts.

IRESS Accounts: Standard, Premium, and gold

A platform cost of $35 to $45 per month is charged with the regular account. They can be waived, though, if at least ten deals are made throughout the month. A data Fee is also a payment associated with each exchange. The commission rates and fees are different depending on the asset category.

There is no monthly platform cost if you have a Premium or Gold account. However, if no trades are made during this time, the account will be taxed.

A set of data Fees are levied for each exchange, however, they might be avoided if you make at least 10 trades in a month. The commission rates and fees are different depending on the asset category. The only significant difference between each IRESS account type is the minimum deposit requirement. The minimum deposit for a gold account is five times that of a premium account.

Leverage

leverage is an important tool for both novice and experienced traders. We have already discussed the fact that the site is regulated by multiple organizations. This is very evident with the leverage ratio rate. the available leverage on the site is 1:100. This is for the Edge and classic trading accounts.

Spread

the site offers both raw and variable spread for its consumers. The raw spread on the Edge account starts at 0.0 pips. An extra seven dollars is required for each round turn. The classic account, on the other hand, has variable spreads that begin with 1.0 pips and go up from there. There are no commissions for per round turn, unlike the edge account.

On the home screen, you have access to several options such as quotes chart training activity history mailbox news, and an economic calendar. If we go to the quotes table, we can actually see here we’ve got a list of different symbols available to trade on, with the euro-dollar at the top.

Minimum Deposit

The minimum depositing amount on the site for regular accounts is $100 which use MetaTrader as their trading platform follows the guidelines of the regulatory bodies.

The minimum opening amount for a Professional Account is $5,000. With their professional trading platform choices, the account provides access to competitive DMA commission and margin rates.

The Platinum account requires a minimum opening balance of $10,000 to open. On their professional trading platform, the account offers significantly cheaper commission and financing rates.

The minimum deposit for a Gold Account is $50,000. The account is designed for professional traders, with no platform fees and no minimum brokerage price.

Available Promotions – Lack of Bonuses

unfortunately, there aren’t any bonuses on the site. This is definitely a negative aspect of the site as the industry standard is to have some type of promotional offer. in this regard, we have seen that the form shows very little effort. Their primary focus is the partnerships they have established with organizations like the Australian Open for tennis.

After diving deep into the long history of the firm, we have concluded that this was not always the approach for this broker. In fact, the company used to have a 50% no deposit bonus which one would get straight after registering on the platform.

TMGM is a worldwide regulated broker that is governed by the Australian Securities and Investments Commission and maintains an Australian financial services license. It is also governed by the Vanuatu Financial Services Commission. TMGM provides further investor safeguards by requiring external audits from an independent auditor and isolating client funds from company money by storing funds in tier one Australian banks such as the National Australia Bank, as shown on the broker’s regulatory page.

TMGM Review – Final Verdict

all in all, we would not recommend this forex broker in a sense it is so much easier to be diluted into an idea of what an f0rex broker should be, we think that even though the site offers interesting features regarding leverage and spread, the virtual nonexistence of promotional offers to help their traders.

In forex trading, the commission could be either a fixed fee or a relative fee. A commission is similar to a spread in that it is paid by the trader on each trade.

Relatively speaking the site is quite functional. some of the aspects of a brokerage are paid more attention and precision. These are the leverage and the design pattern. Athletically speaking we could not find many faults.

TMGM users can trade on a variety of financial CFDs, including forex, shares, metals, energies, cryptocurrency, soft commodities, and indices, using the metatrader4 trading platform, as well as the metatrader5 trading platform and the IREES trading platform. The broker also offers access to unique trading tools, such as hub x, which is a bespoke platform that allows users to trade on a variety of different financial CFDs.

More information is available on the broker’s website and on the customer support page, where live chat is available 24 hours a day, five days a week in several languages.

The live chat widget is a big red flag as it requires one to provide additional information besides an email. This is making it very dysfunctional, The software they are using for it is very outdated and overall it doesn’t offer functionality.

Comments (0 comment(s))